Kvants USDC Alpha Aggressive Vault Secures No. 1 Ranking on Drift Protocol

Nov 25 | 5 mins MIN | Product

By

Kvants

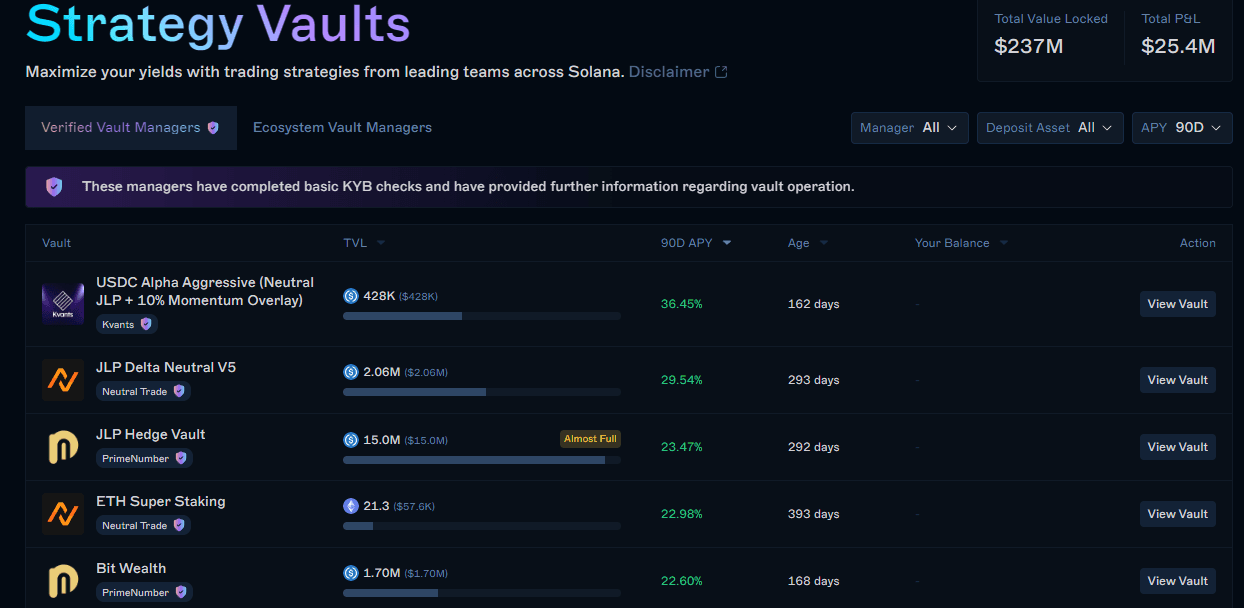

The USDC Alpha Aggressive Vault has officially secured the No. 1 position on Drift Protocol, marking a major validation of Kvants quantitative infrastructure. This ranking is not just a performance highlight but a confirmation of the vault’s ability to consistently generate measurable alpha through all market conditions. Over the past 165 days, the vault has demonstrated both resilience and precision, attracting investors who prioritize transparency, risk control, and true quant execution.

Kvants Performance Continues to Lead Onchain Quant Alpha Generation

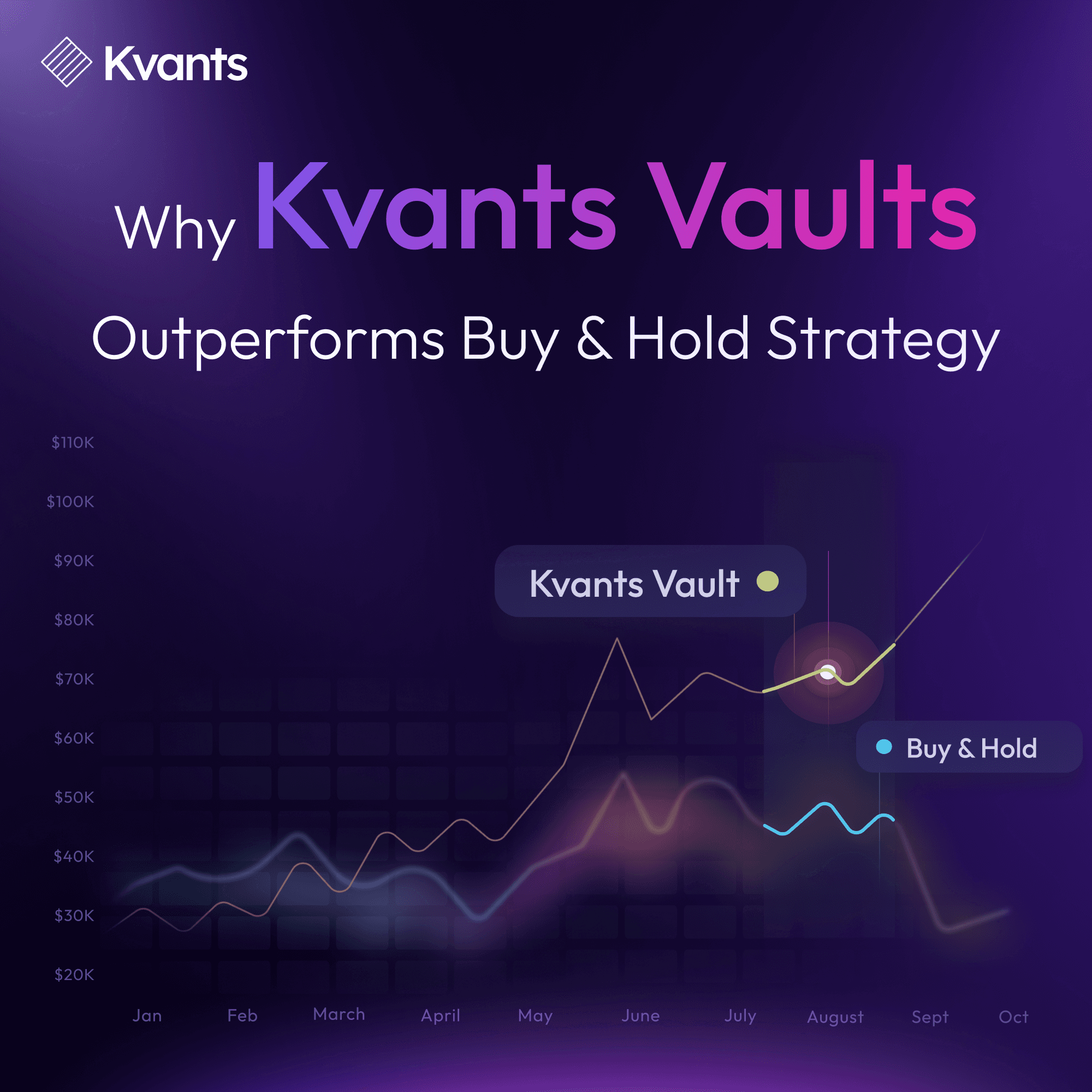

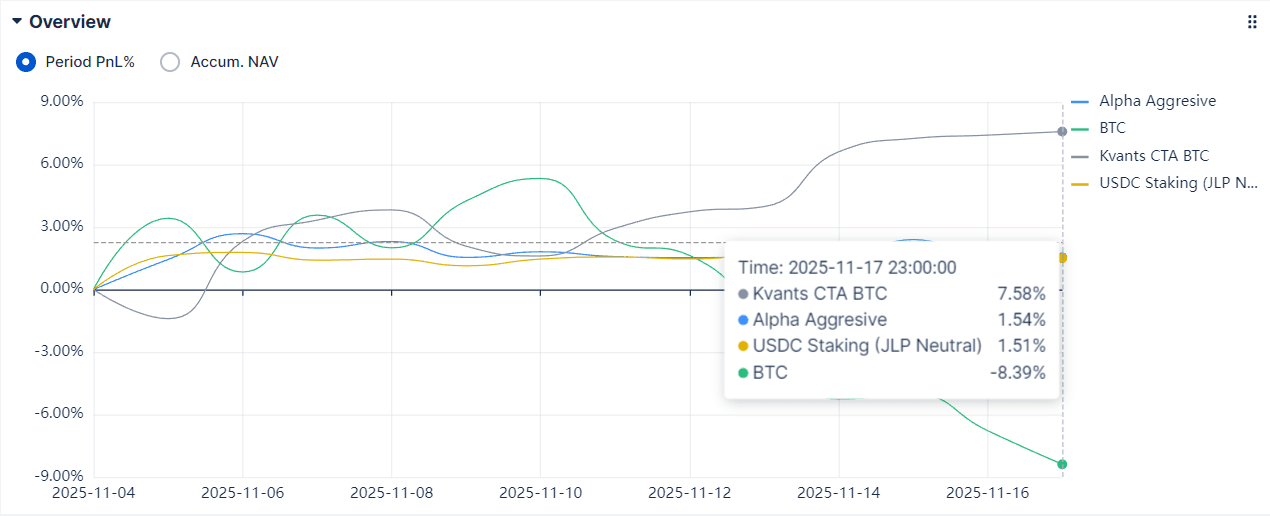

Over the past 2 weeks the market dropped 15% to 20%, yet the Kvants strategy remained stable and is up 0.5% while the market is still down more than 10%. With crypto markets often unpredictable, Kvants continues to outperform by providing structure, discipline, and risk-adjusted returns.

Kvants Vault Metrics That Matter to Performance-Driven Investors

The USDC Alpha Aggressive Vault stands out in every metric that matters to serious investors evaluating on-chain strategy performance. The vault currently produces a 90 day APY of 43.65%, supported by quant execution that adapts continuously to changing conditions. Its 30 day trading volume reached $1.85M, indicating active participation and liquidity efficiency. TVL stands at $430K, backed entirely by real on-chain deposits. Most importantly, the vault maintains a controlled max drawdown of −4.00%, demonstrating a balanced approach between alpha generation and capital protection. These metrics place Kvants at the top of Drift’s strategy leaderboard for both performance and stability.

How Kvants Turns Volatility Into Sustainable Alpha

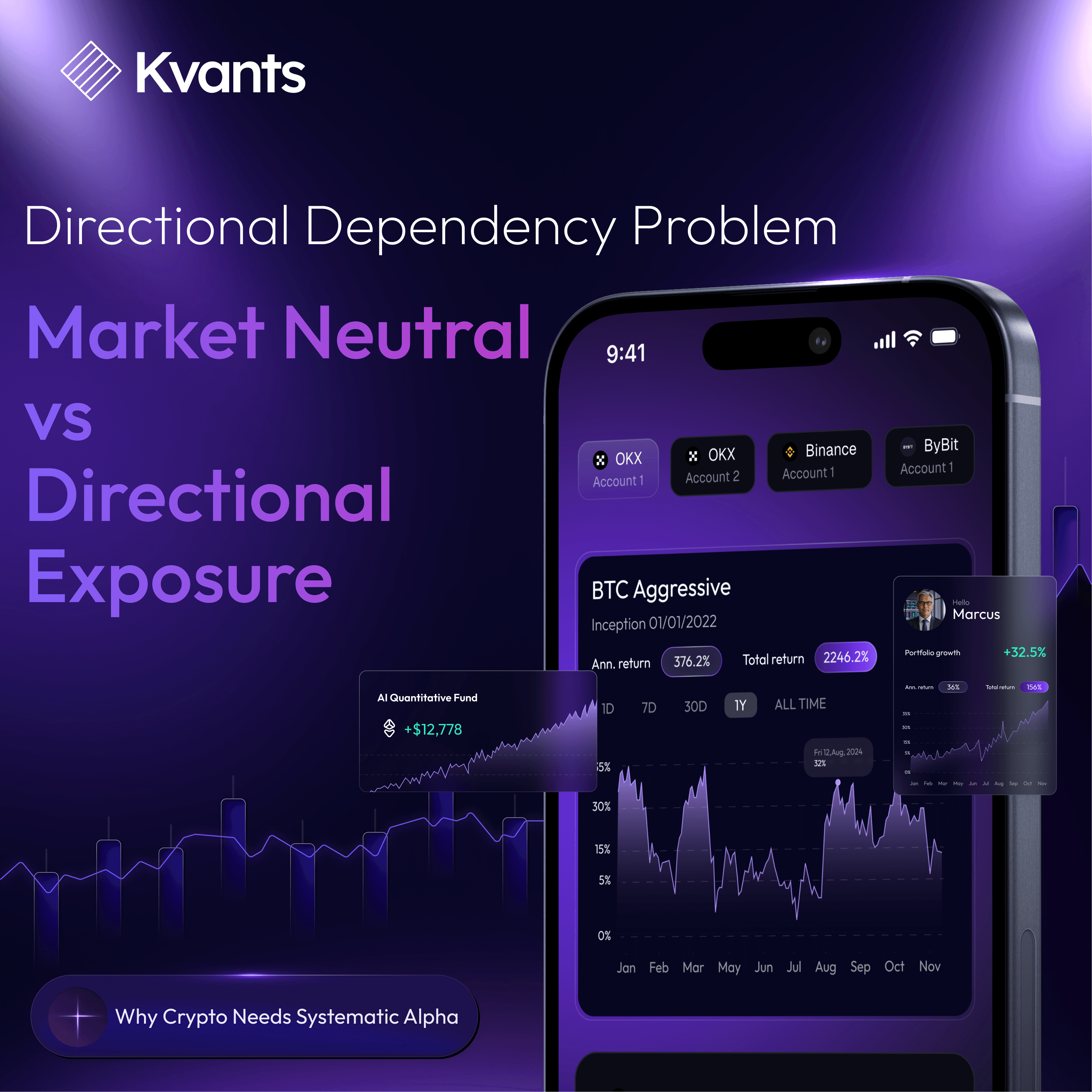

Crypto markets may experience 40% to 60% swings within short cycles, creating significant difficulty for passive and directional strategies. Kvants is engineered to convert this volatility into sustainable alpha through continuous hedging, exposure optimization, and funding rate capture. Instead of being harmed by volatility, the USDC Alpha Aggressive Vault uses it as an input to drive systematic decision making. Some vaults rely on directional momentum and struggle when markets reverse. Kvants maintains productivity during both upward and downward phases by removing emotion and relying on structured quantitative logic. This adaptability is one of the reasons Kvants stands above alternatives.

For more information, explore the vault directly on Drift Protocol:

For more information, explore the vault directly on Drift Protocol:

Explore Available Kvants Vault Strategies Built for Different Investors Risk Appetite

The Kvants Vault lineup gives investors three distinct ways to access structured, quant-driven alpha with full transparency and real-time on-chain verification.

USDC Staking (Neutral JLP) Vault

A fully hedged, low-risk alpha strategy that earns through JLP incentives and Drift funding mechanics. This vault is designed for investors seeking consistent, market-neutral performance without directional exposure.

A near-delta-neutral structure with a controlled momentum overlay. This vault aims to deliver steady alpha while maintaining tight drawdowns and a balanced risk profile suitable for conservative and medium-risk allocations.

USDC Alpha Aggressive Vault

A higher-turnover strategy with leveraged momentum overlays that targets amplified returns. This vault is optimized for investors seeking elevated performance with dynamic, actively adjusted exposure.

Kvants Leadership with Transparency and Real-Time Verification

Transparency is the backbone of Kvants. On the Kvant transparency dashboard, every NAV update, exposure shift, hedge adjustment, volatility change, and execution fill is visible in real time on-chain. Investors can verify performance at any moment through Drift Protocol and the inbuilt Kvants Transparency Dashboard. Kvants provides deeper visibility into how alpha is created and how capital is protected. This real-time view is critical for investors who want continuous insight into how strategies behave during different market regimes. Full transparency strengthens confidence and reinforces Kvants credibility as a top-performer.

Kvants Vaults Stand Out for Sustainable Alpha and Capital Preservation in Bearish Market Conditions

The last 2 weeks have highlighted the importance of capital preservation. While the broader market dropped 15% to 20%, with most assets still down more than 10%, the Kvants USDC Alpha Aggressive Vault remained stable and is currently up 0.5%. This contrast demonstrates the strategy’s ability to protect capital while still generating sustainable alpha through disciplined quant execution. Instead of participating in the market decline, the vault maintained controlled exposure, updated risk parameters, and preserved investor capital through the downturn. This is the type of performance that investors look for when market sentiment turns bearish and volatility increases.

Why Investors Choose Kvants Over Other Strategies

The vault’s 43.65% APY, $1.85M monthly volume, $430K TVL, and −4.00% max drawdown showcase a blend of alpha generation, stability, and transparency unmatched on the platform. Some vaults deliver strong returns during specific cycles, but few can match the combination of adaptability, consistency, capital preservation, and real-time visibility offered by Kvants. As investor demand shifts toward structured, quant-driven solutions that can operate in all markets, Kvants has established itself as the leading on-chain quant platform.

Get started with Kvants Vaults

Read more