Analysing DeFi Vaults Portfolio Management: Infrastructure, Strategy Integration, and Risk Control

Jul 14 | 5 Mins MIN | Product

By

Kvants

Introduction

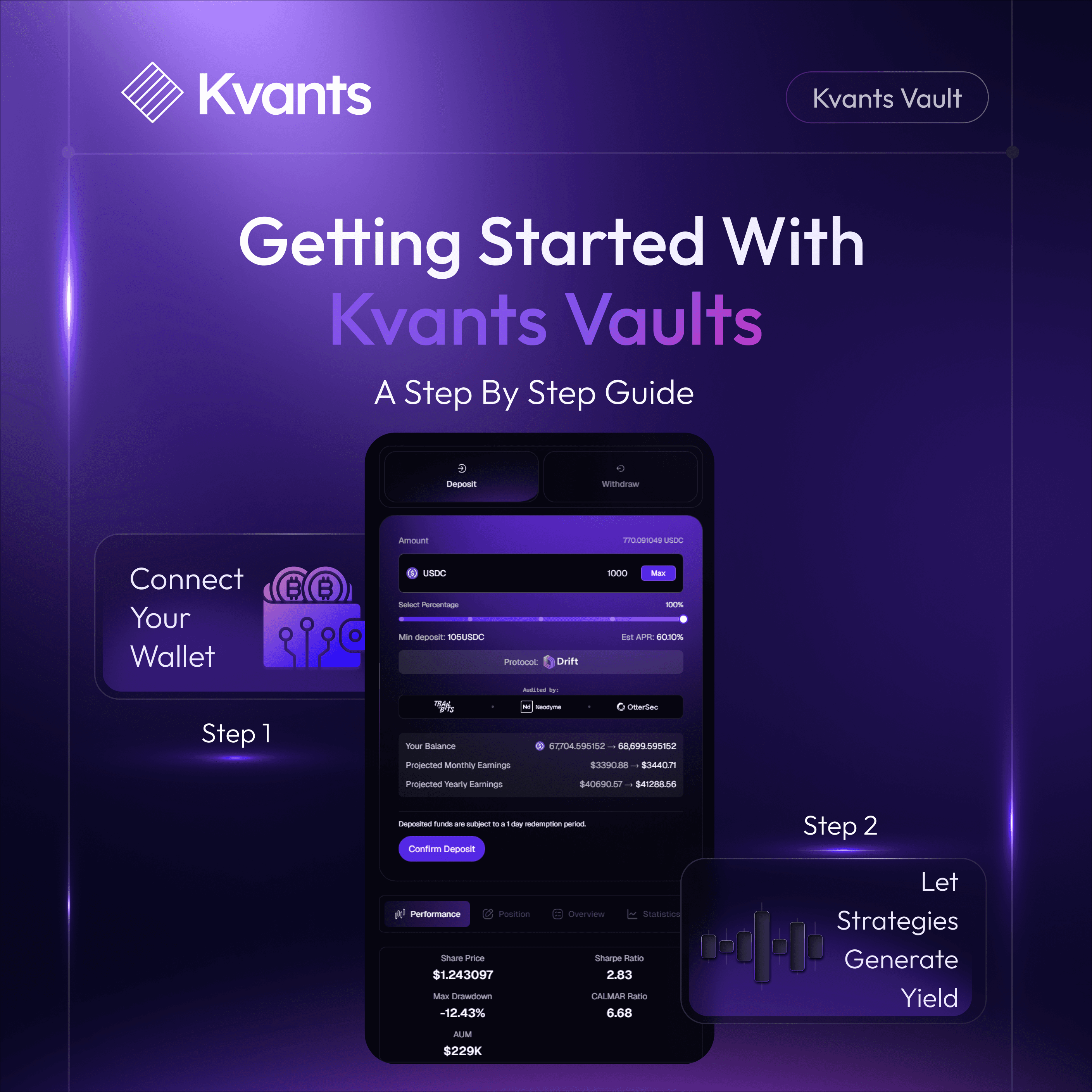

Institutional adoption of DeFi vaults is increasingly seen as a systematic method for deploying quantitative strategies within digital asset portfolios. A DeFi vault is a smart contract–based repository that manages capital deployment to predefined strategies, offering transparency in execution and real‑time visibility into performance. Instead of speculative yield farming, institutions now seek structured approaches that resemble traditional fund mechanics, yet operate fully on chain. Vaults enforce automated execution rules, support tokenized exposures, and provide predictable risk‑adjusted returns aligned with formal investment mandates.

Modular Vault Infrastructure

The architecture separates capital, logic, and governance into modular components, enabling allocators to integrate vaults as strategic building blocks. As TVL(Total Value Locked) in curated vaults grew from under $150 million to over $4.4 billion in twelve months, institutional interest shifted from experimental deployments to operational portfolio adoption BlockheadKiln. This transition reflects preference for strategies such as funding rate arbitrage, volatility spreads and basis trades, deployed within programmable infrastructure that supports oversight, compliance and clear attribution.

Vault Infrastructure and On‑Chain Execution

The infrastructure of a DeFi vault typically features three distinct layers, data ingestion, strategy logic and execution connectivity. Oracle networks such as Chainlink or Pyth provide pricing feeds, while indexing protocols such as The Graph convert on‑chain transactions into usable datasets. These feeds enable vaults to generate signals for strategies like basis arbitrage or volatility harvesting. Strategy logic is encoded directly into smart contracts, enabling deterministic execution rules and clear auditability. Execution occurs on chain via decentralized venues such as Uniswap, Curve or derivatives platforms like dYdX. Simple funding rate arbitrage strategies, for example, can be automated by routing capital between spot and perpetual markets based on funding differentials.

Compliance and control for institutional-grade vault

This design removes typical intermediaries and embeds transparency at every execution step. Capital remains in vault contracts until conditions are met. Observers can inspect allocation logic, transaction histories and token interactions in real time. Vaults offering delta-neutral strategies operate with real‑time adjustments to maintain neutral exposure, providing institutional allocators with predictable cash flow dynamics. These programmable systems align tightly with expectations for performance, compliance and operational discipline within digital asset allocating frameworks.

Strategic Integration into Institutional Portfolios

Vaults are no longer viewed as isolated yield instruments. Institutions now embed vault-based strategies into broader portfolio allocations, using vault tokens as composable building blocks. Allocators may hold diversified exposures by investing in several vaults: one executing volatility harvesting, another carrying basis trades, yet another offering real‑world asset (RWA) yield. Vault tokens function similarly to managed account shares, enforce fees or gating logic transparently via contracts, and can be used as collateral or composable primitives across lending protocols.

Composability across DeFi ecosystems

This modular approach provides flexibility: allocators can adjust weightings, combine strategies and monitor exposure with clarity. For example, a token representing a funding rate arbitrage strategy might be integrated into a structured product or layered within cross-protocol credit arrangements. The vault abstraction separates execution complexity from fund design, enabling institutions to align strategy selection with internal mandates, while retaining clear visibility into logic and performance. Strategy attribution becomes transparent, and vaults support composability across DeFi ecosystems, reflecting foundational institutional standards for governance and portfolio design.

Governance, Controls, and Risk Oversight

Institutional allocation requires clear controls. DeFi vaults have responded with increasingly sophisticated governance and risk frameworks. Smart contracts now incorporate drawdown limits, performance gates, and circuit breakers to stop execution under predefined adverse conditions. Governance is often structured with multi-signature approvals and time-locked changes, reducing the likelihood of unilateral intervention or governance attacks.

Transparency Infrastructure for Vault-Based Systems

Risk management tools allow vault operators and investors to simulate portfolio behavior under stress, assess sensitivity to volatility, and track exposure across multiple assets and protocols. Oracles are often backed by redundancy measures, such as time-weighted averages and fallback mechanisms, to ensure pricing integrity even during market dislocation.

Compliance teams benefit from on-chain audit logs and real-time monitoring dashboards. Every strategy adjustment, capital allocation, and performance outcome can be verified independently. These features align with the internal control requirements of traditional investment organizations, allowing vault-based systems to meet institutional standards not only in strategy but in governance and oversight.

Trends Driving Institutional Participation

The increase in institutional use of DeFi vaults is not speculative. It is structural. As incentives across early DeFi protocols decline, allocators are moving toward systems that offer reliable, strategy-based returns. Vaults now support exposure to tokenized real-world assets, cross-market arbitrage, and synthetic fixed income instruments. These mechanisms provide consistent, risk-adjusted returns while avoiding the volatility common in early-generation DeFi.

Institutional Defi Capital Inflows

Recent market data indicates that over 35 percent of new DeFi capital inflows now originate from institutional sources. Platforms that offer vault infrastructure have seen Total Value Locked grow by over 400 percent year-over-year. These trends are fueled not just by search for yield, but by infrastructure maturity. Allocators no longer need to build from scratch. They can deploy capital into audited, modular systems that conform to operational expectations.Institutional custody integrations, smart contract audits, and front-end interfaces tailored for fund workflows have further accelerated participation. The result is a new class of on-chain strategies that behave like hedge fund structures, but offer greater transparency, granularity, and speed.

Maturity Milestones

Despite this growth, challenges remain. Legal frameworks for on-chain strategy tokens are still evolving. Determining how these assets are classified for regulatory or tax purposes remains an open question in many jurisdictions. In addition, data standards, strategy disclosures, and governance norms vary widely across platforms. However, the infrastructure gap is closing. Formal verification of contracts, modular separation between strategy logic and custody, and the emergence of standardized portfolio reporting tools signal real progress. Institutional allocators now have access to tools that support due diligence, monitor real-time exposure, and align vault deployment with internal compliance frameworks.

Key Takeaways

DeFi vaults are transforming from fringe yield tools into foundational infrastructure for institutional portfolio management. They combine smart contract automation, modular strategy design, and built-in risk controls within a transparent ecosystem. Vaults can replicate many functions of traditional investment vehicles, data-driven model execution, execution governance, composability and real‑time oversight, while operating entirely on chain. Institutions gain clarity into how strategies generate returns, exposure is allocated, and governance is enforced.

These systems are not investments in volatility. Rather, they are programmable, rules-based structures that provide exposure to structured risk-management in digital markets, aligned with formal investment mandates. They support scalable deployment, audit readiness and composability. With modular design and measurable attribution, vaults can now serve as core components of institutional asset allocation in digital asset finance.

Read more