The Directional Dependency Problem

Jan 6 | 7 Minutes MIN | Kvants

By

Kvants

Here is an uncomfortable truth about most institutional crypto allocations: they are one bet disguised as a portfolio.

Whether you hold Bitcoin directly, a basket of Layer-1 tokens, exposure through ETFs, or a diversified mix of DeFi assets, the return profile is remarkably similar. Academic and industry research consistently shows that 85-95% of altcoin returns are explained by Bitcoin's price movement. During periods of market stress, correlations approach 1.0. Diversification across crypto assets provides the illusion of risk management while delivering concentrated directional exposure.

This isn't a failure of asset selection. It's a structural feature of how crypto markets behave. And it creates a fundamental question for institutional allocators: how you get crypto exposure matters as much as whether you get it.

The Cost of Directional Dependency

Directional dependency creates three problems for institutional portfolios:

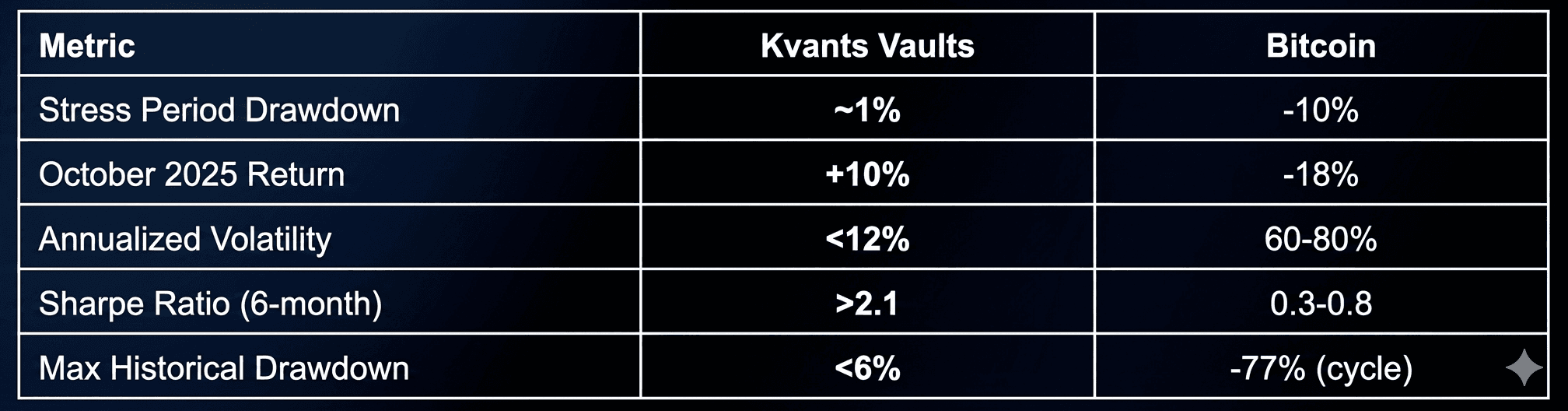

Concentrated drawdowns. When Bitcoin corrects 15-20%, diversified crypto portfolios typically fall 20-40% or more. There is no internal hedge. October 2025 demonstrated this vividly: Bitcoin fell 18%, Ethereum dropped 20%, and altcoins collapsed 50-70% in a single day. $19.4 billion in leveraged positions were liquidated. Holding different tokens provided no protection.

Volatility without compensation. Crypto's annualized volatility ranges from 60-80% for Bitcoin to 100%+ for altcoins. Accepting this volatility makes sense if you're being compensated with superior risk-adjusted returns. But when your return is simply a leveraged expression of Bitcoin's direction, you're taking outsized risk for a single factor bet.

Portfolio-level fragility. For allocators managing multi-asset portfolios, directional crypto exposure adds beta, not alpha. It increases overall portfolio volatility without providing the uncorrelated return stream that justifies alternative allocations.

The Systematic Alternative

Market-neutral systematic strategies solve this problem by extracting returns from an entirely different source: market microstructure.

Crypto markets contain persistent structural inefficiencies that exist independent of price direction. Funding rate dislocations occur when leveraged traders pay premiums to maintain positions. Statistical relationships between correlated pairs create mean-reversion opportunities. Basis spreads between spot and futures markets offer arbitrage yields. These inefficiencies persist because of the market's unique characteristics: 24/7 trading, fragmented liquidity across venues, and a participant base dominated by retail speculation.

Systematic strategies harvest these returns through delta-neutral positioning. By maintaining offsetting long and short exposures, they generate alpha from market activity itself—not from predicting whether Bitcoin will rise or fall. The result is a return stream that behaves fundamentally differently from directional crypto exposure.

Performance Under Stress: Kvants vs. Directional Exposure

The difference between systematic and directional approaches becomes most apparent during market stress:

The contrast is structural, not coincidental. During the largest single-day liquidation event in crypto history, Kvants Alpha Vault generated positive returns while directional portfolios suffered catastrophic losses. This outcome reflects the fundamental difference between harvesting market microstructure and betting on price direction.

THE VOLATILITY-RETURN EQUATION

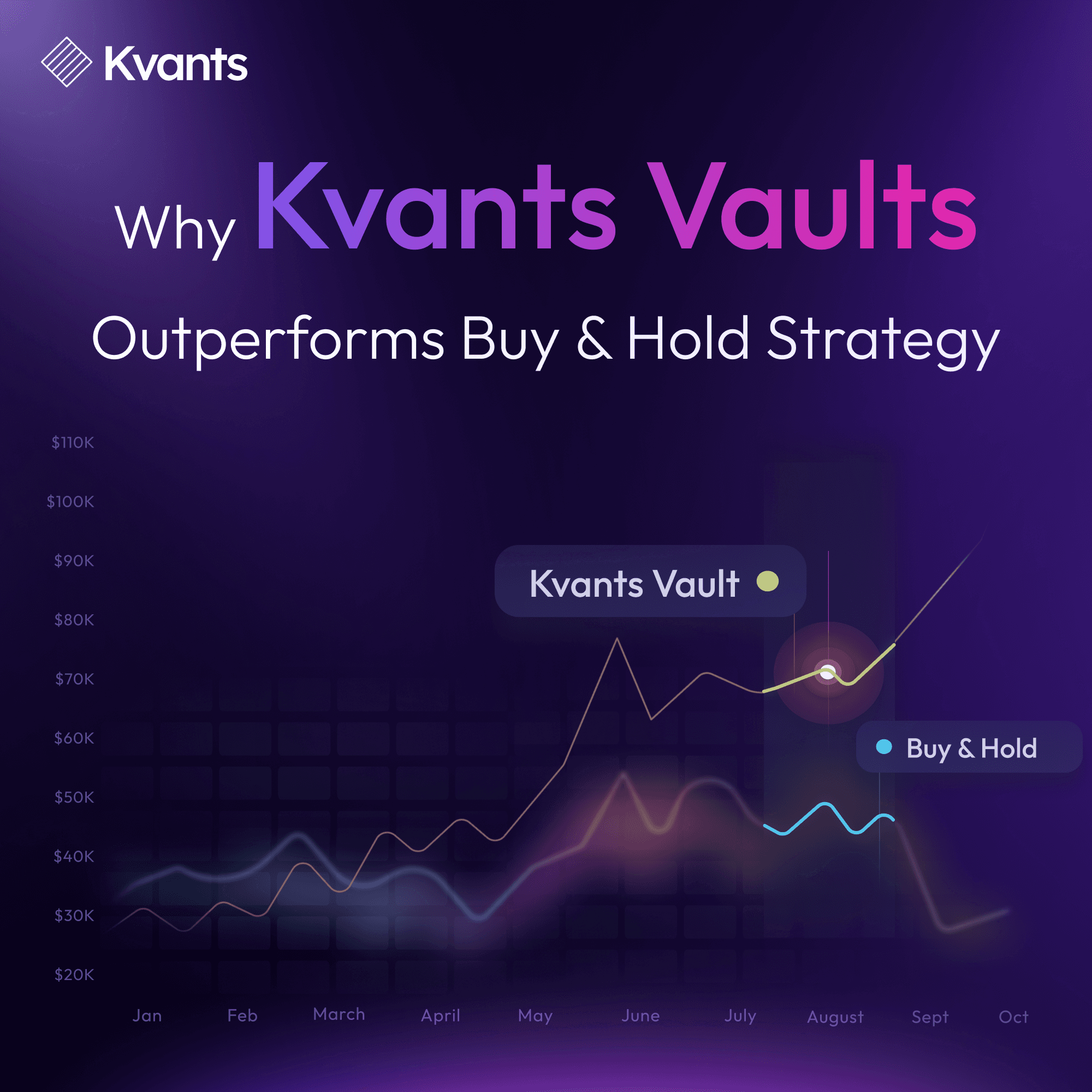

Kvants vaults have delivered ~35% average APY with sub-12% volatility, producing Sharpe ratios consistently above 2.0. Bitcoin has delivered comparable long-term returns with 5-7x the volatility. For institutional allocators evaluating risk-adjusted performance, systematic strategies offer a fundamentally more efficient path to digital asset returns.

The Institutional Case for Systematic Crypto Alpha

For institutional allocators, systematic market-neutral strategies address the core tension in crypto allocation: participating in a high-growth asset class without accepting concentrated directional risk.

Uncorrelated returns. When your equity and fixed income portfolios are under pressure, you need alternatives that behave differently. Systematic crypto strategies provide genuinely uncorrelated return streams—alpha derived from market structure, not market direction.

Managed volatility. Institutional mandates often constrain acceptable drawdowns. Systematic strategies with sub-12% volatility and max drawdowns under 6% fit within portfolio risk budgets that would exclude directional crypto exposure.

Transparent, verifiable execution. Kvants operates through non-custodial architecture—DeFi vaults with on-chain transparency or CeFi signal services via API. Institutional allocators can verify performance, audit risk metrics, and maintain full custody of assets.

The question for institutional allocators isn't whether to have crypto exposure. It's whether that exposure should come through directional bets on price—accepting 60-80% volatility and concentrated drawdown risk—or through systematic strategies that harvest structural alpha with institutional-grade risk management.

We welcome the opportunity to discuss how Kvants' systematic approach might complement your digital asset allocation strategy.

Kvants Institutional

IMPORTANT DISCLOSURES

Past performance is not indicative of future results. Cryptocurrency investments carry significant risk including potential loss of principal. Performance figures shown are net of fees unless otherwise stated. Returns may vary and are not guaranteed.

This material is for informational purposes only and does not constitute investment advice, an offer to sell, or solicitation of an offer to buy any securities or investment products. Investors should conduct their own due diligence and consult with qualified financial advisors before making investment decisions.

DeFi protocols involve smart contract risk. While contracts undergo security audits, no audit can guarantee the absence of vulnerabilities.

Read more