How To Invest In Kvants Vault: A Step By Step Guide

Dec 19 | 5 Mins MIN | Product

By

Kvants

Most investors are forced to react to the market. Kvants allows you to stay ahead of it. By running high-frequency quantitative models directly on-chain, the Kvants App automates complex trading logic that was once the exclusive domain of elite desks.

Kvants App design and strategy framework empowers investors to accumulate risk-adjusted returns by choosing their strategy intelligently and generating alpha with visibility into risk and exposure.

Kvants App Account Setup

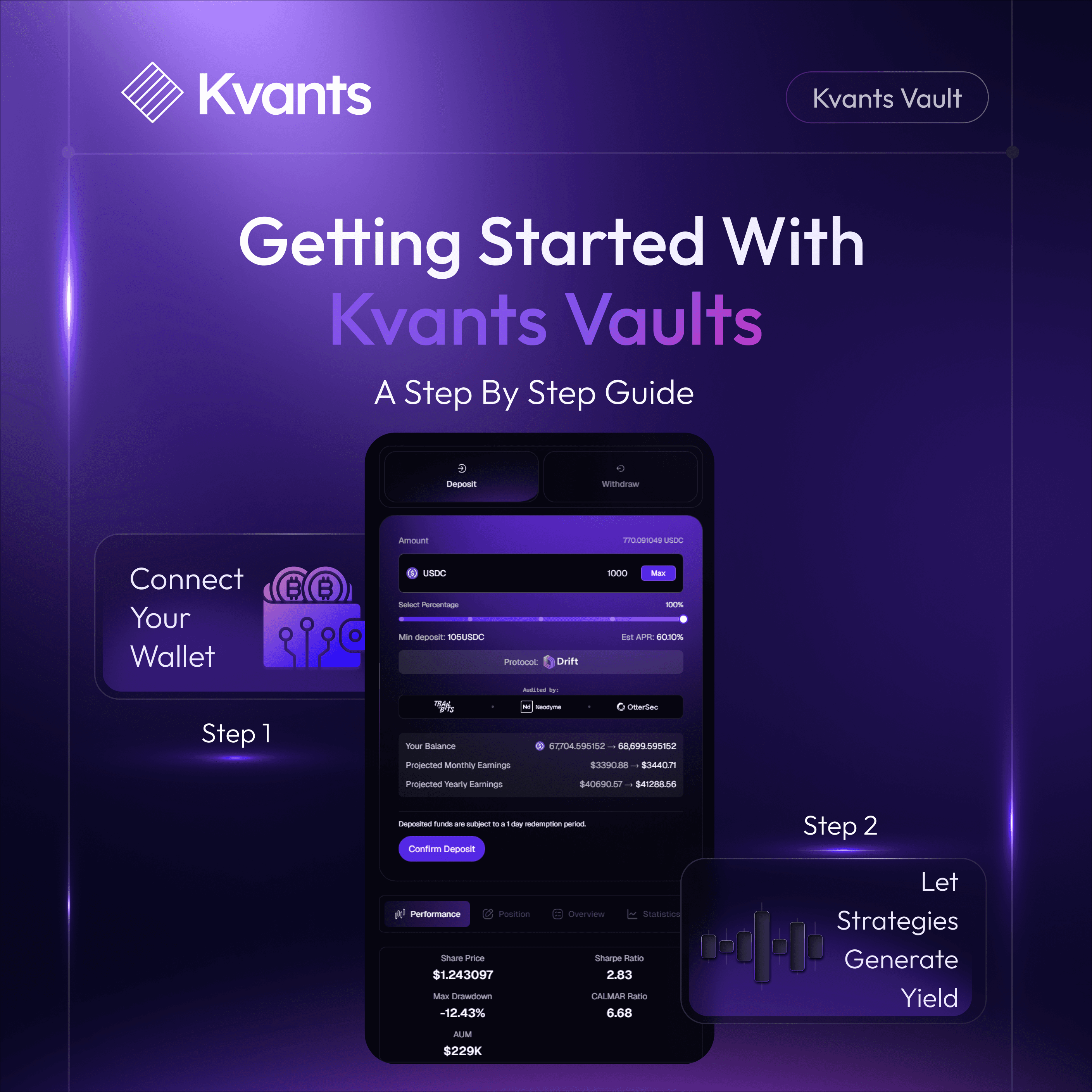

Investing in a Kvants Vault is a non-custodial process. You retain 100% control of your assets; the smart contracts simply execute the strategy you select.

- Connect Your Wallet Access the decentralized application at app.kvants.ai and link your preferred digital wallet. Supported providers include:

- MetaMask & Coinbase Wallet (Multi-chain)

- Fund Your Wallet Ensure your wallet is topped up with the assets you wish to allocate.

- Minimum Requirement: A minimum of 100 USDC is required to initiate a strategy.

- Funding ensures the system can efficiently deploy your capital across the internal engine and risk parameters.

- Select and Allocate Choose the vault that aligns with your financial goals via the app.kvants.ai interface.

- Once you allocate, the vault automatically manages exposure, leverage, and risk controls.

- Note: Deposited funds are subject to a 1-day redemption period. This ensures the orderly unwinding of positions and protects the strategy's integrity.

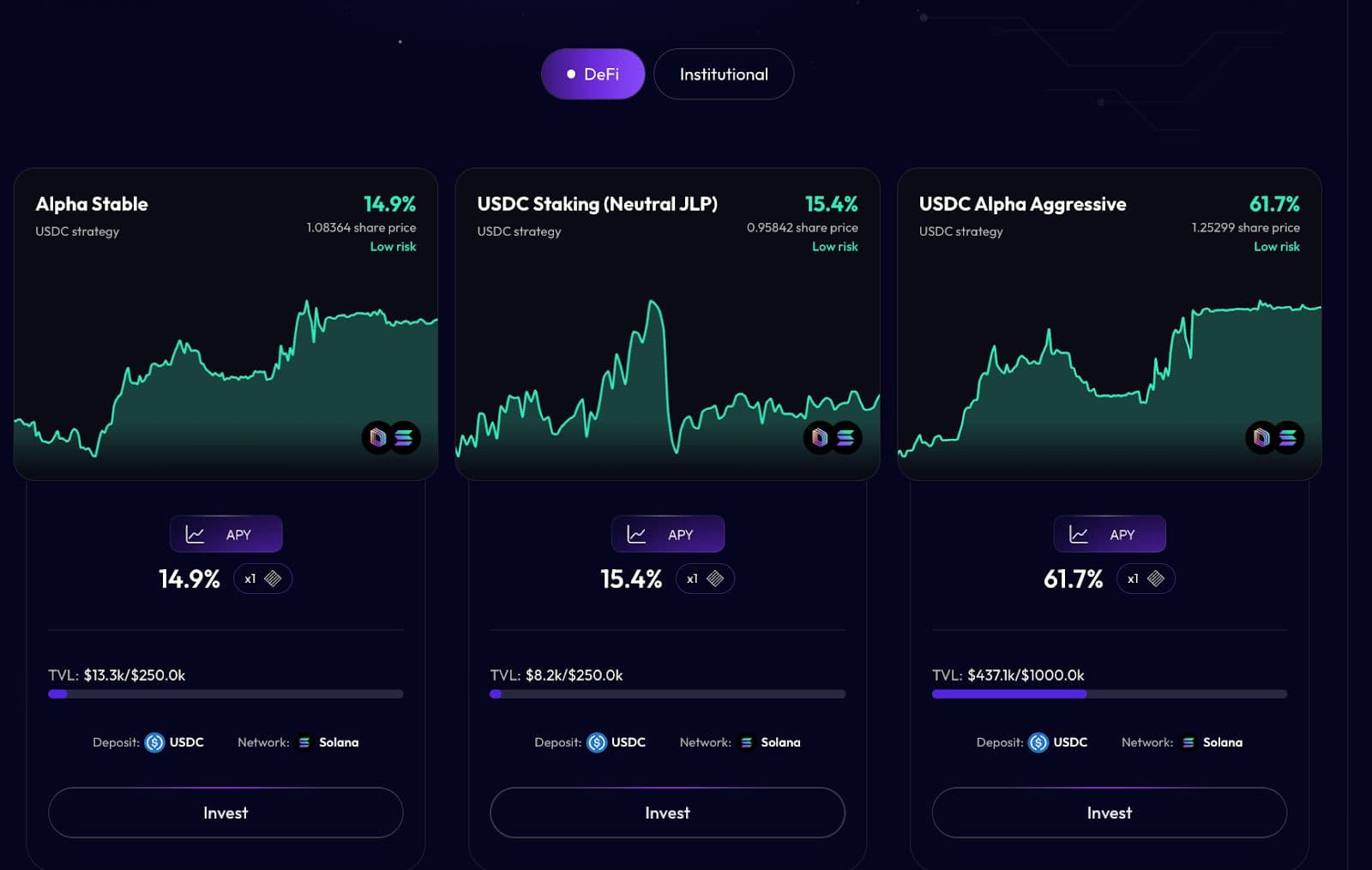

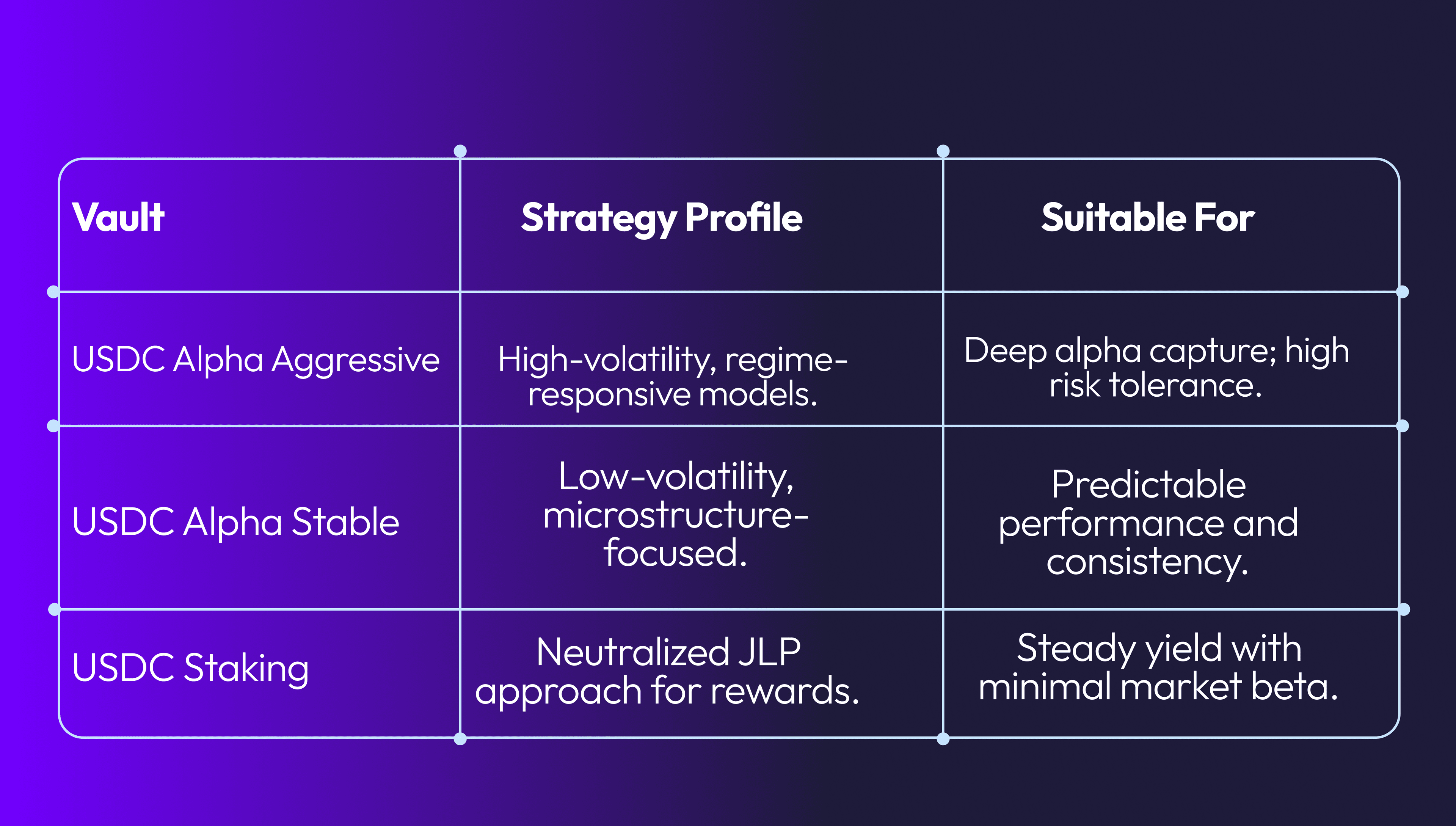

The vaults interface allows users to evaluate the available quant strategies before allocating capital. Each vault operates under defined risk parameters and expresses a distinct return profile.

Hardcoded Security: The Kvants Infrastructure

Security is the foundation of the Kvants ecosystem, providing a provable, risk-first architecture governed by audited smart contracts that prevent human interference or "admin" overrides.

By integrating directly with Drift Protocol on Solana, Kvants inherits a battle-tested risk framework featuring:

- Oracle-Linked Pricing: Real-time data from Pyth and Switchboard prevents price manipulation.

- Isolated Risk: Strategies run in separate sub-accounts, ensuring zero contagion if one market becomes volatile.

- Zero-Custody Execution: Kvants never holds your funds. Capital is governed by deterministic code, ensuring you retain complete ownership of your assets.

- Full Transparency: Verify every funding payment and position fill on-chain via the Transparency Dashboard at app.kvants.ai.

Kvants Transparency Dashboard

The transparency dashboard provides real time performance metrics and a historical archive of strategy behaviour. It displays regime transitions, volatility phases, and return distribution patterns with granularity. This ensures that users always have an auditable view of how strategies function in different market environments.

Kvants Network Dashboard

The Network Dashboard functions as the affiliate and referral hub, allowing users to track performance generated through their personal referral link. It displays referral activity, connected users, and cumulative rewards earned through the programme. Participants earn a 10 percent boost from the earnings generated by any user who joins and allocates capital through their referral code.

Selecting a vault aligns your capital with the appropriate mandate, operating logic, and volatility tolerance. The buffer period ensures orderly unwinding of positions and protects the strategy from execution impact.

Click here to get started: app.kvants.ai

Read more