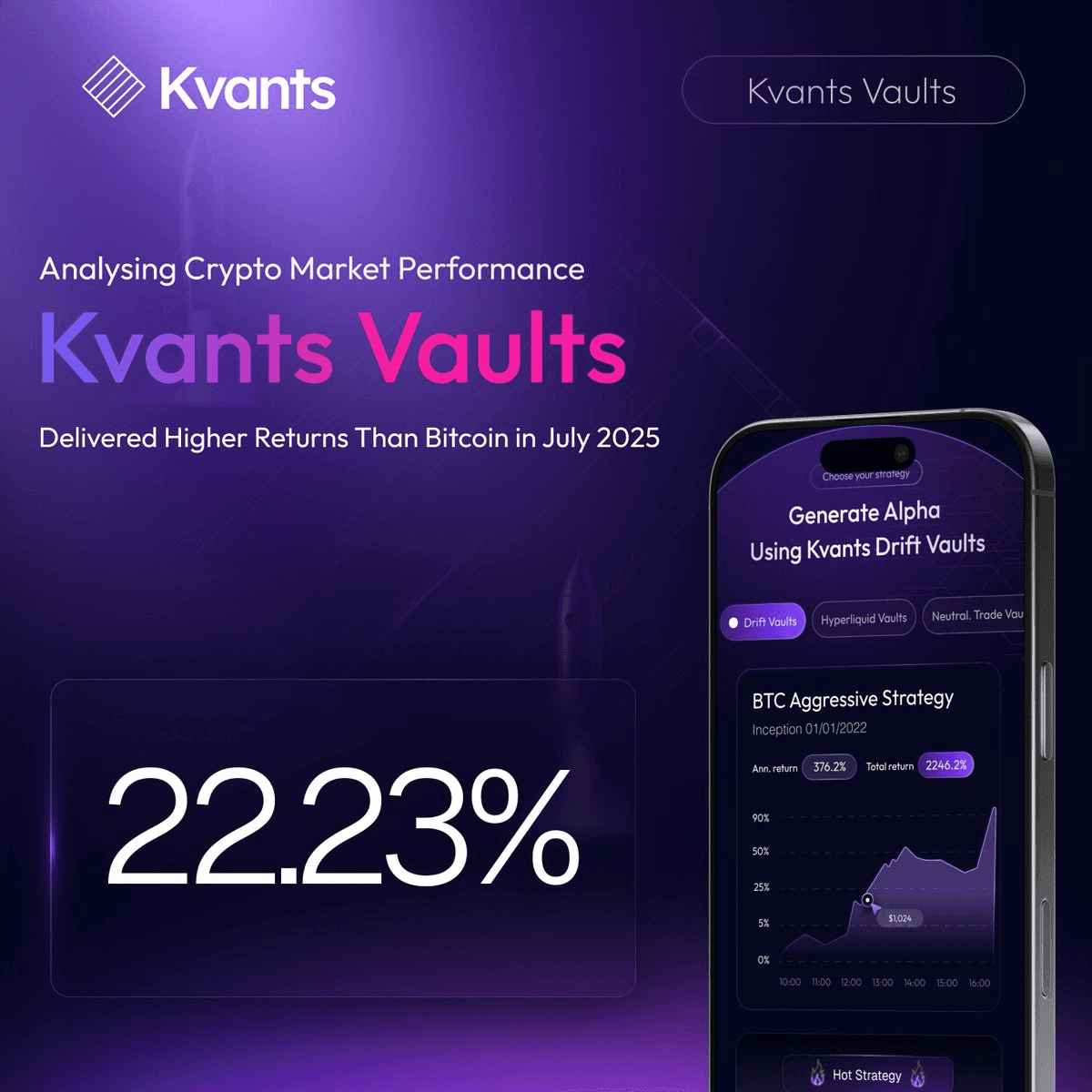

Analysing Crypto Market Performance: How Kvants Vaults Strategies Outperformed Bitcoin in 2025

Aug 22 | 5 Mins MIN | Product

By

Kvants

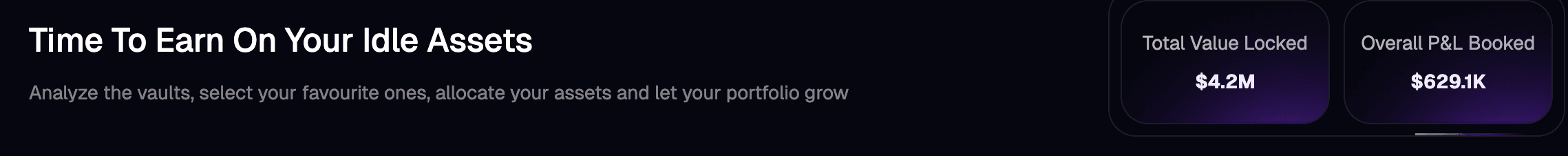

Kvants Vaults Quant Strategies Outpace Market Performance

From January to July 2025, Bitcoin had a strong run. It climbed about 27%, going from the $95,000 range to a new all-time high of $123,000. That kind of move still grabs headlines, especially with new spot ETFs, growing institutional interest, and global economic uncertainty in the background. In July 2025, Bitcoin delivered an impressive 8.3% return, reinforcing its position as the market leader.

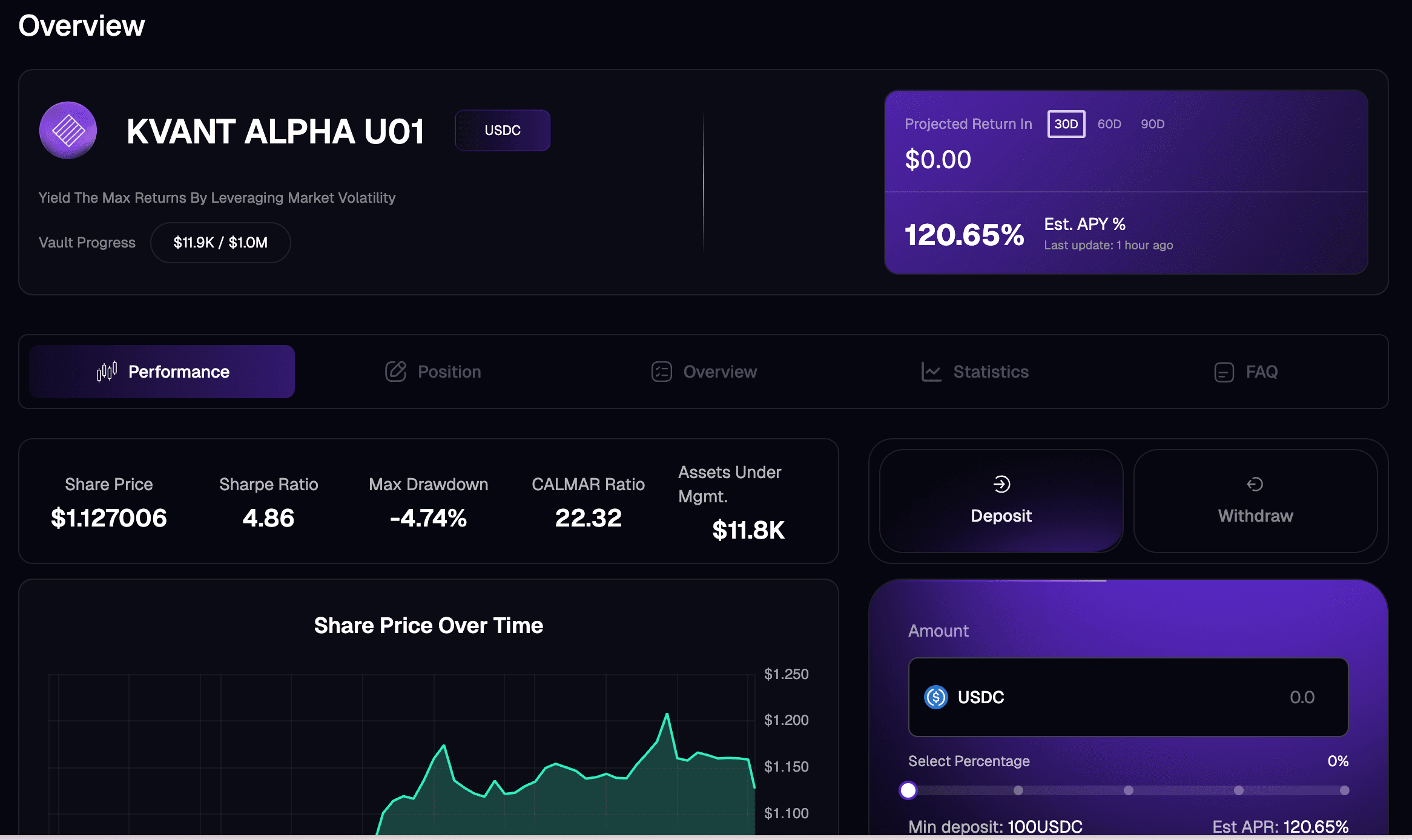

However, the KVANT ALPHA U01 Vault on Drift Protocol significantly outperformed, generating more than a 22% net return over the same period. This contrast highlights the growing appeal of structured, market-neutral strategies that can exceed the gains of traditional crypto exposure.

While Bitcoin’s growth was impressive, its price remained extremely volatile. Big swings, ETF inflows and outflows, and macro events kept investors on edge.

Meanwhile, Kvants Vaults quietly delivered something much more appealing to capital allocators. Not just price appreciation, but real, compounding yield. With far less stress.

Bitcoin Price Growth and Volatility Trends in 2025

Bitcoin's rise in 2025 has been fueled by a mix of institutional inflows, increasing adoption as a treasury reserve asset, and ongoing global macroeconomic uncertainty. The cryptocurrency reached a record high of $123,153.22 by mid-year, gaining over 27 % since January. This growth followed renewed interest in digital assets after the approval of several spot ETFs and increased corporate treasury allocations. Despite the bullish trend, Bitcoin's price action has been marked by high intraday volatility and sharp corrections, often triggered by ETF flow reversals and macro-driven sell-offs. The gains, while substantial, have come with elevated risk, making it a more speculative asset in institutional portfolios. While Bitcoin continues to serve as a long-term store of value for some investors, its performance is highly dependent on external market drivers, regulatory clarity, and investor sentiment, factors that make it less predictable for risk-conscious capital allocator.

Breakdown of Kvants Drift Vault Strategy Modules

- Funding Rate Carry: Captures yields from positive funding rates in futures markets

- Statistical Arbitrage: Exploits price dislocations between correlated pairs like ETH/BTC or SOL/ETH

- Momentum with Delta-Neutral Hedging: Generates convex returns in trending environments without directional exposure

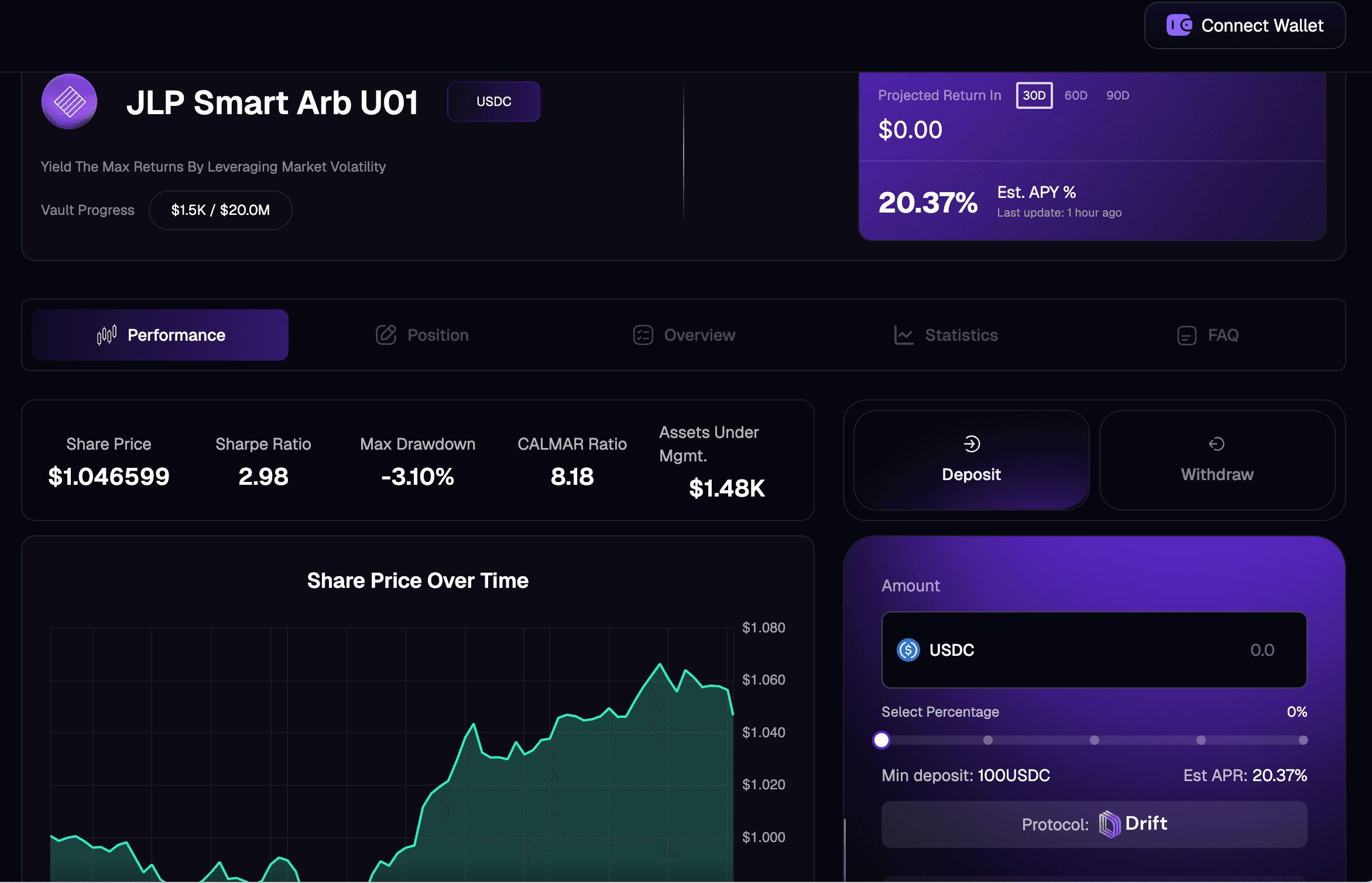

- JLP Yield Structures: Combines liquidity provision with hedged positions for stable return

- Sentiment-Index Overlays: Adjusts positioning based on on-chain sentiment indicators

Each strategy is risk-scoped and executed using Kvants’ AI-based execution framework, which optimizes for slippage, latency, and rebalancing efficiency. Returns are compounded per block and rebalanced dynamically based on market structure shifts. The KVANT ALPHA U01 Drift Vault, which uses USDC as base collateral, is purpose-built for investors seeking high-frequency, capital-efficient yield with full downside control.

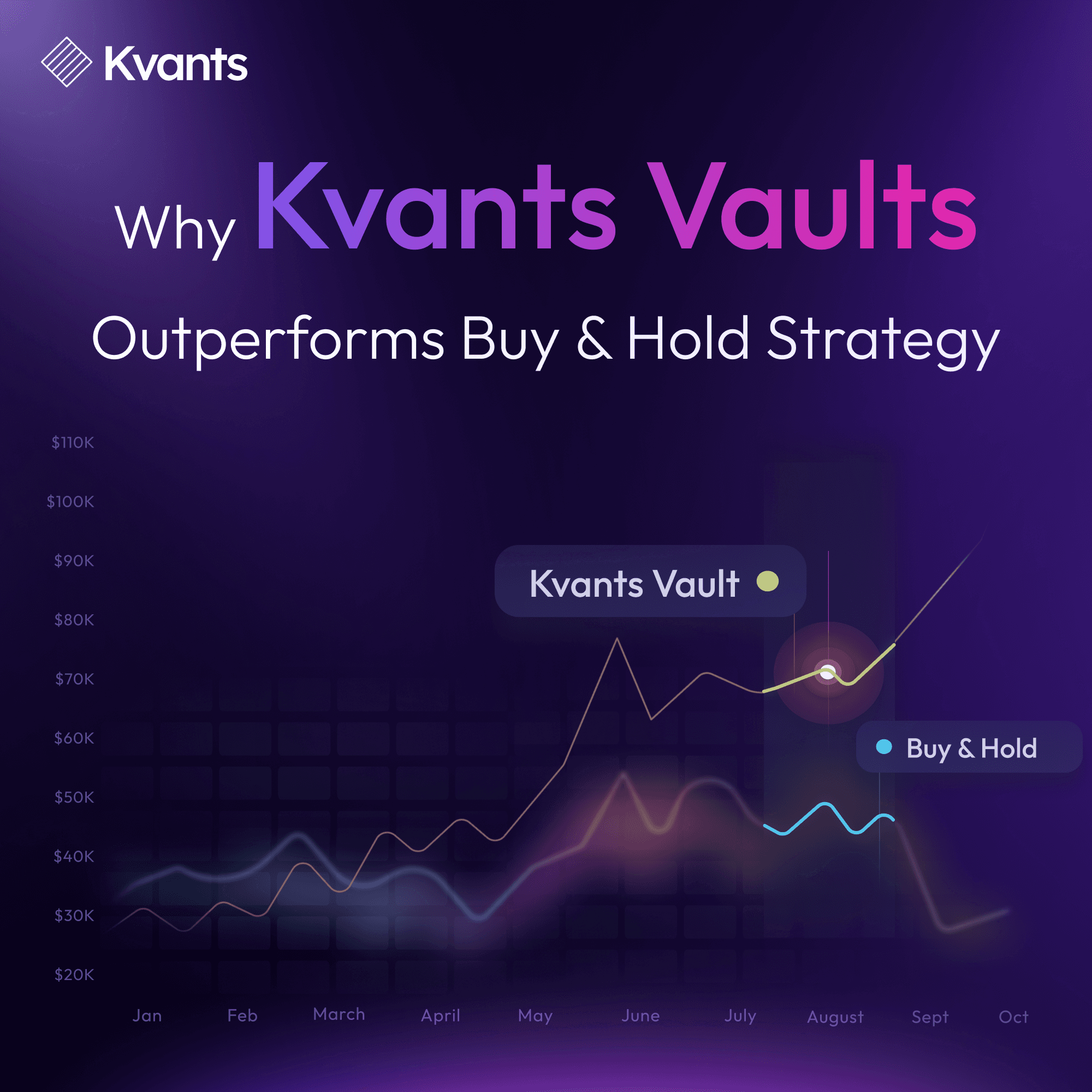

Comparing Bitcoin Volatility with Kvants Risk Metrics

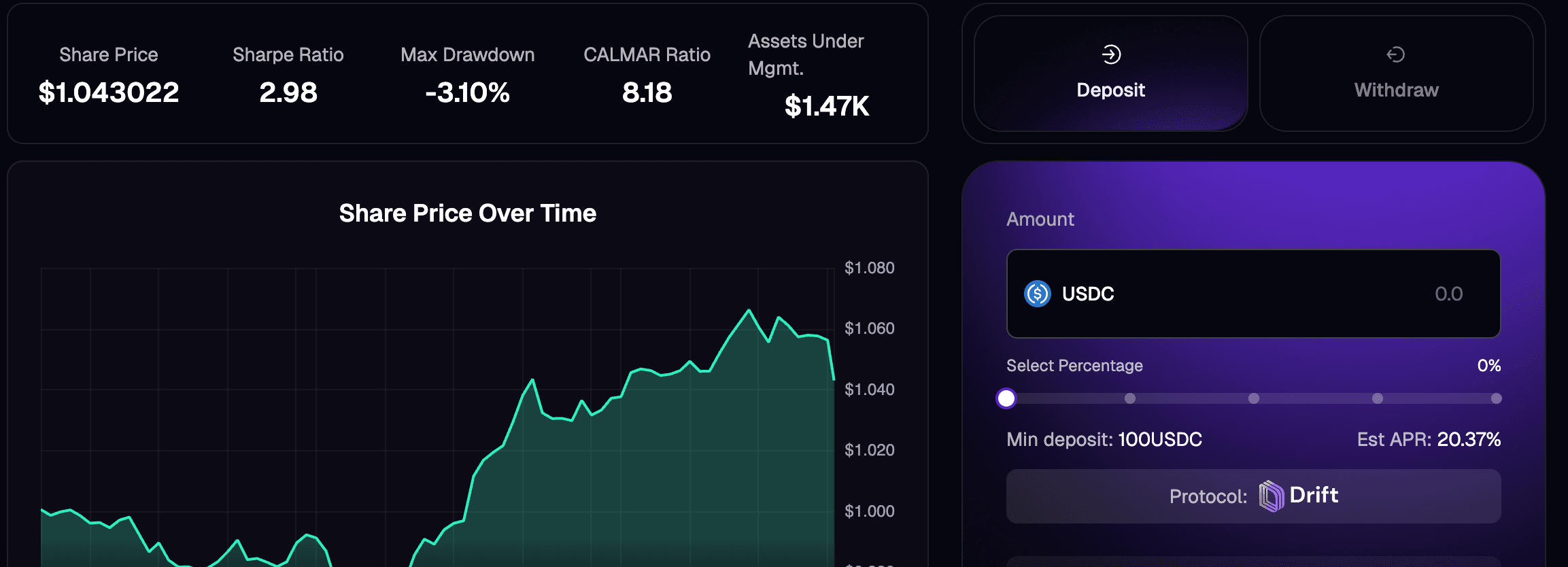

Bitcoin’s directional returns offer upside in bull markets but carry significant volatility and downside risk. From January to July 2025, BTC saw intraday swings as wide as 12%, with ETF outflows exceeding $300 million during periods of macro instability. These fluctuations can cause severe drawdowns for passive holders. In comparison, Kvants Vaults have demonstrated superior risk-adjusted returns, evident in key metrics:

- APY: 22% on Kvant Alpha U01

- Max Drawdown: -1.55%

- Sharpe Ratio: Significantly higher than BTC over the same period

- Volatility: Actively suppressed through hedging, dynamic allocation, and liquidity-aware trade execution

These metrics reinforce the utility of Kvants Vaults as yield vehicles rather than speculative assets. Investors in vaults are insulated from market crashes, while Bitcoin holders remain vulnerable to macro shocks, ETF sell-offs, or exchange risk.

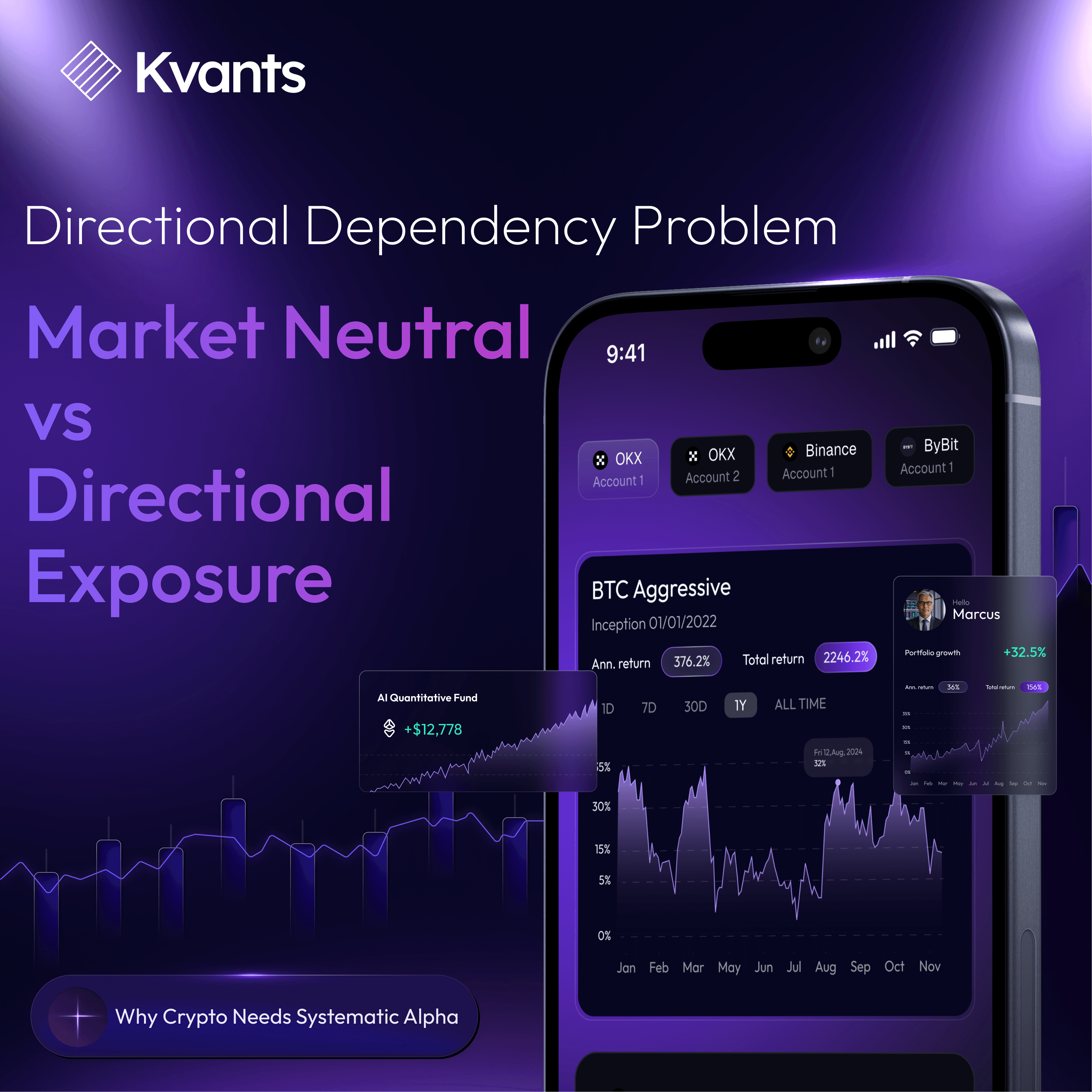

How Kvants Vaults Fit Institutional Allocation Strategies

For corporate treasuries and high-net-worth capital allocators, the Kvants Drift Vault strategy offers an operational and strategic edge. Treasuries are increasingly seeking instruments that provide predictable, compounding yield without exposure to token price volatility. Bitcoin, while valuable as a long-term store of value, does not offer income without incurring directional risk.

Kvants Vaults solve this by offering:

- Non-directional return streams

- Real-time on-chain performance tracking

- Vault tokenization for composability across DeFi protocols

- Full transparency into execution logic, fee structure, and risk metrics

Capital can be allocated to these vaults with clear expectations around risk, lockup terms, and expected yield. For institutions managing large balances in USDC or stablecoin reserves, vaults like KVANT ALPHA U01 present a structurally superior return profile compared to passive BTC exposure or staking in volatile assets.

Unlocking DeFi Liquidity with Kvants Vault Tokenization

One of the less discussed advantages of Kvants Vaults lies in their liquidity efficiency and composability within DeFi ecosystems. Unlike traditional structured products or passive crypto holdings, Kvants Vault positions are tokenized, enabling users to collateralize or transfer yield-bearing positions across decentralized protocols. This allows capital to remain productive on multiple layers, earning strategy-based yield while simultaneously being used in lending, borrowing, or other DeFi primitives. Such multi-dimensional capital utility is not feasible with assets like Bitcoin, which primarily rely on price appreciation and lack natively integrated composable yield layers. For active portfolio managers and treasuries optimizing for liquidity, capital stacking through Kvants vault tokens opens new paths for operational agility and integrated cash flow generation in decentralized finance.

Transitioning from Speculative Assets to Systematic Yield Strategies

The January to July 2025 performance of Kvants Vaults, particularly those on Drift presents a clear case for strategic yield over speculative positioning. While Bitcoin has delivered a respectable 18% gain during this period, it remains subject to deep retracements, ETF-driven outflows, and macroeconomic uncertainty. Kvants strategies, on the other hand, are optimized for sustainable, delta-neutral returns that outperform on a risk-adjusted basis.

With 22% annualized yield, minimal drawdown, and compounding logic built into the protocol, Kvants Vaults are redefining what efficient capital deployment looks like in DeFi. They offer structured access to alpha, not based on narrative, but on execution, arbitrage, and intelligent risk control. For allocators, this marks a shift from passive holding to active, yield-based participation in the digital asset ecosystem without the need to bet on market direction.

Check out available vaults and capture the edge before others do.

Read more