Setting Up Your Kvants Vault Account

Dec 2 | 5 mins MIN | Product

By

Kvants

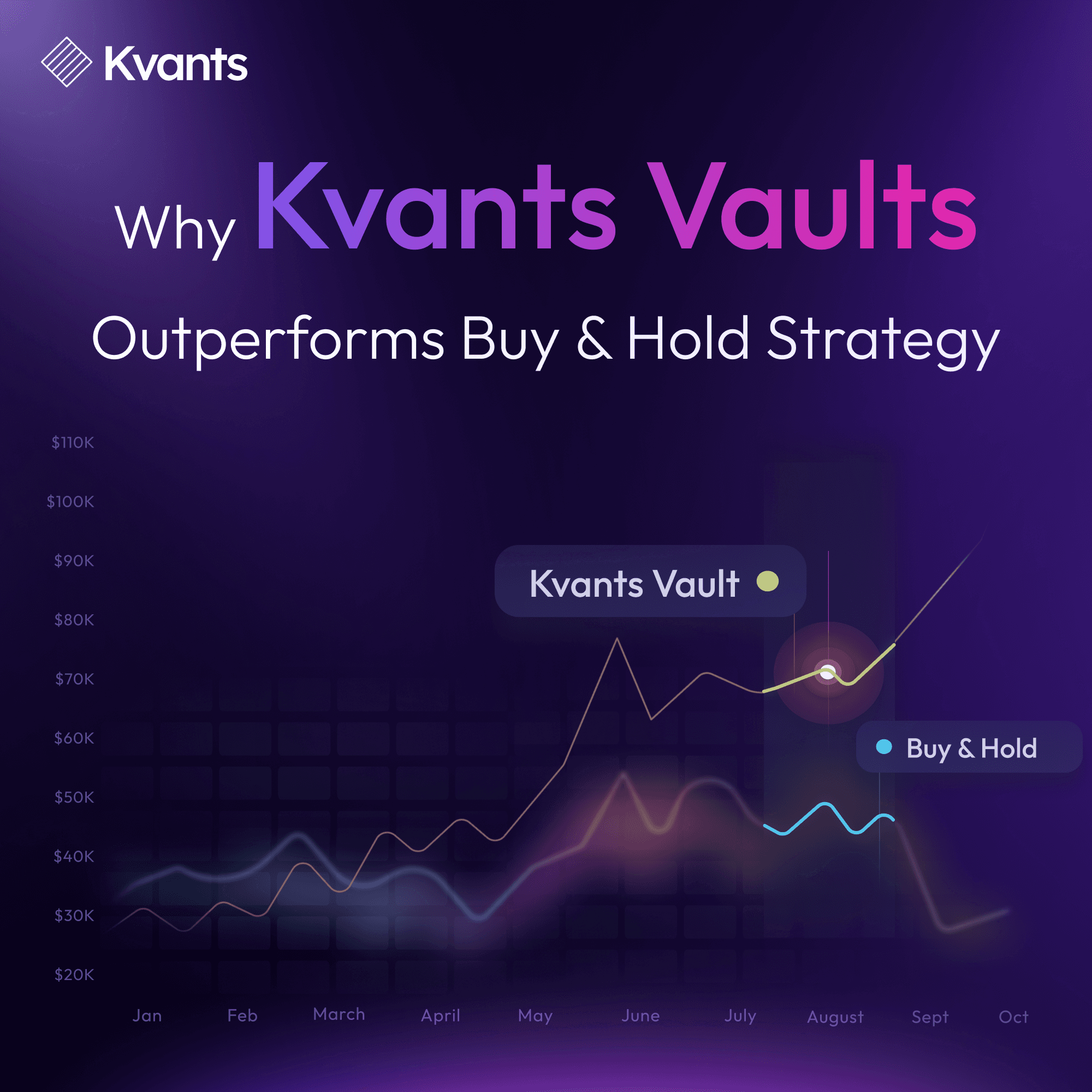

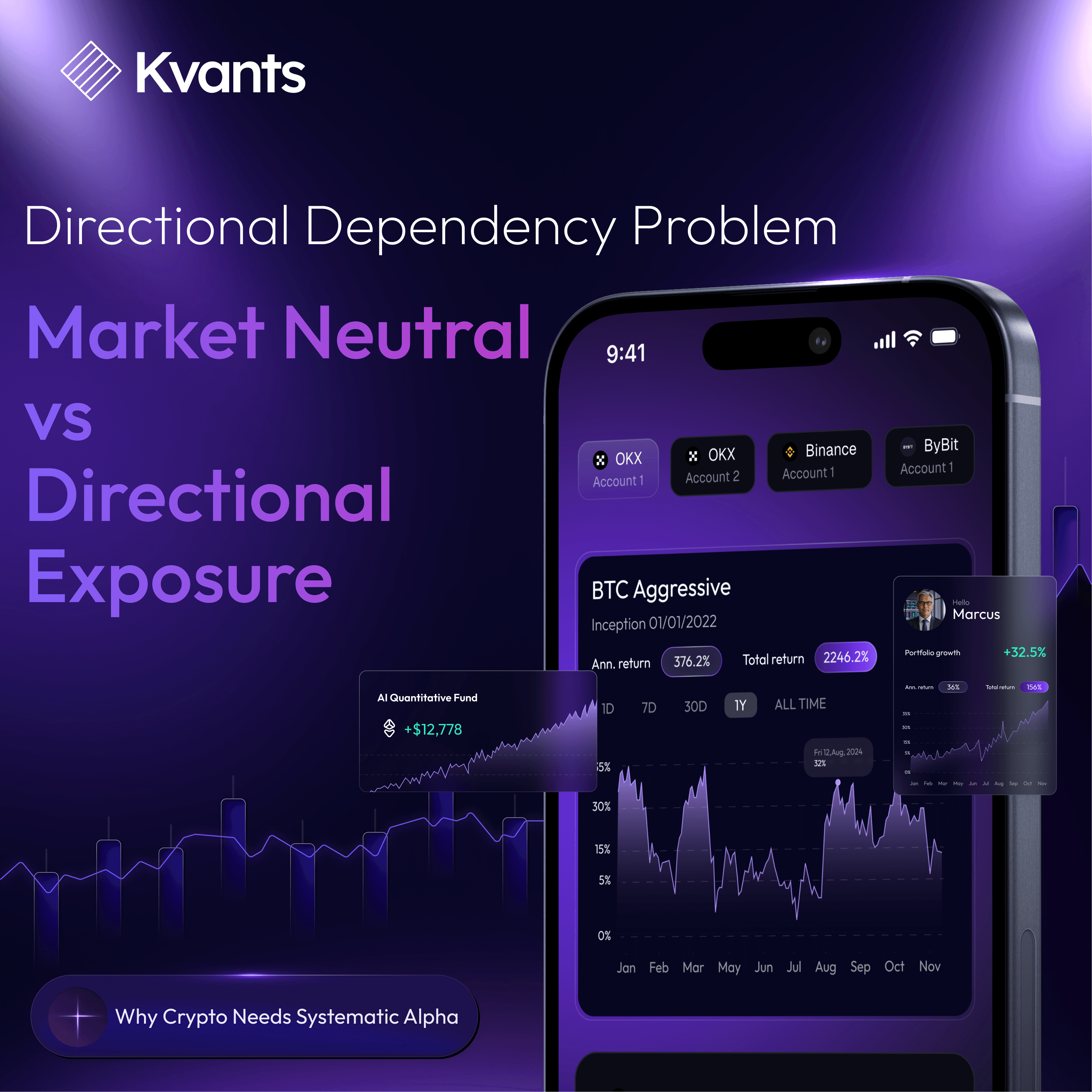

Kvants AI powered quantitative asset management platform brings automated AI driven quantitative strategies to everyday investors. The Kvants APP enables both fund allocators and retail investors to create an Kvants account and directly connect to institutional grade quant strategies. The platform is designed to unlock growth with quantitative trading by providing access to strategies that outperform the market through structured exposure, controlled risk, and adaptive AI powered portfolio growth. It offers the ability to select a quant strategy across market neutral, earn, directional, momentum, or statistical arbitrage categories. Kvants App design and strategy framework empowers investors to accumulate risk-adjusted returns by choosing their strategy intelligently and generating alpha with visibility into risk and exposure.

Kvants APP Dashboard

The Kvants APP Dashboard consolidates every core analytical surface into a single unified framework, including the Vaults section, Transparency Dashboard, Network Dashboard, and Portfolio Dashboard. Each component provides a distinct layer of visibility into strategy behaviour, capital allocation, execution conditions, and system wide activity.

An Overview Of Available Vault Strategies On The Kvants App

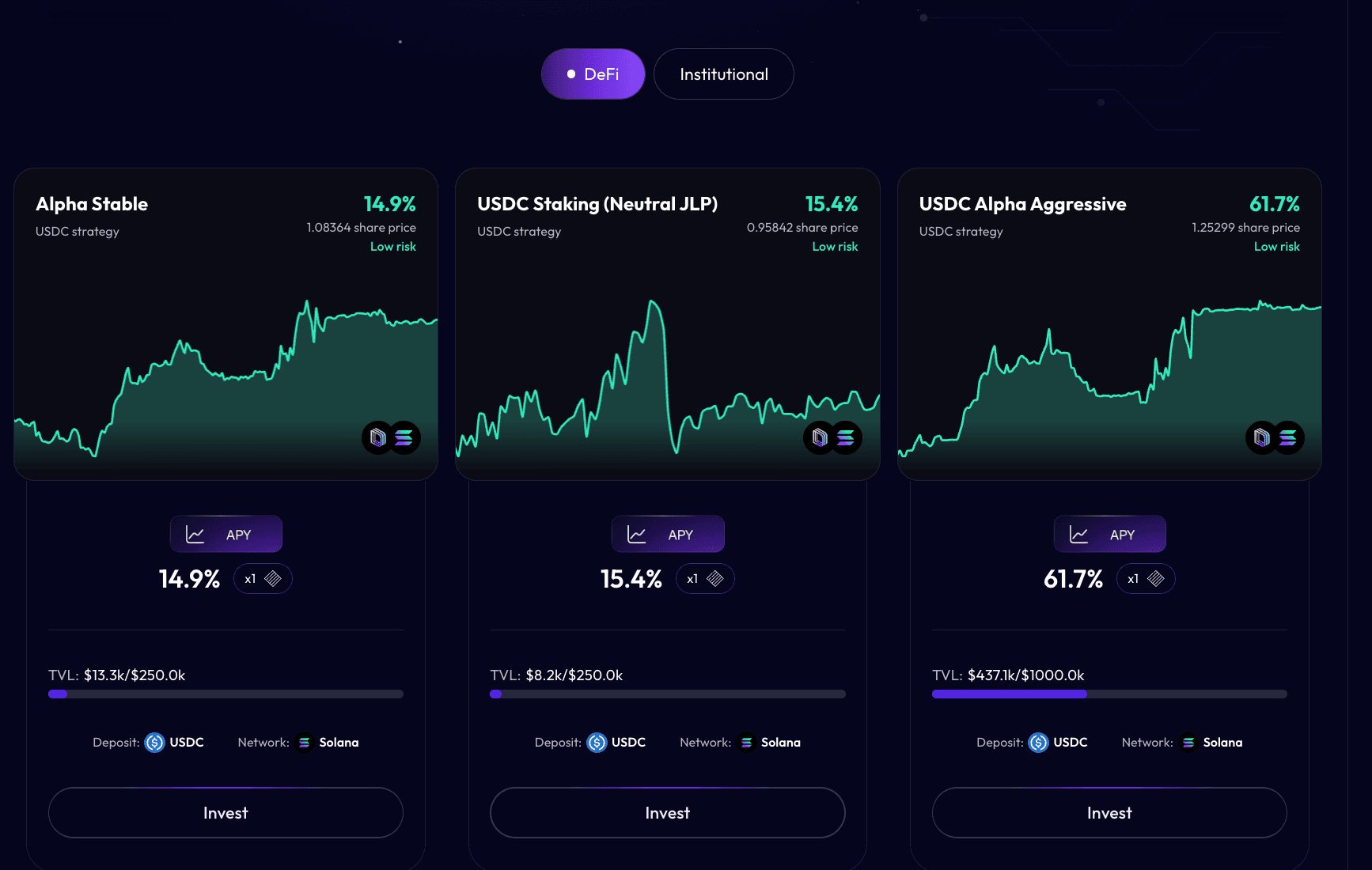

The vaults interface allows users to evaluate the available quant strategies before allocating capital. Each vault operates under defined risk parameters and expresses a distinct return profile.

USDC Alpha Aggressive

This vault is designed for users seeking higher volatility return streams and deeper alpha capture. It leverages dynamic, regime responsive models that expand exposure selectively during favourable conditions. The design prioritises elevated return potential with a wider tolerance for drawdowns.

USDC Alpha Stable

This vault focuses on consistency by employing low volatility strategies anchored in carry, microstructure signals, and controlled exposure. It is optimised for stability across liquidity regimes. The structure makes it suitable for users aiming for predictable performance with moderated risk.

USDC Staking (Neutral JLP)

This vault applies a neutralised JLP approach to capture staking and liquidity rewards without directional market exposure. The aim is to produce steady yield with minimal beta. It serves investors who want reliable accrual rather than volatility driven alpha.

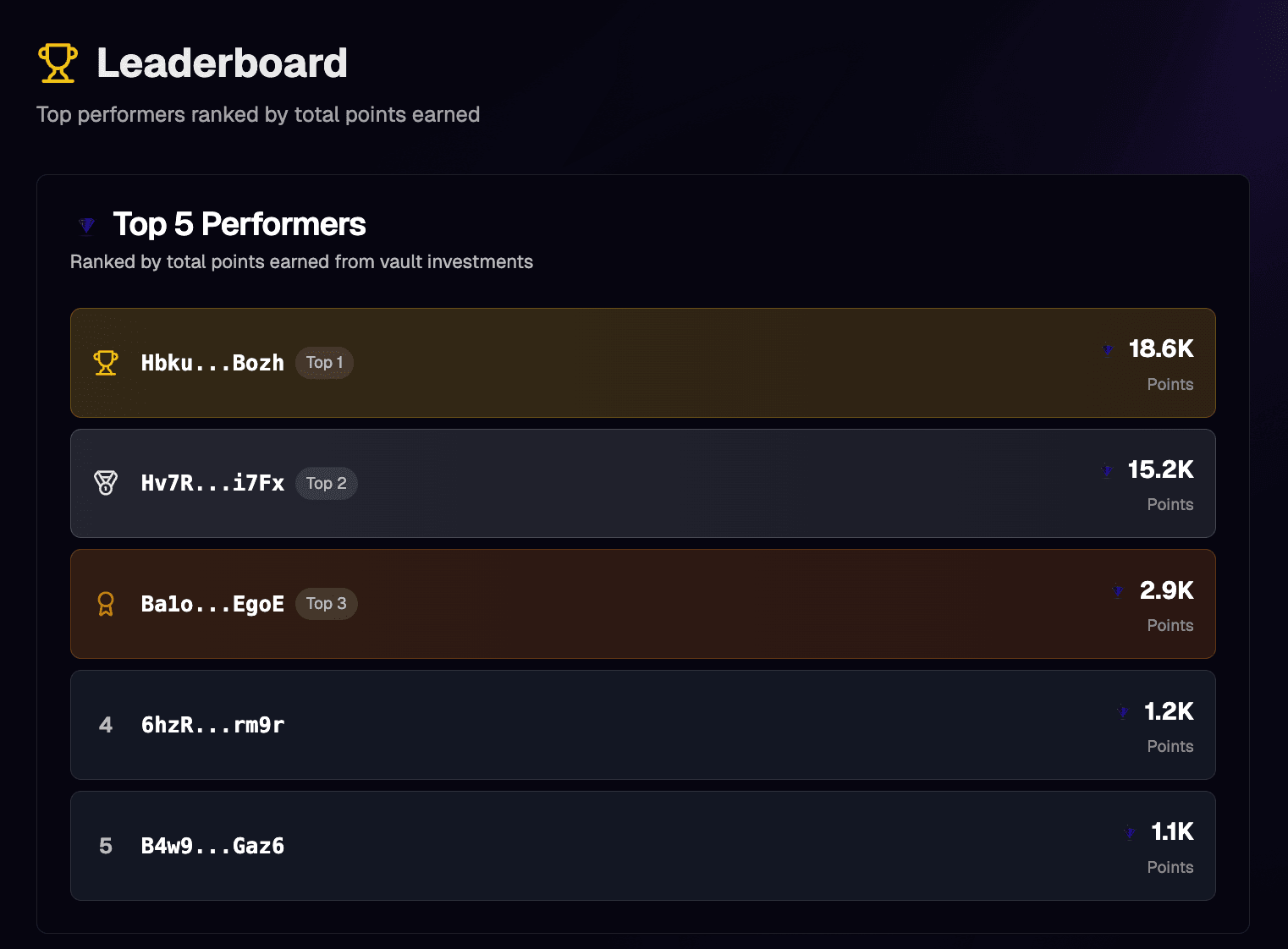

Kvants Leaderboard Section

The leaderboard ranks vaults based on performance across varying time horizons to show which strategies have delivered the strongest risk adjusted returns. It allows users to compare consistency, volatility characteristics, and long horizon stability. This enables informed allocation decisions for both institutional and retail participants.

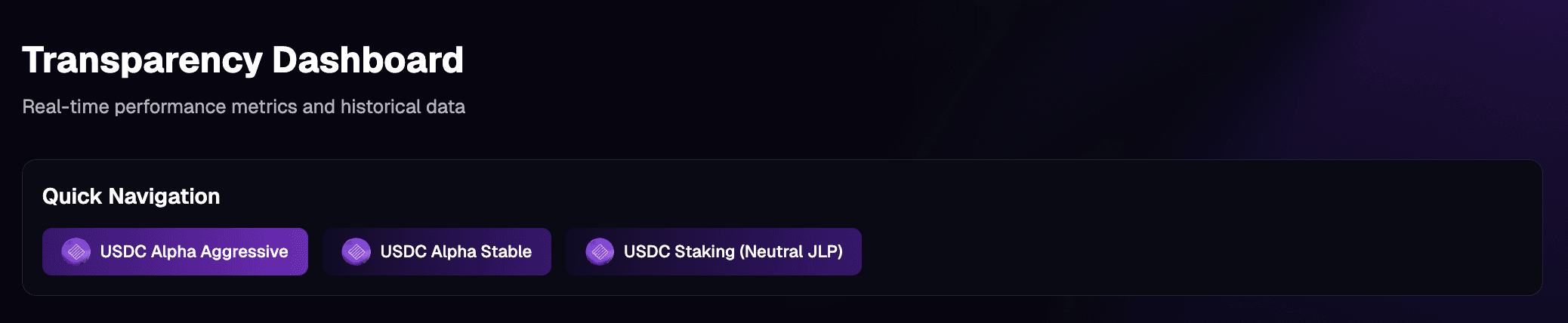

Kvants Transparency Dashboard

The transparency dashboard provides real time performance metrics and a historical archive of strategy behaviour. It displays regime transitions, volatility phases, and return distribution patterns with granularity. This ensures that users always have an auditable view of how strategies function in different market environments.

Kvants Network Dashboard

The Network Dashboard functions as the affiliate and referral hub, allowing users to track performance generated through their personal referral link. It displays referral activity, connected users, and cumulative rewards earned through the programme. Participants earn a 10 percent boost from the earnings generated by any user who joins and allocates capital through their referral code.

Setting Up Your Kvants App Account

Getting started with Kvants App takes only a few minutes. Kvants provides a structured workflow where you connect your wallet, verify funding availability, select your preferred strategy, and allocate capital. Once deployed, the vault automatically adheres to its defined exposure, leverage, and risk controls.

Connect Your Wallet:

You will be able to connect to any of the below supported options include Phantom, Solflare, Metamask, Coinbase Wallet, Trust Wallet, and Kucoin Wallet.

This step establishes a secure non custodial session so the APP can verify your account and enable vault interaction. Your assets remain fully controlled by your wallet.

Top Up Your Wallet:

First, ensure you have assets in your connected wallet. You will need a minimum of 100 USDC. Funding ensures the vault can initiate the strategy and align your capital with its execution and risk parameters. Maintaining at least 100 USDC allows the system to deploy your allocation efficiently.

Choose Your Preferred Vault:

Based on your risk objectives and strategy profile. Select a vault aligns your capital with the appropriate mandate, operating logic, and volatility tolerance. During withdrawal, a one day withdrawal buffer period applies. The buffer period ensures orderly unwinding of positions and protects the strategy from execution impact.

Click here to get started:app.kvants.ai

Read more