Performance Case Study: How Kvants Is Redefining Systematic Alpha

Nov 21 | 5 Mins MIN | Product

By

Kvants

The Structural Shift Toward Systematic Alpha

DeFi has entered a phase where capital allocators increasingly prioritize repeatable outcomes over episodic alpha spikes. As liquidity seeks frameworks with explicit risk controls, transparent execution, and verifiable performance, Kvants has positioned its vault architecture to meet these requirements.

Unlike discretionary directional approaches, Kvants strategies operate through deterministic models built around market structure, short-horizon inefficiencies, and predictive carry. This alignment between methodology and market dynamics has enabled the vault suite to deliver stable, risk-adjusted returns during a period characterized by elevated volatility and inconsistent beta performance.

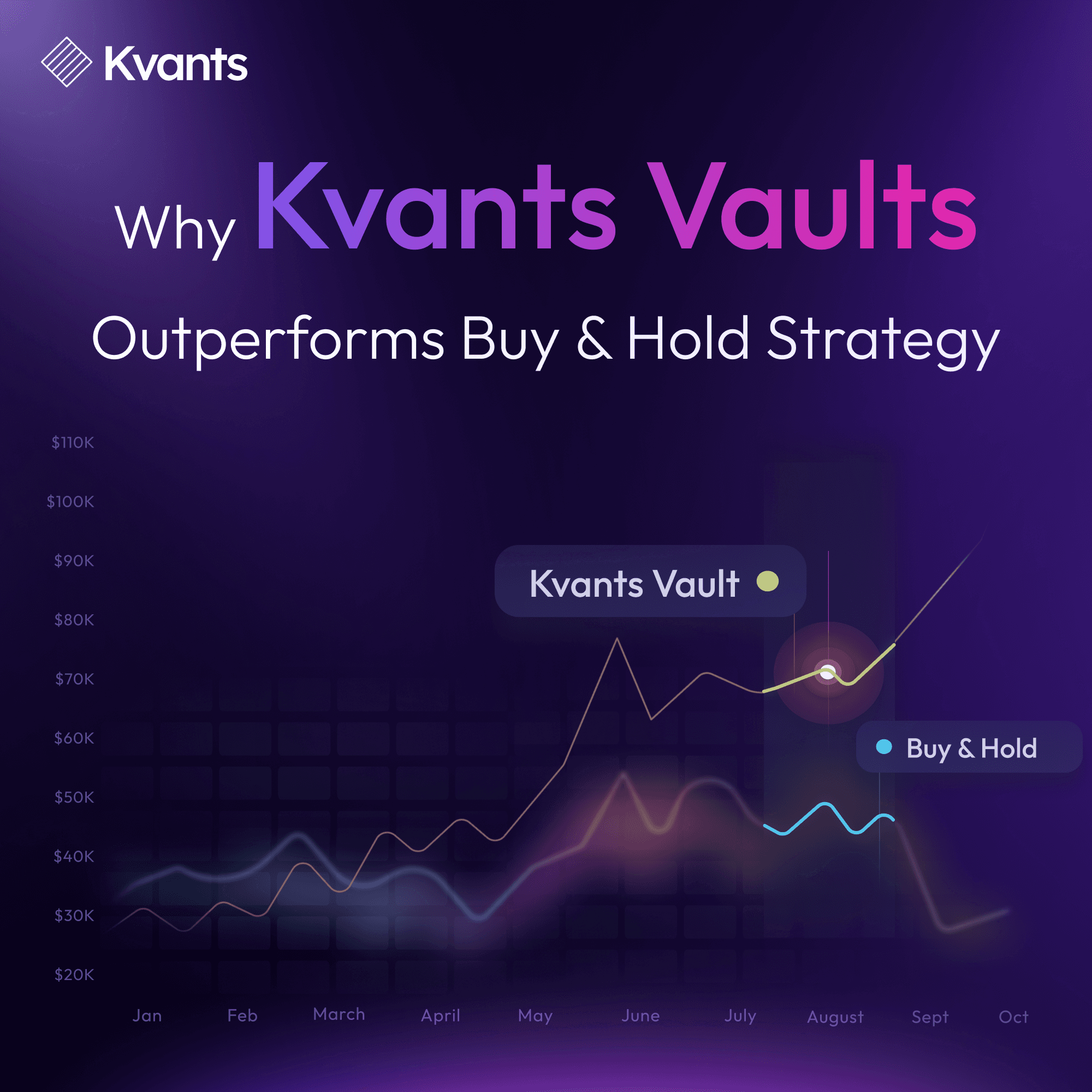

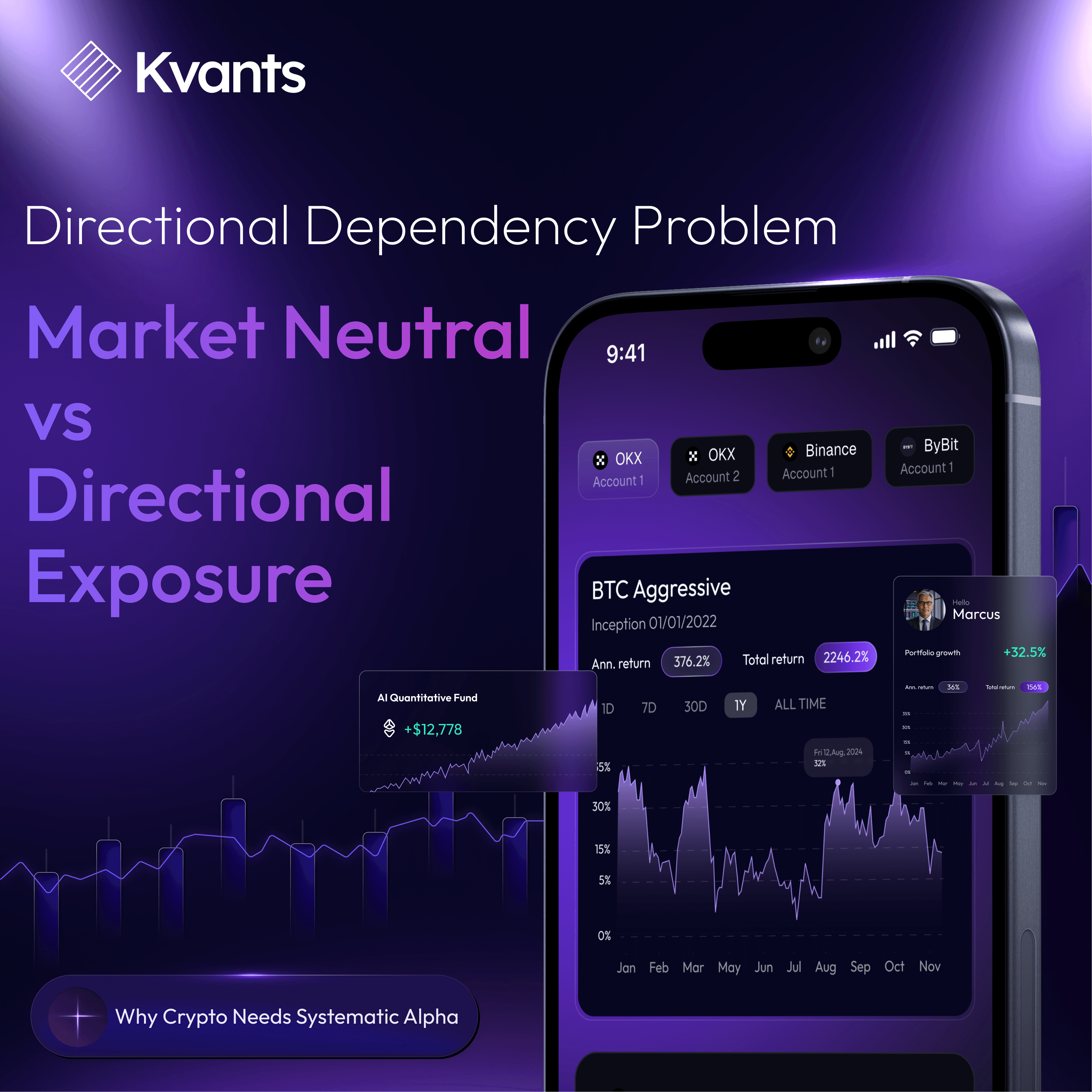

Why Directional Exposure Fails to Compound Capital

Buy and hold strategies in crypto remain structurally exposed to 60% to 80% drawdowns, long recovery times, and path dependency. These characteristics impair compounding and materially increase behavioral and liquidity risk. Kvants vaults avoid this entirely by eliminating reliance on asset appreciation. Alpha is derived from microstructure flows in perpetual markets, specifically funding, liquidity rebates, basis capture, and fee accrual. Because these flows persist across regimes, the vaults exhibit smoother NAV paths, faster recovery cycles, and lower tail sensitivity compared to directional portfolios. The result is an alternative alpha profile that behaves independently of broad market direction.

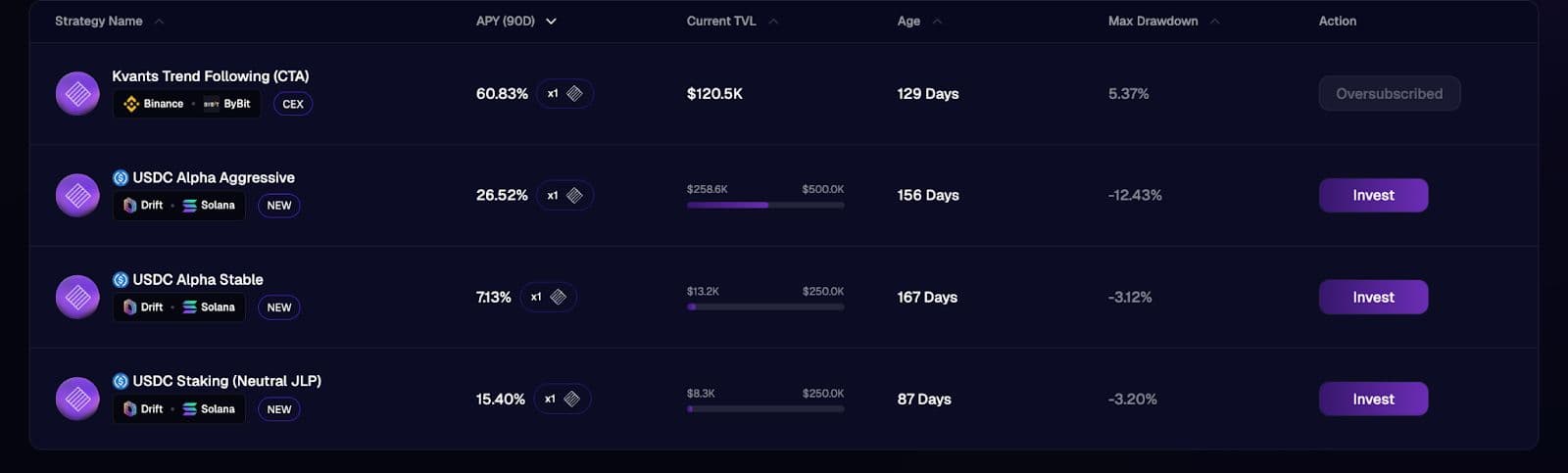

Available Kvants Vaults

- USDC Staking (Neutral JLP) USDC Vault: Fully hedged, low-risk alpha farming through JLP and Drift funding

- USDC Alpha Stable Vault: Near-delta-neutral with a small momentum overlay for balanced alpha

- USDC Alpha Aggressive Vault: Higher turnover with leveraged momentum overlays, targeting amplified returns

All vaults are transparent, non-custodial, and verifiable on-chain, letting investors track live PnL, TVL, and risk in real time.

Get started with Kvants Vaults today and seamlessly access automated, market-neutral quant strategies built for stability and real on-chain performance. Begin here: https://app.kvants.ai

How Kvants Market Neutral Quant Vaults Delivers Structured, Hedged Alpha - A Case Study

Kvants Market Neutral Quant Vaults deliver structured, hedged alpha by removing directional exposure and focusing on predictable trading flows rather than market speculation. Through delta-neutral positioning, the vaults offset long exposure with short perpetuals and rebalance every 10–15 minutes, maintaining consistent neutrality across all conditions. Built on Drift Protocol, they earn from trading fees, funding payments, and basis opportunities. three independent alpha streams that remain active even when markets move sideways or become highly volatile. This design produces lower drawdowns, reduced volatility, and more stable returns compared to traditional LPs or lending markets, offering a disciplined, quant-driven alternative for stablecoin growth.

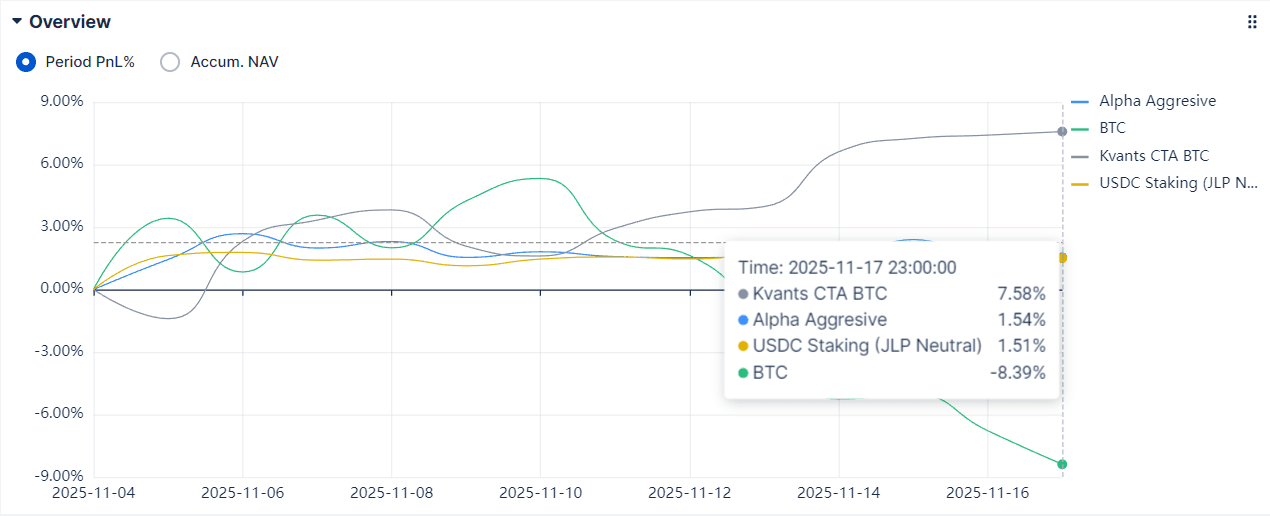

Kvants Vault Performance: Real Results in Live Markets

Over the past 90 days, Kvants’ on-chain vaults have delivered strong, stable returns across multiple market-neutral and quantitative strategies. The Drift Vault suite posted a 22% net return in July 2025, outperforming broader market benchmarks during high volatility. Across strategies, APYs typically ranged up to high-twenties, supported by low drawdowns, controlled volatility, and continuous hedging execution. All performance is fully verifiable through on-chain NAV reporting, which tracks fills, funding capture, and rebalancing in real time. Kvants continues to demonstrate that disciplined, market-neutral quant systems can outperform directional exposure across challenging market conditions.

USDC Alpha Stable — Historical Performance (90 Days)

USDC Alpha Stable delivered consistent monthly returns between 8–14% APY, maintaining low volatility under 6% and a maximum drawdown below 1.5%. Its stable carry engine performed smoothly across varying conditions, compounding predictable alpha through disciplined momentum overlays and conservative risk controls.

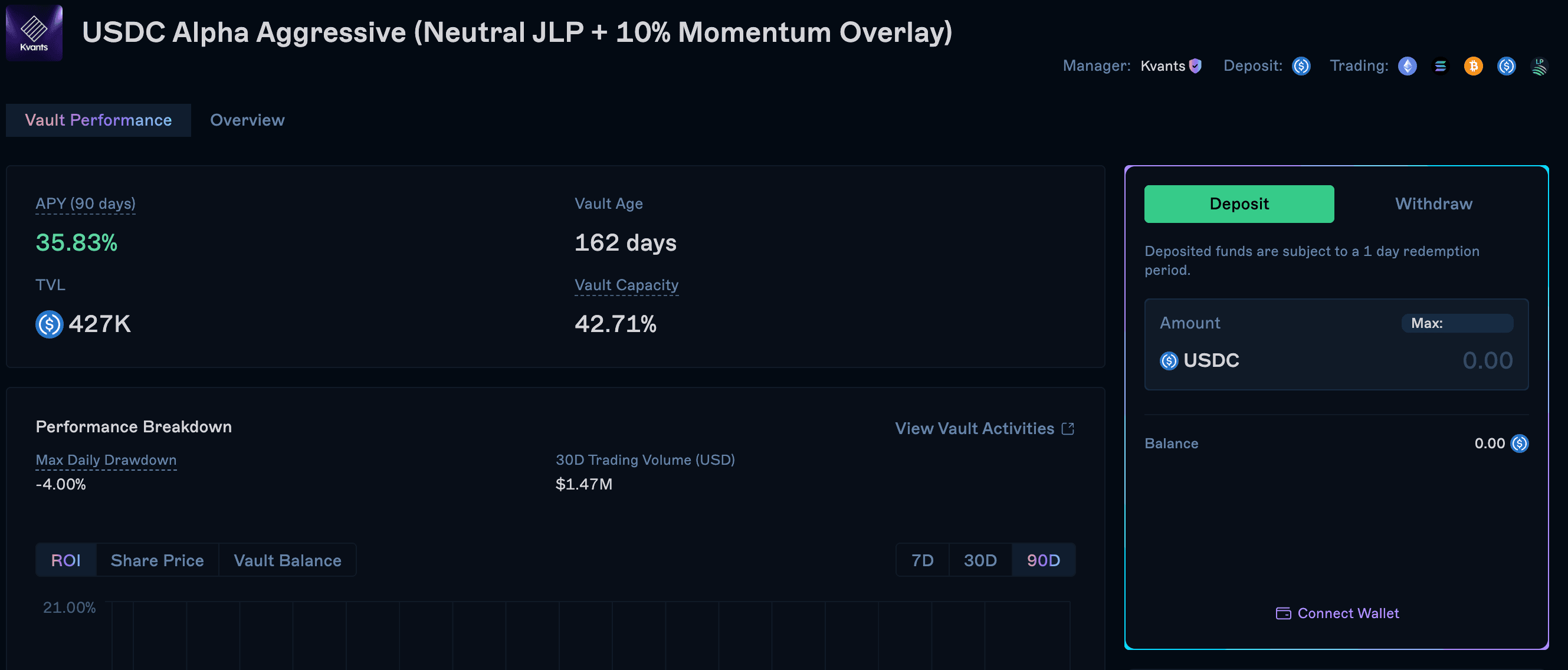

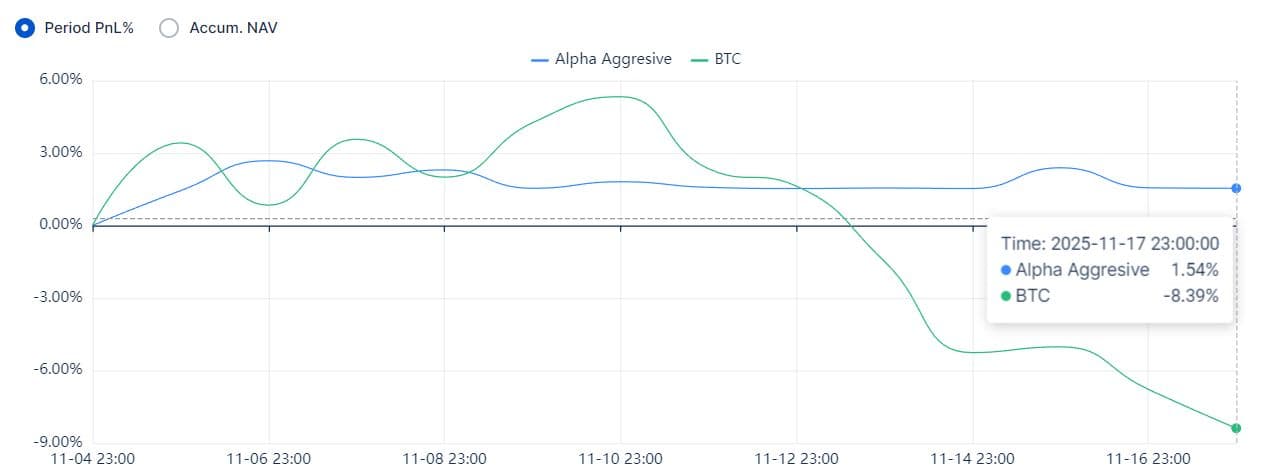

USDC Alpha Aggressive — Historical Performance (90 Days)

USDC Alpha Aggressive produced stronger rotation-based returns of 15–28% APY, driven by adaptive momentum models identifying short-term inefficiencies. Volatility averaged 10–14% with controlled drawdowns, benefiting from faster trading cycles and opportunistic market exposure during high-volume periods.

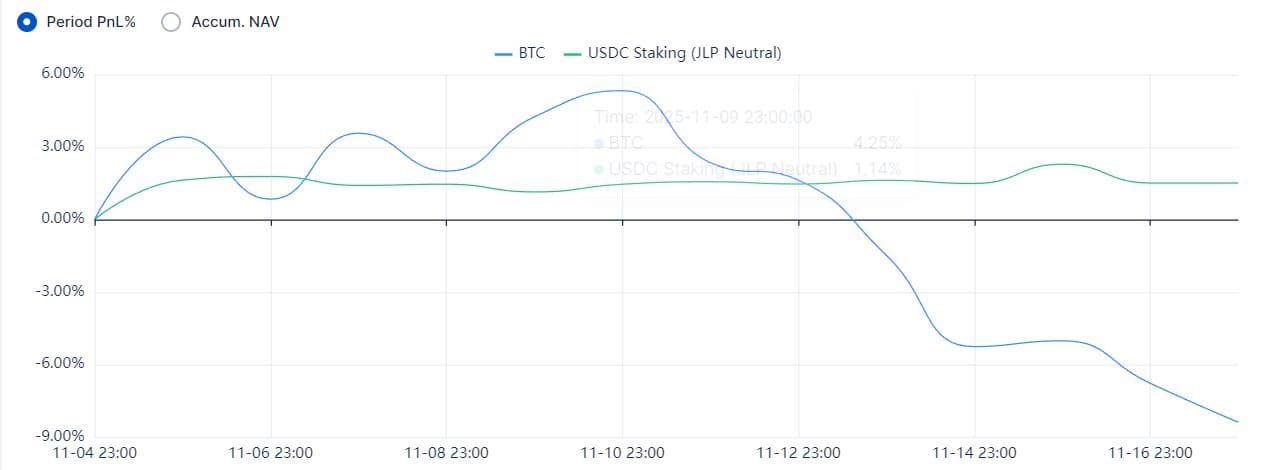

USDC Staking (Neutral JLP) — Historical Performance (90 Days)

The Neutral JLP strategy generated 12–33% APY, peaking during elevated Drift trading activity, while keeping volatility below 8% and maximum drawdown near 1.89%. Its delta-neutral hedging captured fees, funding, and basis alpha, outperforming traditional LPs with stable, market-independent returns.

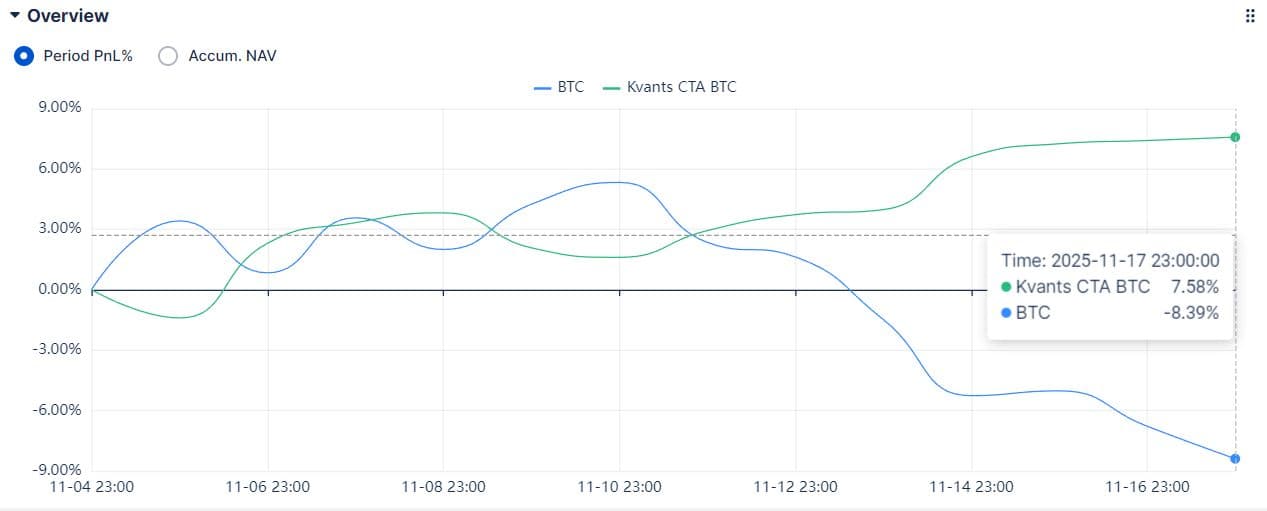

Bitcoin Comparison and Relative Outperformance

Bitcoin is undergoing a sharp correction, dropping 10% to a 7-month low of $82,082.84, with over $1 billion in market liquidations occurring within just an hour. Analysts warn the downtrend may extend into the $60K–$80K range as sentiment worsens. The broader market climate sits firmly in Extreme Fear, reflected by a Fear & Greed Index of 15, while Bitcoin shows bearish momentum, 0.87% supply inflation, 56.82% dominance, and 9.56% volatility. Overall, the asset now trades at roughly $83K, sitting 33% below its $126K all-time high, highlighting the intensity of current market stress.

The broader market impact has been severe, over the last six weeks, approximately $1.2 trillion has been erased from the total cryptocurrency market capitalization. This environment of sharp reversals, compressed rallies, and elevated intraday volatility has produced a weak risk-adjusted return profile for directional exposure. In contrast, the Kvants Alpha Aggressive Vault generated 15–28% APY, maintained volatility in the 10–14% range.

Capital Preservation as the Core Strategy in Volatile Markets

In today’s hyper-fragmented digital asset environment, volatility is not an anomaly, it is the baseline. Markets routinely swing 20%–40% within days, making capital preservation the defining principle of sustainable performance. The objective is simple: protect the base, then compound. Investors who prioritise preservation avoid the destructive drawdowns that erode multi-year returns and force behavioural errors such as panic selling or liquidity mismanagement. Capital preserved during stress periods compounds disproportionately when markets normalise, delivering stronger risk-adjusted outcomes over a full cycle. Kvants vaults are built around this discipline, using market-neutral structures, strict VaR controls, and dynamic hedging to ensure that capital remains intact even when volatility expands

Who Benefits From Kvants Vaults: Matching Strategies to Investor Mandates

Kvants Vaults are structured for allocators who prioritize downside control and return consistency. This includes passive investors targeting stable, digital asset treasuries seeking predictable income, and quant-oriented users who value rule-based execution. The platform’s transparency, live dashboards, on-chain visibility, continuous hedging, provides institutional-grade oversight. The hands-off nature of Kvants Vaults enables users of all experience levels to benefit from strategies traditionally limited to hedge funds and prop trading desks without requiring active management or technical expertise.

Looking Ahead into the Future of Kvants

The Neutral JLP Vaults represents the foundation of Kvants’ broader quant infrastructure. Upcoming developments include cross-chain strategy expansion, AI-driven hedging improvement.

Unlock on-chain quant strategies built for consistent returns.

Start your journey in just a few clicks here: https://app.kvants.ai

Read more