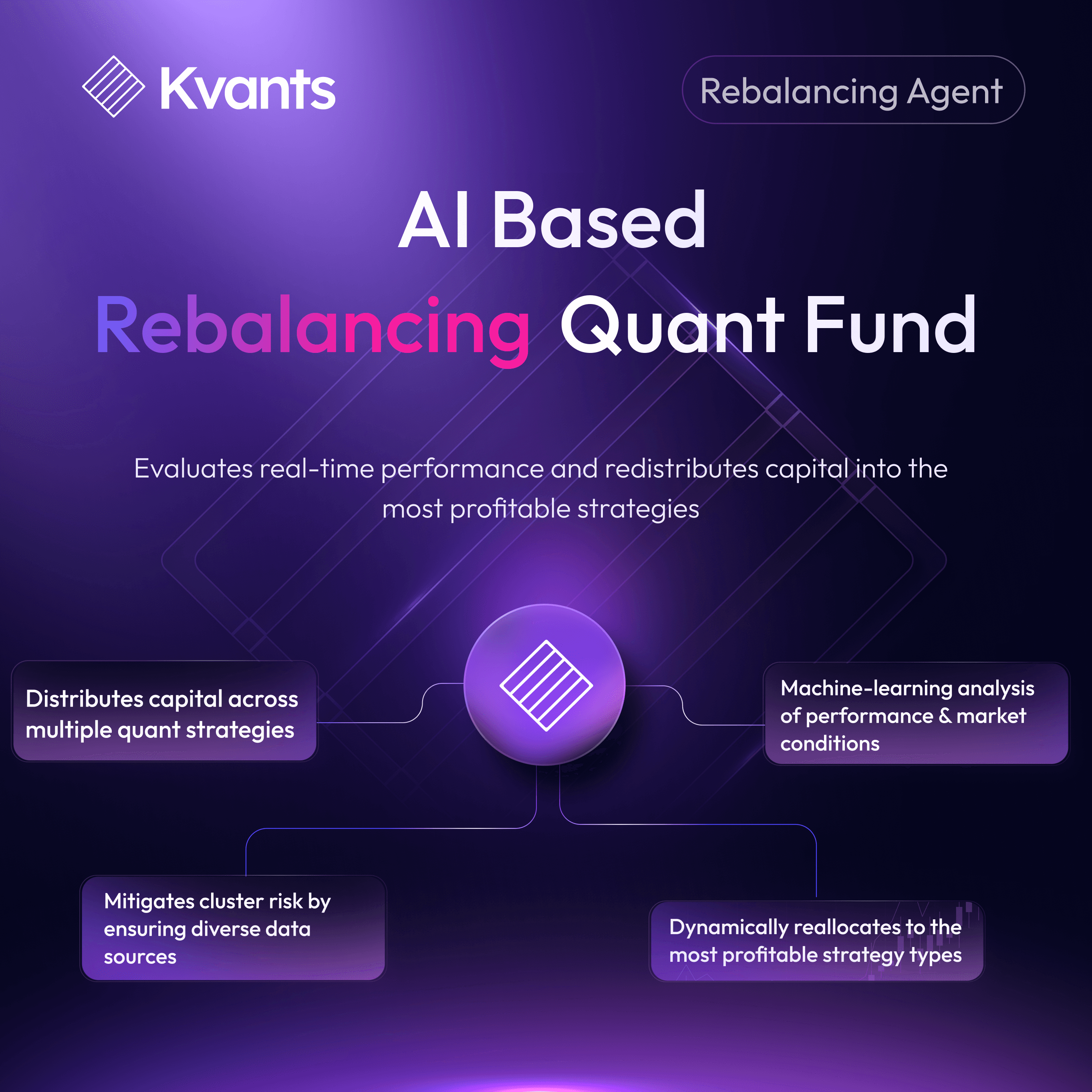

The Next Evolution in Quant Strategy Allocation: AI-based Rebalancing Quant Fund

Jun 10 | 5 mins MIN | Product

By

Kvants

How adaptive AI systems are redefining capital efficiency and performance optimization in multi-strategy quant funds

Key Takeaways

- Static allocation frameworks are inefficient in dynamic, multi-strategy portfolios.

- AI-based rebalancing agents allow real-time capital shifts driven by live data and risk models.

- These systems detect hidden correlations and prevent exposure to clustered risks.

- Faster reallocation improves drawdown control and amplifies short-term alpha capture.

- Context-aware intelligence turns these systems from automation tools into strategic capital managers.

Beyond Static Allocations

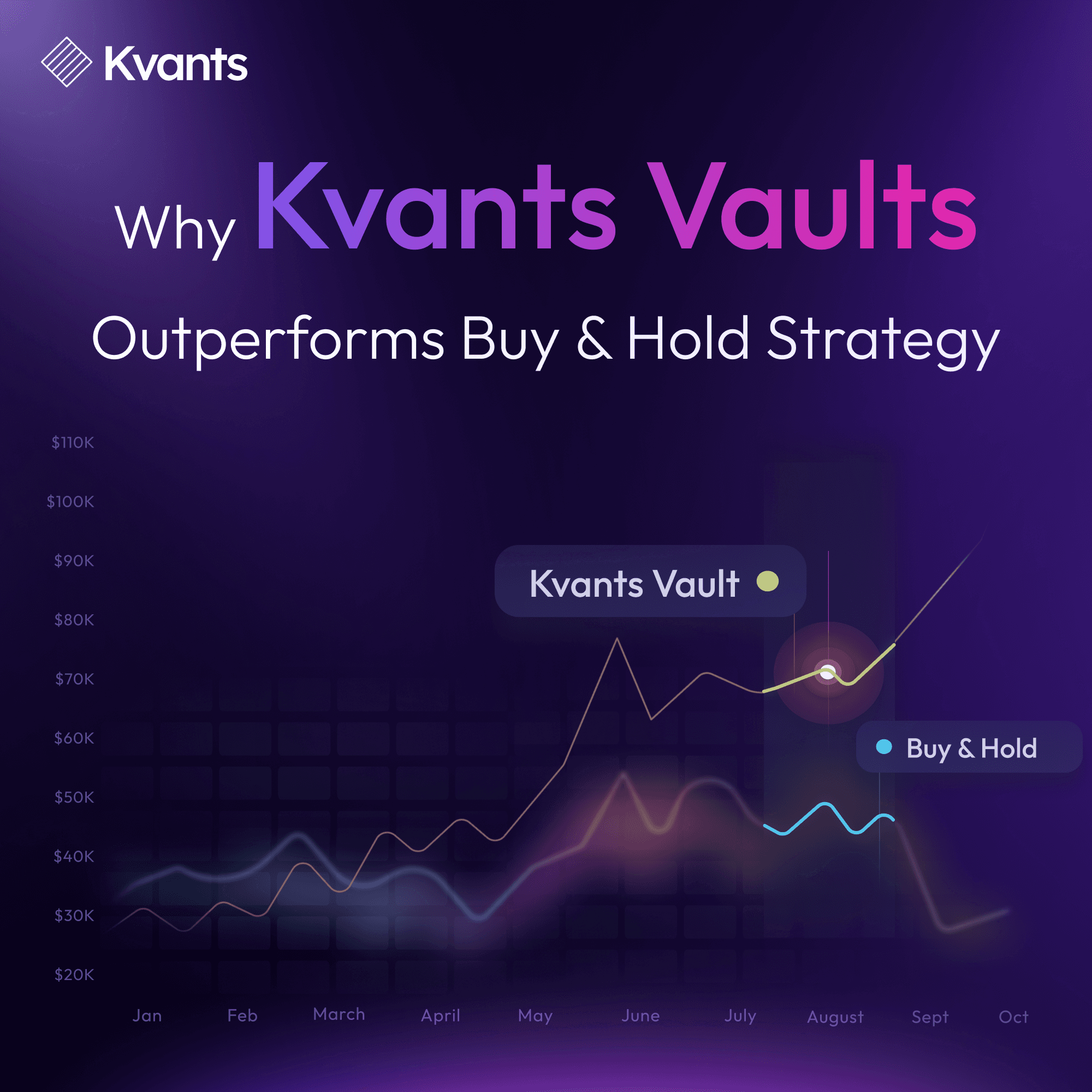

Multi-strategy quant funds have traditionally relied on research depth, signal quality, and disciplined execution to generate alpha. But as volatility increases and signals decay faster, the differentiator is no longer just about finding alphas but about how swiftly and intelligently capital flows toward it. Ai agent systems integrate machine learning directly into the reallocation process. By continuously analyzing live performance, market regimes, and cross-strategy behavior, they dynamically shift capital toward higher-performing systems. It's not just about automation, it's optimization informed by context, operating in real time.

Signal Discovery to Allocation Intelligence

The heart of quant is signal discovery. But alpha generation doesn’t end with signal creation. Allocation where and when capital is deployed across strategies is equally critical. Static weights or manual rebalances create lag, and lag erodes performance. AI-driven rebalancing agents adapt continuously. They digest volatility shifts, evaluate drawdown risks, monitor correlation changes, and fine-tune allocations in real time. This ensures more capital flows to what’s currently working, based on actual performance, not prior assumptions. These agents also improve with time. Each cycle adds to a growing base of learning, enabling the system to refine its noise filtering, signal confidence, and capital deployment. The result is a rebalancing mechanism that becomes a core edge, not a background function. Importantly, these systems don’t just react to market conditions—they learn from them. Over time, the agent develops a profile of each strategy’s behavior under different conditions, allowing it to anticipate shifts in efficacy based on leading indicators. For instance, if a particular strategy tends to deteriorate after a spike in implied volatility or under specific funding rate trends, the AI will preemptively adjust its allocation before the signal breaks down.

This anticipatory nature also allows the AI to consider second-order effects. When a strategy begins to attract more capital across the market, slippage and crowding can undermine its edge. A sophisticated agent can detect the early signs of saturation and start rotating capital to strategies that remain under the radar. This kind of forward-looking risk management is not something rule-based systems can achieve without constant human supervision. Ultimately, the agent transforms capital allocation from a static assignment into a dynamic, intelligent process. It acts like a living organism within the fund, reallocating resources based on probabilistic assessments of strategy fitness. And that transforms the role of capital from passive weightings into active, competitive positioning.

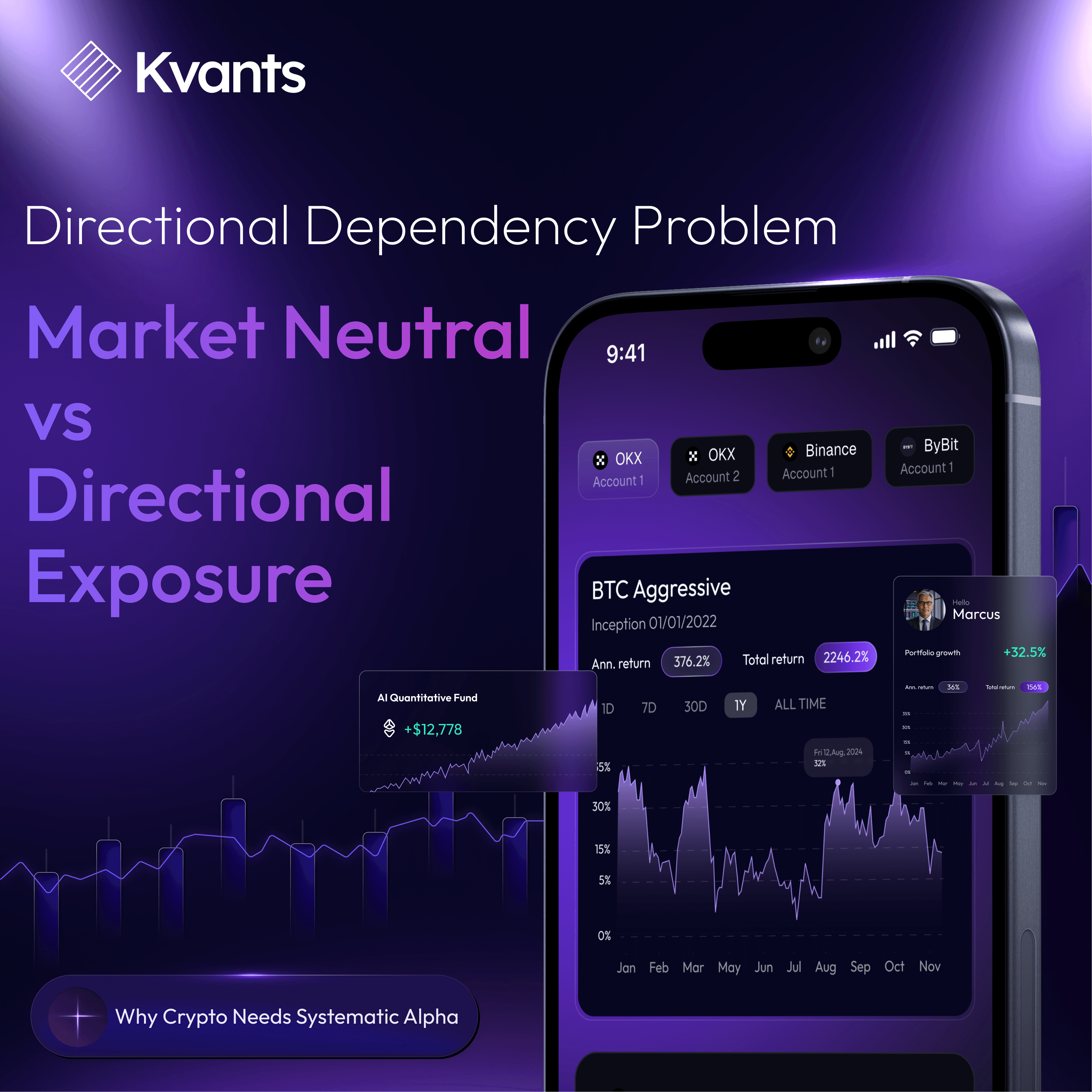

Cluster Risk and the Myth of Diversification

Holding many strategies isn’t diversification if they all respond to the same market drivers. Without understanding the data lineage behind signals, funds risk unintentional exposure to the same underlying factors. AI agents are equipped to identify this. They track the source and behavior of each strategy's features, spotting overlaps in logic or response to macro stress. Two strategies may look different, say, one trades volatility surfaces, the other order book signals but both could fail under the same liquidity event. AI rebalancing systems can spot these correlations before they’re evident in returns. This enables capital to be steered away from correlated clusters, especially under stressed conditions, resulting in more robust portfolio construction and better performance persistence.

Capital Mobility in Multi-Strategy Portfolios

A major inefficiency in traditional fund structures is the delay between strategy underperformance and capital reallocation. By the time human intervention occurs, damage is often done and opportunities elsewhere are missed. AI agents change this. They operate continuously, assessing strategy health and shifting capital instantly. In volatile or fast-shifting markets, this mobility allows the portfolio to stay close to the alpha curve while avoiding prolonged exposure to decay. Especially in intraday or high-frequency environments, regime changes are measured in minutes. These agents can respond within that window, reallocating with precision and without the drag of meetings, committees, or delayed reports.

Intelligence Layer: More Than Just a Rebalance Engine

True AI-based rebalancing is not just a rules-based engine; it’s a contextual interpreter. It doesn’t simply react to performance changes. It analyzes why those changes are happening. By processing macro signals, volatility regimes, signal decay profiles, and slippage patterns, the agent builds a multi-dimensional picture of each strategy’s real-time relevance. For example, it may recognize that mean reversion is working because of compressed volatility and fading liquidity but also infer that this is short-lived, and reduce weight accordingly. This context-driven logic allows the system to be anticipatory rather than purely reactive. It’s not just moving capital. It's thinking about risk, sustainability, and signal integrity every time it reallocates.

Real-time funding rates, regime persistence probabilities

As more market variables are integrated such as real-time funding rates, regime persistence probabilities, or even competitor positioning this layer evolves into a true decision-making core. In practice, this might mean tapering exposure to a statistically robust signal if market impact costs are rising, or avoiding crowding in a strategy that is beginning to exhibit increased correlation with broader risk-off moves. This intelligence layer also acts as a governance mechanism. It helps prioritize robustness over overfitting, and resilience over raw returns. That balance is critical. A signal might appear profitable, but if its edge evaporates under liquidity stress or transaction cost pressure, the system will underweight it proactively. It's the difference between chasing backtests and building forward durability.

Final Thoughts: A Shift from Tools to Intelligence

The next evolution in quant isn’t just about smarter signals or faster execution. It’s about the intelligence layer that governs how capital is allocated among those signals. AI-powered rebalancing agents are redefining that layer. They don’t just automate, they understand. They adapt and learn. For funds operating in fast-moving markets, these agents provide a structural advantage. What used to be a back-office function is now a driver of alpha. Rebalancing, once periodic and manual, has become dynamic and strategic. In this new paradigm, the rebalancing engine doesn’t just follow the fund’s logic, it helps define it.

Read more