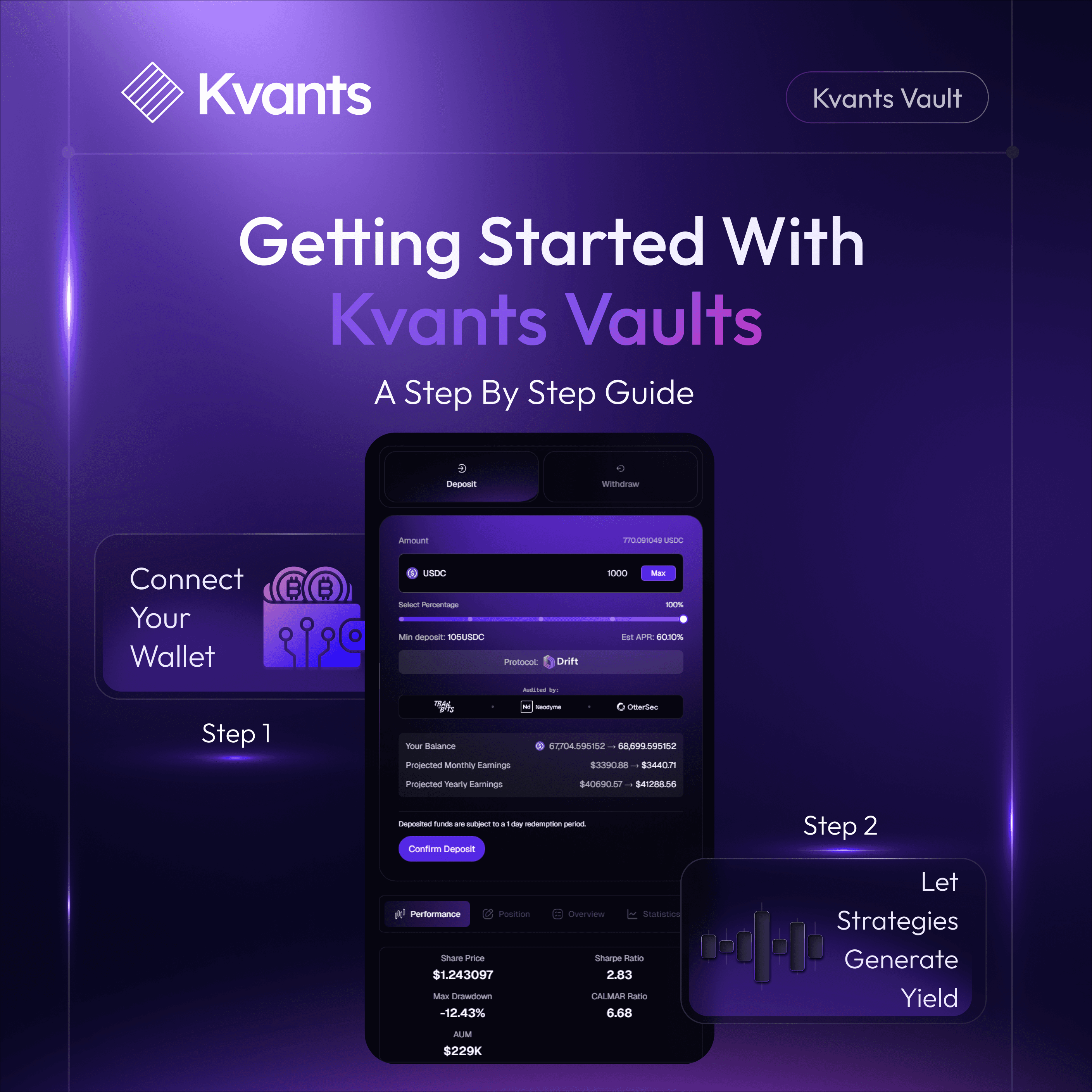

Getting Started With Kvants Vaults: A Step By Step Guide

Oct 15 | 5 Mins MIN | Product

By

Kvants

The Rise of Quantitative DeFi Infrastructure

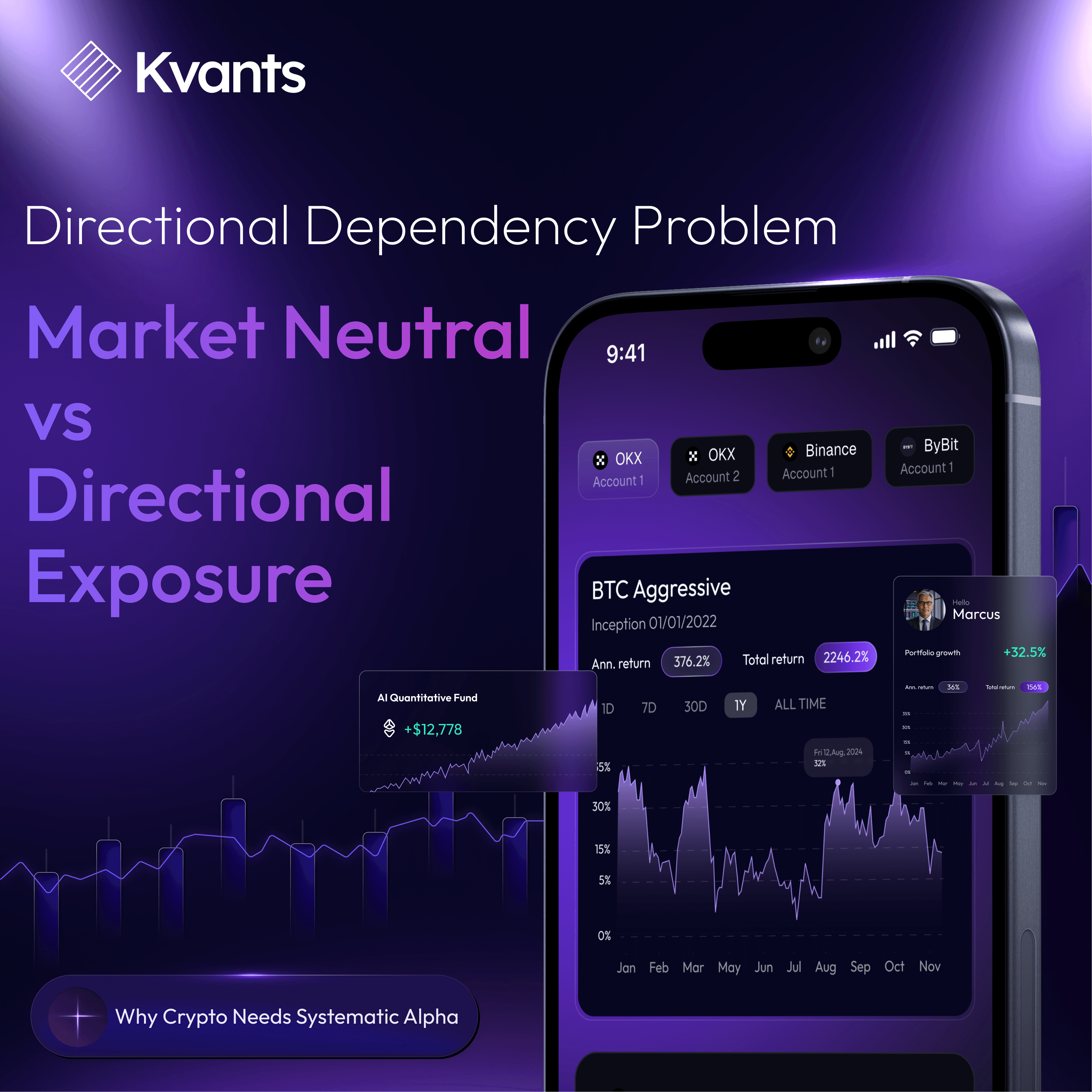

Investors are increasingly looking for ways to access structured, risk-adjusted returns in decentralized markets. Kvants Vaults bridge that gap by combining AI-driven quantitative strategies with institutional execution standards and full on-chain transparency.

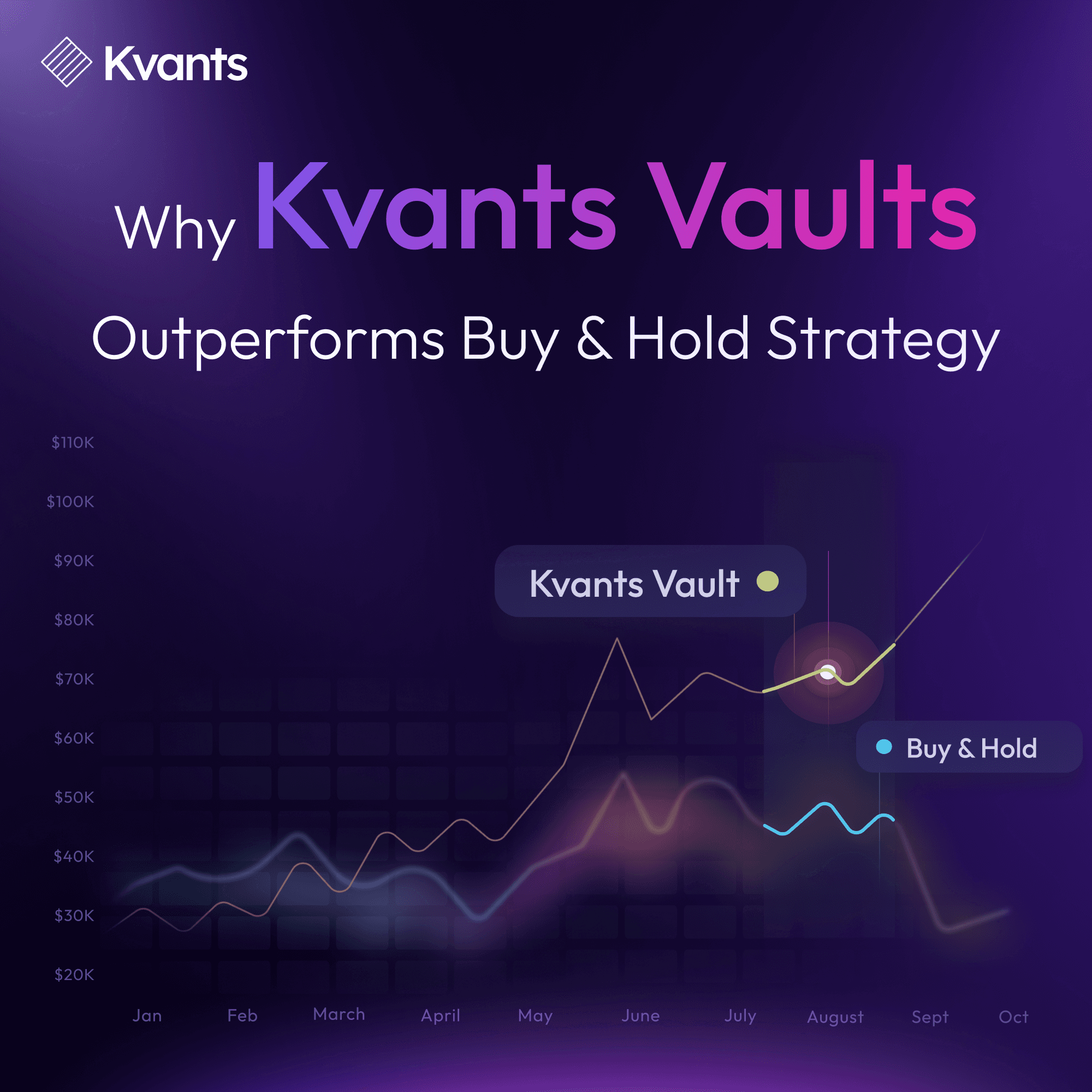

In an ecosystem dominated by yield speculation and unsustainable incentives, Kvants introduces a system that measures performance through established metrics like Sharpe, Sortino, and Calmar ratios, rather than token emissions. The vaults are designed as market-neutral strategies, capturing inefficiencies across BTC, ETH, and SOL while maintaining tight control over volatility exposure.

Kvants Growth and Performance Metrics

Kvants has already established significant institutional traction, managing $42M in CeFi AUM, while its DeFi vaults have become performance benchmarks. The USDC Alpha Aggressive Vault, for example, has delivered up to 89% net returns in 118 days and even generated +14% absolute gains during recent market stress when broader crypto markets fell sharply.

This combination of quant precision, transparency, and real-time adaptability defines Kvants’ evolution into the infrastructure layer for structured on-chain asset management.

Kvants Vaults are on-chain, permissionless investment structures built for market-neutral yield generation. Each vault combines a neutral JLP base, which captures exchange fee carry and funding spreads, with a momentum overlay that reacts to volatility shifts.

This dual approach allows Kvants to capture short-term dislocations in market structure without taking directional bets. The result is a quant system capable of generating consistent alpha through liquidity efficiency, automated rebalancing, and strict risk control frameworks built around VaR (Value at Risk) and Sharpe Ratio optimization.

Unlike conventional yield protocols, Kvants Vaults are fully verifiable on-chain, with live performance metrics and capital flows available for public review. Investors, whether individuals or institutions, can see how their capital is deployed, rebalanced, and performing in real time.

Investing in Kvants Vaults is designed to be straightforward for users of all experience levels while maintaining the precision that institutional allocators expect.

How to Invest in Kvants Vaults

Step 1: Visit the Kvants Platform

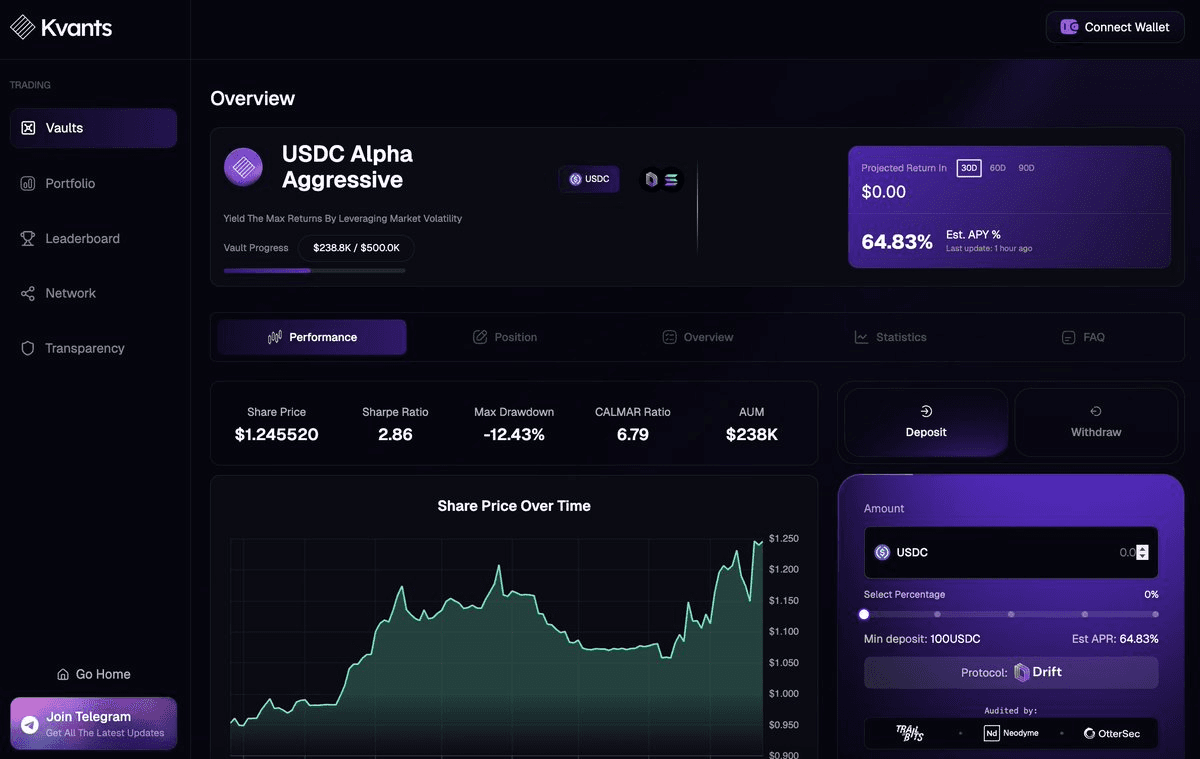

Start by visiting the official Kvants App. The interface provides real-time analytics for every active vault, including AUM, estimated APY, drawdown, and Sharpe Ratio.

Each vault page displays transparent performance data, historical share price trends, and underlying strategy mechanics. Investors can review how capital is distributed between neutral liquidity positions and volatility overlays before allocating funds.

The dashboard also integrates directly with Solana’s high-speed architecture, enabling low-latency execution, negligible transaction costs, and continuous performance tracking ,key features that make Kvants scalable for institutional-level participation.

Step 2: Select a Kvants Vault Strategy

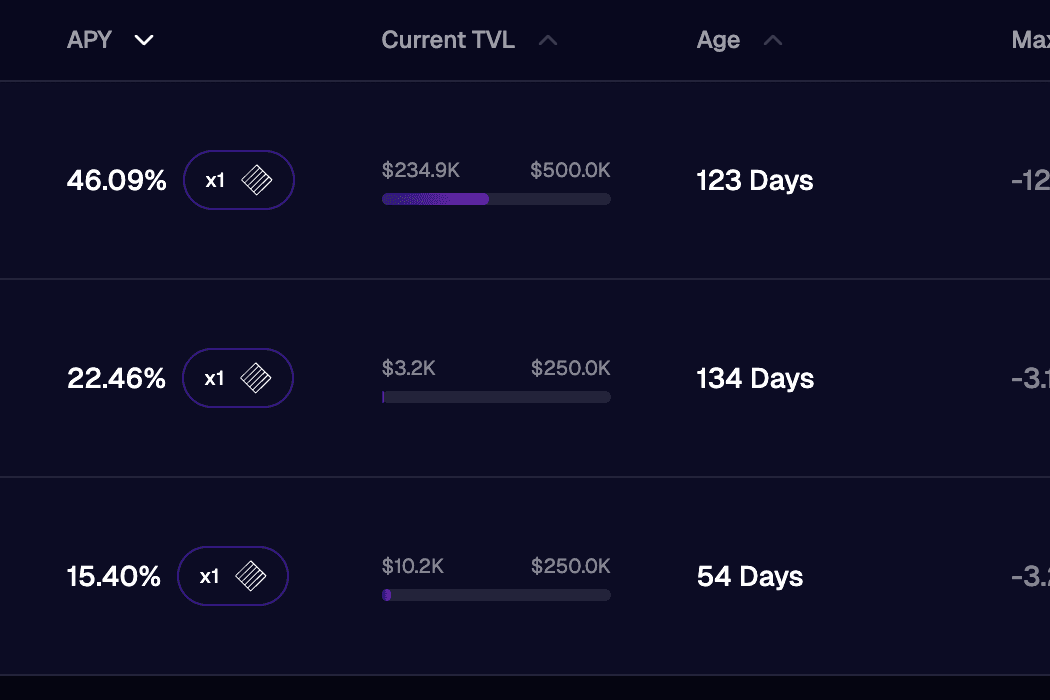

Every Kvants Vault caters to a different investor objective:

- USDC Alpha Aggressive Vault – Built for high volatility conditions, it combines a neutral JLP base with a 10% adaptive momentum overlay, enabling it to capture short-term inefficiencies. This vault achieved 89% performance in 118 days and remained profitable during recent market turbulence.

- USDC Alpha Stable Vault – Targets lower-risk, steady returns by focusing on carry yields and conservative rebalancing.

- USDC Staking Vault (Neutral JLP) – Designed for allocators seeking capital efficiency and preservation while maintaining yield stability through hedged liquidity positions.

These strategies offer flexibility for diversified portfolios, allowing investors to balance exposure based on volatility preference, liquidity requirements, and performance expectations.

Step 3: Connect Your Wallet

Once a vault has been selected, investors can connect a compatible Solana wallet directly through the Kvants platform.

Wallet connection ensures non-custodial ownership, meaning funds remain under the investor’s control at all times. For smaller investors, the minimum deposit threshold starts as low as $50–$100 USDC, while institutions can deploy larger allocations seamlessly through multi-signature wallets or custodial integrations.

All deposits are confirmed on-chain and visible through blockchain explorers. Kvants’ transparency ensures that both retail and institutional investors have the same verifiable view of the strategy’s activity and vault utilization.

Step 4: Subscribe To A Preferred Vault Strategy

After connecting the wallet, the next step is subscribing to the vault. Once subscribed, the strategy automatically activates and begins executing trades in alignment with predefined quant parameters.

Capital is dynamically routed across perpetual exchanges like Drift Protocol and liquidity venues optimized for carry and spread harvesting.

Each trade and rebalance adheres to strict quantitative controls.

This includes continuous VaR monitoring, Sharpe Ratio tracking, and Sortino Ratio optimization, all executed programmatically without manual intervention. Investors can monitor results live via Kvants’ on-chain performance dashboard.

This structure removes the need for trust-based fund management and replaces it with transparent execution logic that aligns with institutional-grade reporting standards.

Step 5: Let The Strategies Generate Yield

Once subscribed, Kvants Vaults operate autonomously, executing systematic trades and adjusting exposures in real time.

Returns are generated through fee capture, arbitrage spreads, and volatility harvesting, not through leverage or token inflation. The design ensures controlled drawdowns, verified through live data.

Recent market events and Kvants Vaults Performance

Kvant vaults have proven its model’s resilience. While the broader market saw an 18% drop in open interest and double-digit declines in Bitcoin and Ethereum, Kvants Vaults remained profitable, with +14% returns during extreme volatility.

There was an 18% drop in open interest among traders as they moved away from risky positions, signaling a low appetite for investment in the crypto market. Analysts believe this fall is a result of a mix of macro shockwaves and extreme leverage, marking the worst day for crypto since Q1 2025.

According to the data, Bitcoin was trading at $111,773.13, down by almost 11% in the last seven days. Similarly, Ethereum was trading at $3,842.09, down by 16% in the last seven days.

Considering the resilience and consistency of systematic trading strategies under pressure, it demonstrates the value of structured, risk-managed DeFi for modern investors. Kvants AI redefines how the world earns yield, opening access to DeFi Yield via a single tap.

Why Kvants Vaults Are The Preferred Yield Platform For DeFi

Kvants Vaults represent the convergence of quantitative finance and decentralized infrastructure. The model blends institutional execution discipline with permissionless transparency, giving investors data-backed confidence in every allocation.

Each vault runs on a unified quant infrastructure that powers both CeFi and DeFi operations. This standardization allows Kvants to maintain cross-market capital efficiency, ensuring risk management remains consistent across platforms.

With an existing $42M CeFi AUM, Kvants has a proven foundation in managing professional-grade portfolios. The DeFi vault expansion extends this capability to a broader audience while maintaining the same analytics rigor that institutional allocators expect.

The focus is not speculation but sustainable compounding. Kvants builds products that function as portfolio infrastructure, not just yield vehicles, a key reason why both professional and retail investors are turning toward structured DeFi allocations.

The Future of Structured DeFi

As capital markets continue to evolve, the next phase of DeFi will belong to platforms capable of integrating risk frameworks, verifiable performance, and automation. Kvants is leading this transition by creating a quant infrastructure layer that brings institutional logic to on-chain execution.

Read more