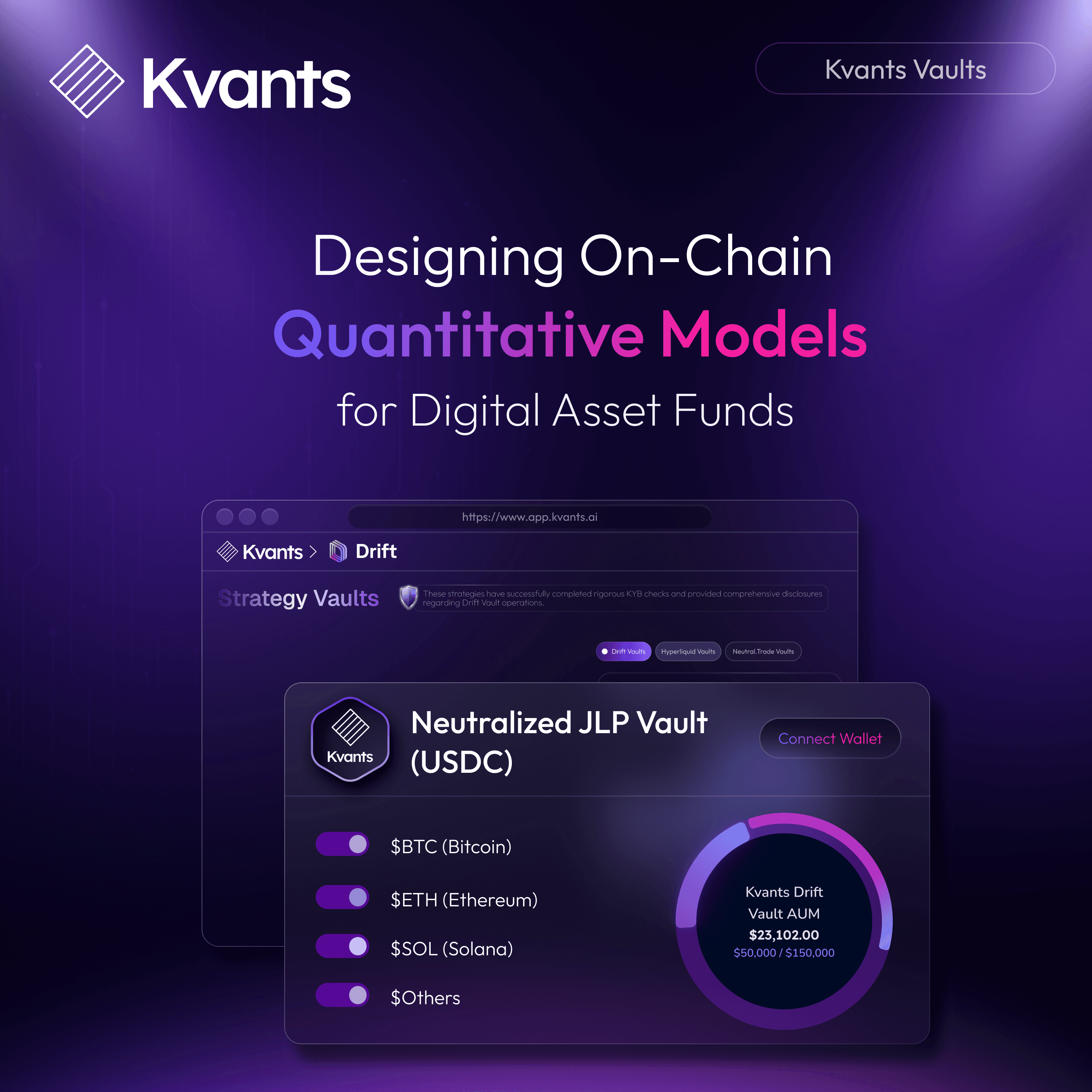

Designing On-chain Quantitative Models for Digital Asset Funds

Jul 31 | 5 Mins MIN | Product

By

Kvants

Why On-Chain Quant Models Are the Next Frontier in Institutional Crypto Investing

The evolution of quantitative finance in digital asset markets is no longer speculative. As institutional investors look beyond surface-level exposure to crypto, interest has turned toward replicating and extending quant strategies within on-chain environments. The rise of permissionless financial infrastructure offers not only new asset classes but also a fundamentally different execution and settlement paradigm.

This article outlines the infrastructure stack necessary to design and operate an on-chain quantitative model within a digital asset hedge fund. It covers data acquisition, model design, execution systems, custody frameworks, and tokenization structures. Our focus is not on retail DeFi experimentation, but on the systematic workflows, architecture, and tooling that can support institutional-grade strategies. The aim is to provide clarity on how on-chain systems can reflect or improve upon the operational discipline found in traditional quantitative finance.

Aggregating and Normalizing On-Chain and Off-Chain Market Feeds

A reliable data foundation is the first requirement for any quantitative strategy. In digital asset markets, data fragmentation remains a challenge. Centralized exchanges and decentralized exchanges operate under different data access conventions, and market microstructure varies significantly across venues.

On-chain models rely on blockchain-native data as well as aggregated pricing feeds from external sources. Platforms like The Graph and Pyth Network help index on-chain activity, while Chainlink and other oracle networks provide external price references. Institutional quants must reconcile these sources to construct normalized time series suitable for training, backtesting, and live deployment.

Unlike traditional markets, where trade data is fed through FIX protocols or API endpoints, on-chain models must account for latency, slippage, and gas costs. These frictions become part of the model's assumptions. For example, statistical arbitrage between DEX pairs must incorporate AMM curves and real-time liquidity depth, rather than assuming order book availability. The net effect is that models must be custom fit to a more complex and less standardized data landscape.

Execution Infrastructure in an On-chain Context

Execution systems in the crypto quant space operate under different constraints than their traditional counterparts. In particular, the need to interface directly with smart contracts introduces a new set of design considerations. There is no centralized clearing house, and order execution is mediated by Ethereum Virtual Machine (EVM) logic or similar decentralized systems.

To bridge this, execution frameworks often adopt a hybrid approach. Algorithms generate signals off chain, using traditional infrastructure, Python, cloud VMs, or data science platforms, and then submit signed transactions to smart contracts that execute on chain. This allows funds to maintain intellectual property around alpha generation while ensuring auditability and deterministic trade settlement.

Execution across DEXs such as Uniswap, Curve, and GMX requires integration with router contracts, liquidity aggregators, and protocol-specific adapters. For futures and options exposure, protocols like dYdX and Synthetix are often used in conjunction with centralized venues to hedge basis risk. The goal is not to replace the existing infrastructure but to complement it with permissionless systems that provide transparency, settlement finality, and composability.

Custody and Tokenization: Structuring Digital Asset Funds with Programmable Ownership

A key differentiator of on-chain hedge fund architecture is the ability to tokenize the strategy itself. Instead of operating through legal SPVs or LP agreements alone, a fund’s share class can be represented by a smart contract–issued token, offering programmable access control, redemption logic, and fee enforcement.

Custody in this environment is managed through institutional-grade wallet providers such as Fireblocks, Anchorage Digital, and Copper, which allow for multi-signature control, audit trails, and compliance integrations. These providers support whitelisting, transaction monitoring, and segregation of duties necessary for fiduciary oversight.

Tokenized fund units allow allocators to subscribe and redeem directly on chain, subject to fund terms coded into smart contracts. Governance structures, NAV calculation, and investor disclosures can also be encoded, significantly reducing overhead. This architecture introduces new possibilities for composability, where tokens representing different strategies can be bundled, rebalanced, or collateralized in lending markets, creating an extended surface area for capital efficiency.

Deploying Quant Strategies On-Chain: Adapting to Liquidity, Protocol, and Smart Contract Risks

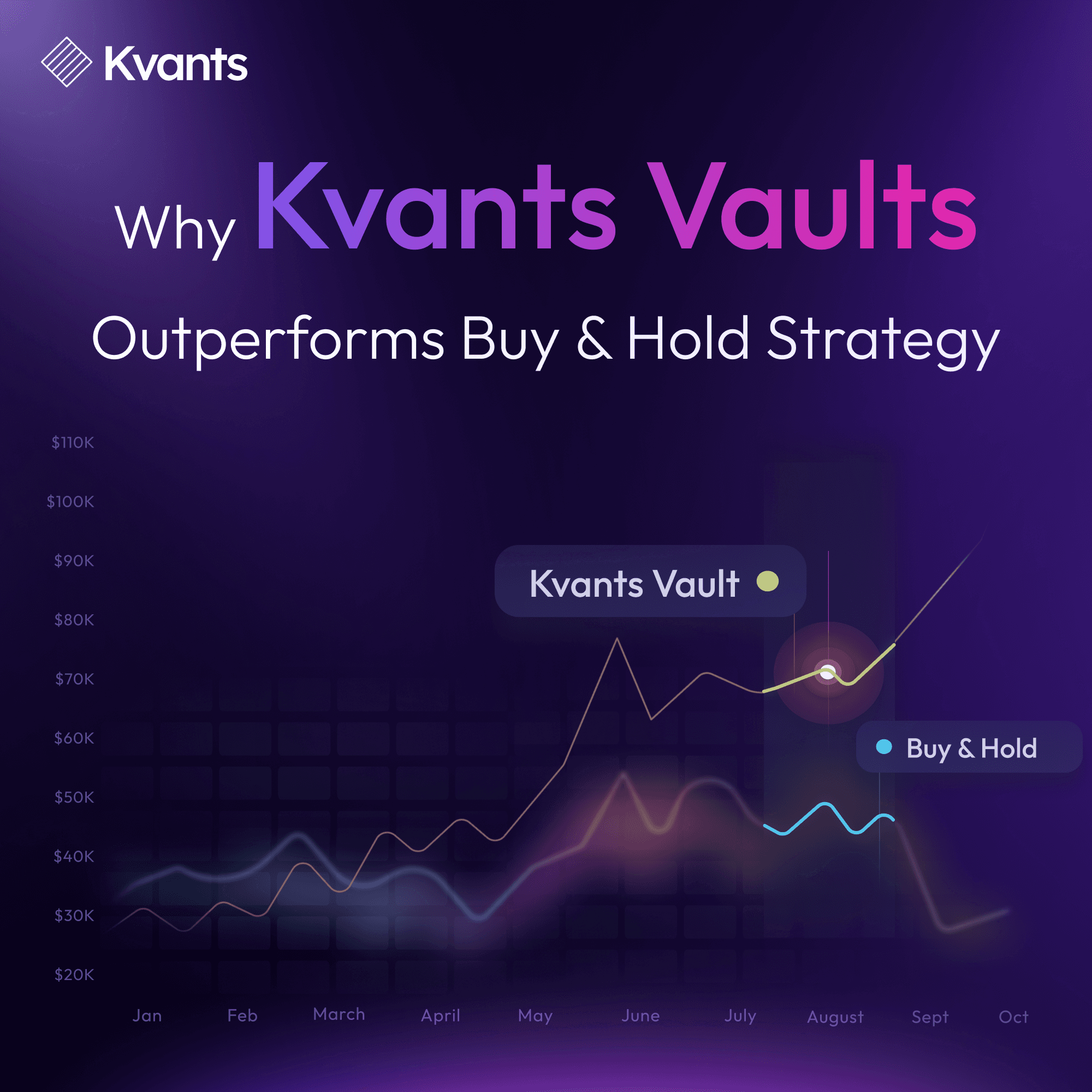

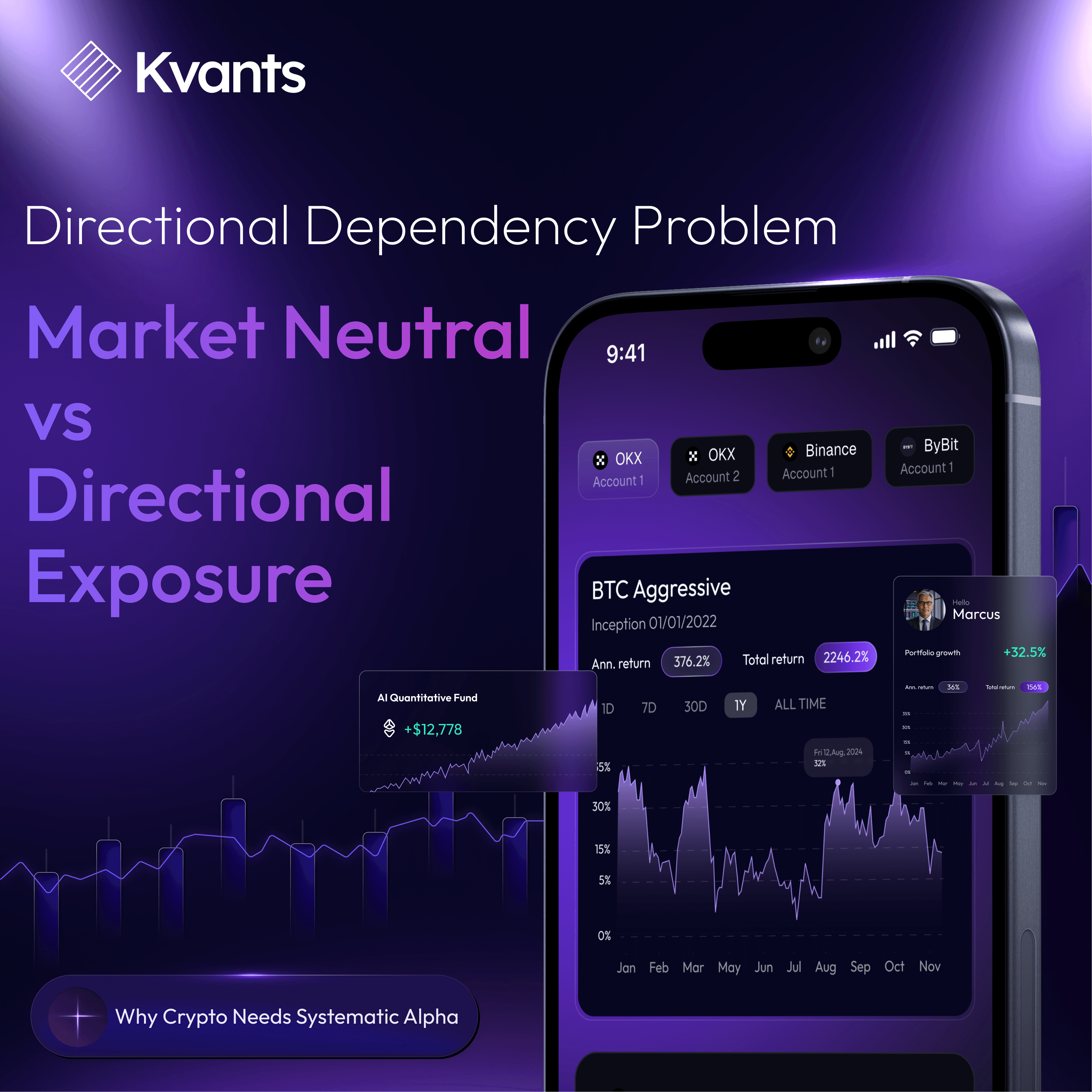

While infrastructure is a prerequisite, the integrity of the strategy remains central. On-chain quant models often adapt traditional methods, statistical arbitrage, momentum, volatility targeting—but execute in very different environments. These strategies must account for liquidity fragmentation, protocol-specific risks, and smart contract exposure.

For example, implementing a stat arb strategy between stETH and ETH requires understanding not just price convergence but also staking mechanics, rebase frequencies, and liquidity constraints on Curve or Balancer. Similarly, volatility models that inform options strategies must incorporate implied vol data from DeFi options protocols like Lyra or Dopex, which are still maturing in terms of volume and depth.

Risk management in this context becomes both operational and structural. Smart contract audits, oracle integrity, and systemic dependencies must be continuously monitored. Risk is not abstracted away by clearinghouses or custodians but embedded directly into execution paths, making transparency both a benefit and a necessity.

Composability in Asset Management: Building Modular, Tokenized Strategy Architectures

Designing on-chain quantitative models for digital asset funds requires a multidisciplinary approach. It is not simply a matter of translating existing models into new infrastructure. It involves rethinking how data is sourced, how execution is handled, how strategies are risk managed, and how capital is structured. For institutional investors, the value proposition lies in increased transparency, reduced settlement risk, and the ability to build modular products that interact directly with the financial stack.

The ecosystem is still early. Standards are emerging. But for quantitative funds willing to engage with the architecture, rather than simply route through it, the opportunities for efficiency and innovation are substantial. On-chain systems will not replace traditional finance outright, but they will increasingly define how systematic strategies are structured, deployed, and scaled in digital markets.

Scaling Institutional Quant Strategies with Composable On-Chain Infrastructure

As more DeFi primitives mature across data indexing platforms, execution protocols, and modular vault frameworks, the scalability of on-chain quantitative strategies is becoming increasingly viable. Innovations in intent-based execution, cross-chain messaging, and MEV-aware routing are enabling quants to design strategies that operate across fragmented liquidity layers without sacrificing performance.

Meanwhile, improvements in modular protocol design, like isolated margin systems and plug-and-play strategy engines, are reducing the operational overhead of deploying and maintaining complex models. These advancements signal a shift from experimental deployments to production-grade, composable systems capable of supporting sustained alpha generation at institutional scale.

Why Embracing On-Chain Architecture Gives Hedge Funds a Competitive Edge in Digital Asset Markets

Designing on-chain quantitative models for digital asset funds requires a multidisciplinary approach. It is not simply a matter of translating existing models into new infrastructure. It involves rethinking how data is sourced, how execution is handled, how strategies are risk managed, and how capital is structured. For institutional investors, the value proposition lies in increased transparency, reduced settlement risk, and the ability to build modular products that interact directly with the financial stack.

The ecosystem is still early. Standards are emerging. But for quantitative funds willing to engage with the architecture, rather than simply route through it, the opportunities for efficiency and innovation are substantial. On-chain systems will not replace traditional finance outright, but they will increasingly define how systematic strategies are structured, deployed, and scaled in digital markets.

Read more