The Structure Behind The Kvants Staking Vault (Neutral JLP): Hedged Yield from DeFi's Market Engine

Nov 13 | 5 Mins MIN | Product

By

Kvants

Liquidity provisioning in DeFi often feels like a gamble: you earn fees from trades, but one big price swing can wipe out your gains through impermanent loss or market drops. It's a tough balance between chasing rewards and dodging risks.

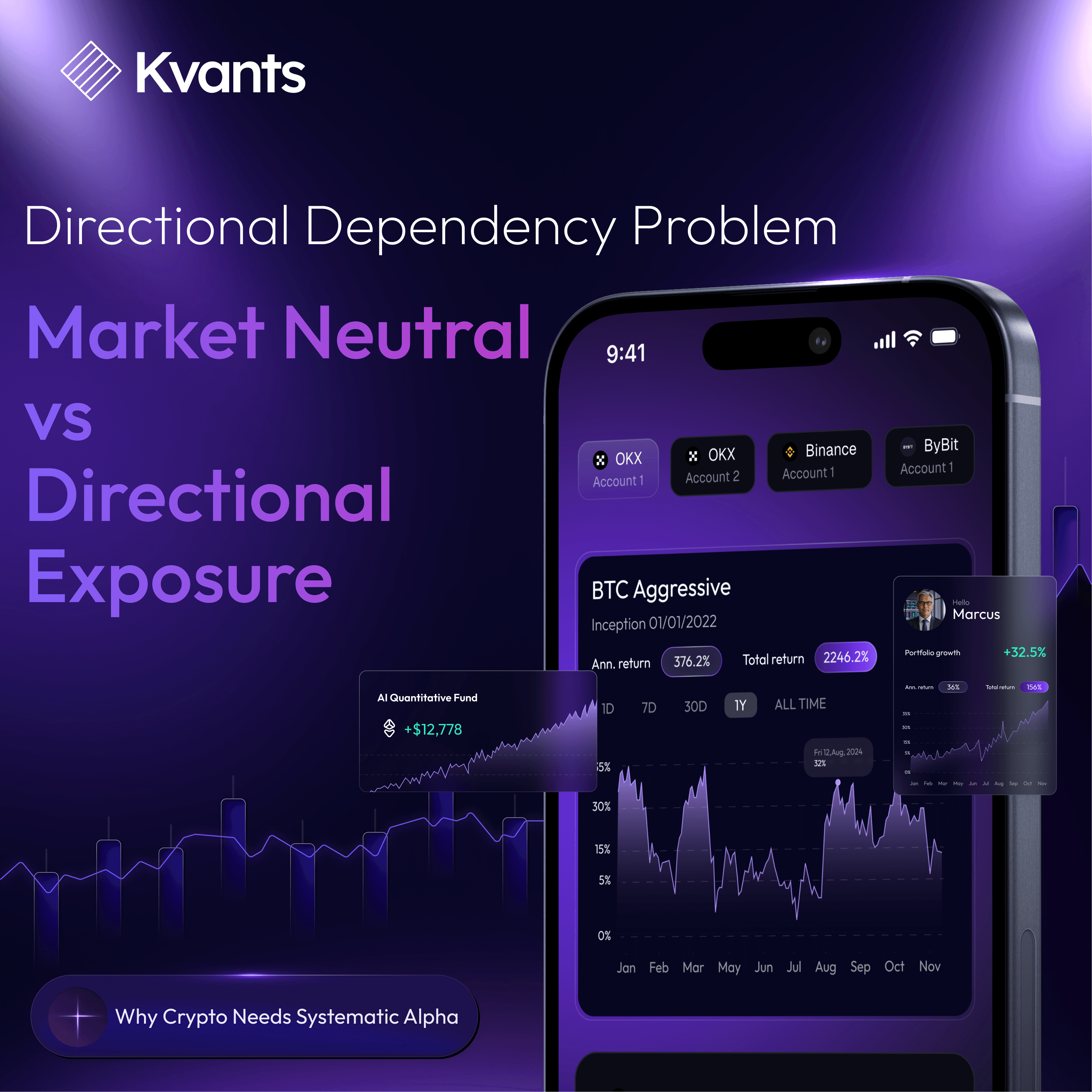

The Kvants Neutral JLP Vault flips the script with a smart, hedged approach. It turns your capital into a steady income stream by neutralizing price exposure, so you focus on reliable yields from trading activity.. Built on Solana's Drift Protocol, this Kvants Vault is perfect for yield seekers who want consistent returns without the rollercoaster. The Neutral JLP Vault stands out for its delta-neutral design, making it a go-to for passive yet protected growth.

How The Kvants Staking Vault (Neutral JLP) Works

Your USDC goes into Drift's JLP pool via the Kvants Vault, a hub where traders swap assets and perpetual contracts follow along. This pool collects everyday fees from those swaps, think of it as a cut from every deal, and shares in funding payments, which are like small tolls paid between buyers and sellers to keep prices fair. Normally, holding these assets means you're along for the ride if Bitcoin or Ethereum jumps or crashes.

The Kvants Neutral JLP Vault fixes that by adding a safety net: for every long position in the pool, it opens matching short perpetual contracts. It's like owning a stock and shorting a futures version of it, your ups and downs cancel out, leaving net exposure close to zero. This delta-neutral setup lets the Kvants Vault scoop up fees and funding without sweating market moves. In practice, it's not a one-time fix; the system watches prices and pool shifts around the clock, tweaking shorts as needed to stay balanced.

This results in yields that feel more like a reliable benchmark, with historical volatility under 12%, a fraction of unhedged pools.

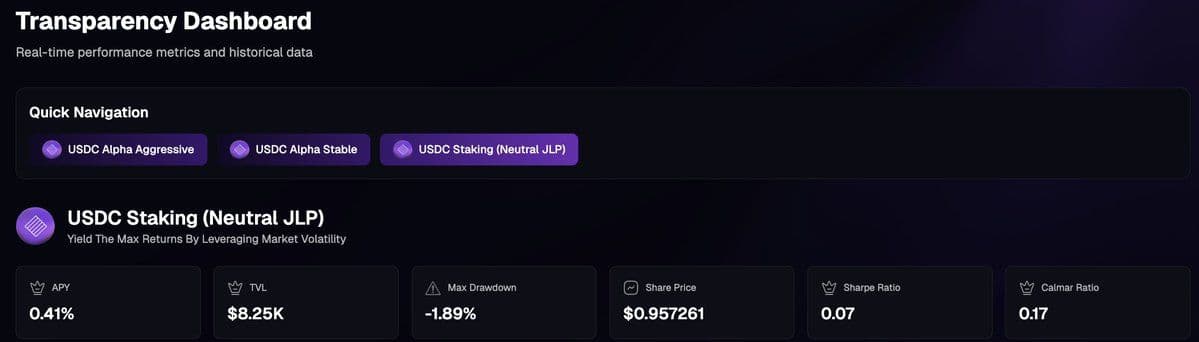

Over the last 90 days to early November 2025, the Kvants Neutral JLP Vault has delivered around 15% APY, with peaks touching 33% during high-activity periods. That's on top of a max drawdown of just 1.89%, making it a safer bet than many stablecoin farms or lending options that can dip harder in tough times.

Exploring Kvants USDC Staking

For those exploring Kvants USDC Staking, this vault's mechanics ensure your deposits work harder, capturing structural alpha without the directional drama. Drift's surging volumes, as reported by The Defiant, underscore why these yields are accelerating in 2025.

Smart Automation: Hands-Off Management with Full Visibility in the Kvants App

That's why Kvants runs an automated engine on Drift within the Kvants Neutral JLP Vault, checking exposures every 10-15 minutes and rebalancing shorts with minimal fuss. It uses smart routing to avoid big price slips during trades, keeping costs low, often just a tiny fraction of your position. Everything happens on-chain, it's fast, secure, and verifiable.

Through the Kvants App's Transparency Dashboard, you get a front-row seat: live share price, performance charts, and breakdowns of what's driving your returns. You get to see how fees from trader buzz add up, or track funding flows during bull runs when shorts get paid to wait. It's not just numbers, it's context, like alerts for rebalances or simple explanations of why a tweak happened. This openness builds trust, especially compared to vaults.

The Kvants Vault's integration with the app makes monitoring Kvants USDC Staking effortless, turning complex hedging into a seamless experience. Transparency like this aligns with broader trends in sustainable yield farming on Solana, where delta-neutral plays are key to long-term viability.

Yield Source For The Kvants USDC Staking Neutral JLP Vault

The Kvants Neutral JLP Vault pulls from perpetual markets, trader volume and natural imbalances. Trading fees ramp up with more action on Drift (which handles hundreds of millions daily), while funding rates reward the side that's out of favor, like shorts in a hype-driven rally. Add in small wins from price alignments between spot and futures, and you have a layered yield: 12-18% from fees, 8-15% from funding, and 2-5% from basis plays.

In the past six months (May to November 2025), this strategy clocked a Sharpe ratio of 2.1, meaning solid returns per unit of risk, and a Sortino above 3.4, focusing on volatility protection. That's 35-50 basis points better monthly than average USDC lending, and it adapts: busier markets mean fatter fees; quieter ones keep things efficient without big losses. These pooled sources provide a sustainable edge, free from the inflation traps that supress other DeFi yields.

Kvants Risk Governance Built-in Safeguards Across Vaults

The Kvants Neutral JLP Vault uses daily Value-at-Risk checks, essentially stress-testing for worst-case scenarios over 180 days, to set smart limits on positions and exposures. It factors in volatility, liquidity crunches, and even wild funding swings, like those in 2022 crashes. Tests show drawdowns capped under 6%, giving you confidence in black swan events.

These rules apply across all Kvants Vaults, from this neutral option to more aggressive ones like Alpha Stable or Alpha Aggressive, so you can mix and match with consistent oversight. It's quant-level protection without the jargon overload, drawing from proven DeFi research on hedged strategies. In the Kvants ecosystem, this governance ensures that every Kvants USDC Staking position, including the Neutral JLP Vault, prioritizes capital preservation alongside yield. This approach echoes the risk frameworks in Solana's top yield opportunities, where protocols like Drift lead in balanced farming.

The Kvants Neutral JLP Vault in Your Portfolio

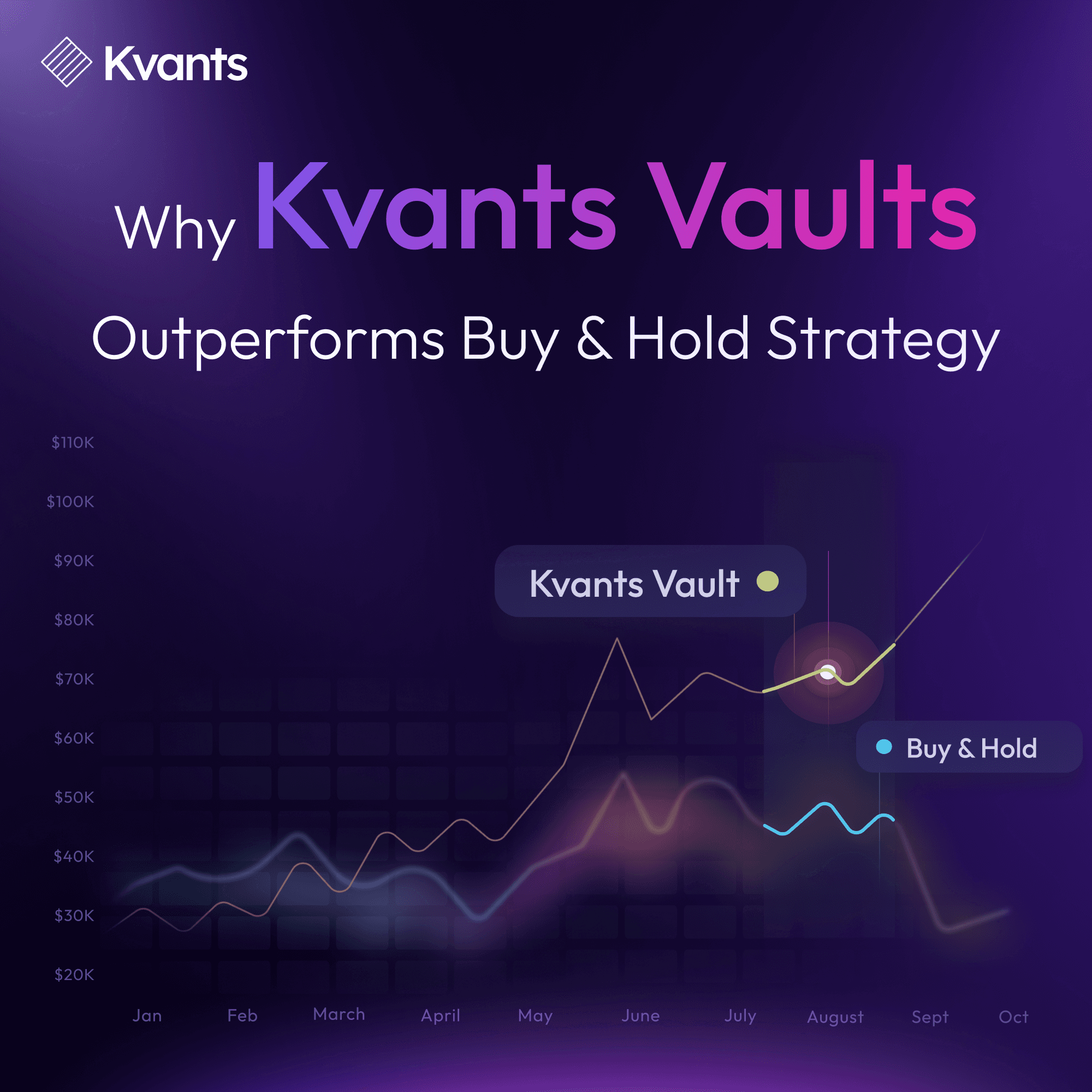

Think of the Kvants Neutral JLP Vault as the calm core of your DeFi bag, an allocation to smooth out wilder bets like levered trades or altcoin farms. Its low volatility (under 10%) offsets high-beta plays, boosting overall portfolio efficiency. Backtests show it lifts your total Sharpe by 0.3-0.5 points when blended right. As a flagship Kvants Vault, it complements the broader Kvants App offerings, making Kvants USDC Staking a versatile tool for balanced, long-term strategies. With Solana DeFi surging, as Messari analyzes, vaults like this are essential for capturing the ecosystem's momentum.

Getting Started with the Kvants App

Getting started is straightforward and secure. Head to the Kvants App at app.kvants.ai, connect your wallet, pick the Kvants Neutral JLP Vault, and deposit USDC, no minimums beyond a practical $100 to start meaningful. Smart contracts handle the LP deposit and hedge setup in one go. Withdraw anytime, while you stay in full control over your keys.

Funding Options Available On The Kvants App

Connecting and funding your Kvants App is fast and flexible, giving you multiple ways to get started. You can link your preferred Solana wallets like Solflare or Phantom, or connect through MetaMask, Trust Wallet, or Coinbase Wallet if you use an EVM setup. For the quickest onboarding, you can simply create a smart wallet using your email, letting you fund your account without installing anything. Once connected, you can deposit assets directly and begin allocating capital into Kvants Quantitative Trading Vaults.

Follow the conversation on Telegram

t.me/kvantsai

Read more