Kvants 2025 Year In Review & Looking Ahead

Jan 6 | 5 Minute MIN | Year In Review, Updates

By

Kvants

Dear Community

With 2025 coming to a close, we are happy to say that 2025 was a very strong year for Kvants in terms of finding the early signs of product market fit, and app development.

To share our main priority for 2026.

The $KVAI Token Generation Event (TGE) will be executed in the first weeks of 2026. This is our top priority.

We received listing offers from 8+ centralized exchanges, including top-tier venues and Alpha/Boost programs. However, our analysis revealed a concerning pattern: the listing structures proposed (high upfront fees, forced liquidity commitments, and massive airdrop requirements) demonstrate negative expected value for long-term token price. We’ve observed competitors who accepted similar terms experience severe post-launch deterioration: 60-80% drawdowns within weeks as mercenary capital exits and airdrop farmers dump allocations.

Most CEX listing deals today are designed for exchange profit, not project success. They extract immediate value while creating structural sell pressure that takes months to recover from.

With the above taken into account, all resources and efforts in early 2026 are aligned to this single objective: successful TGE execution in the first weeks of the new year.

2025 in Review

2025 was about building a strong product with fundamentals that will fuel our revenue post token launch, and contribute to the long term success of the Kvants platform.

This year Kvants has achieved numerous large advancements that marked off major roadmap milestones.

1) DeFi Vaults App Launch

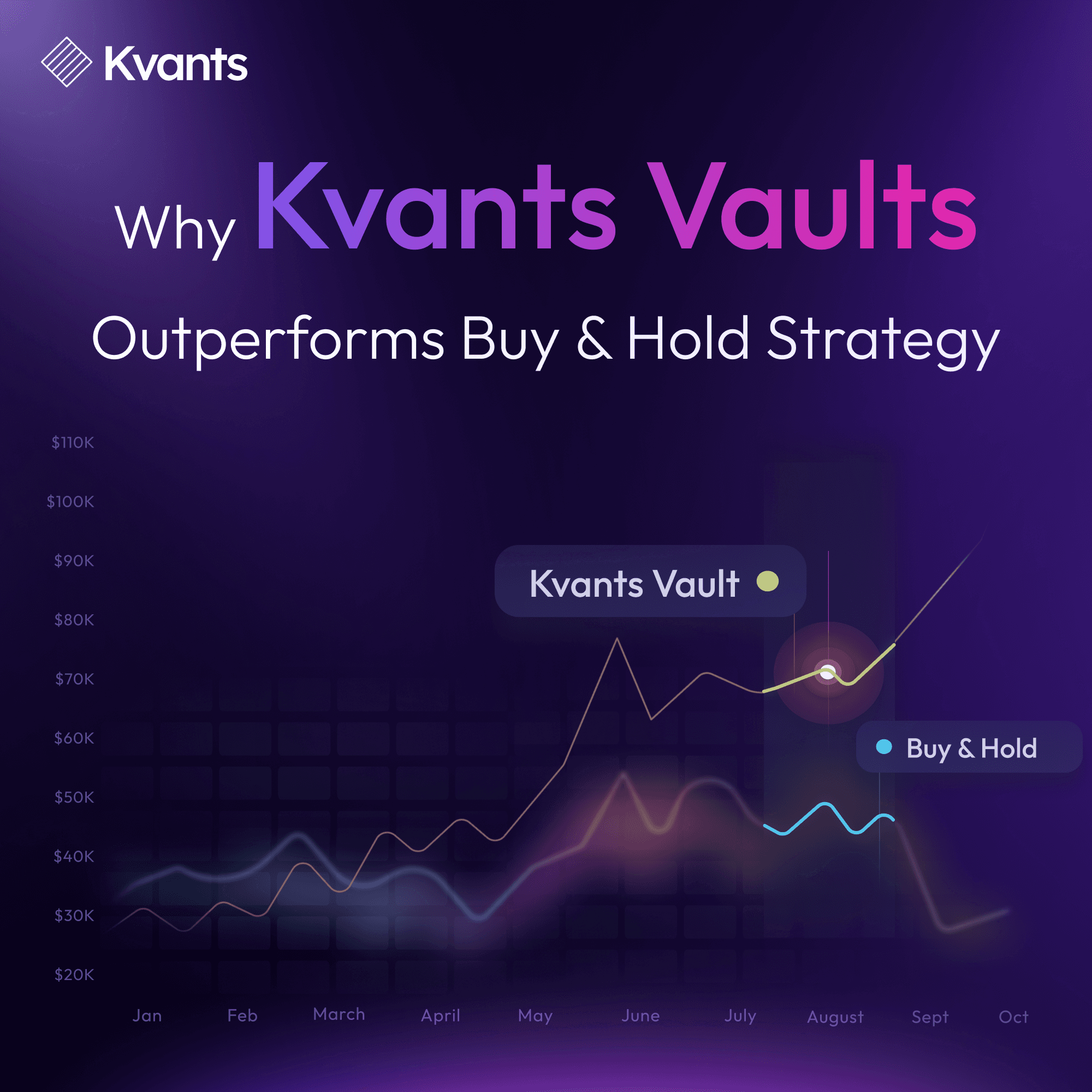

We built Kvants Vaults to be non-custodial, risk-controlled, and fully transparent, then we did the only thing that matters: we put them in the market. In July, after almost a year of development, we went live on Drift Protocol and stress-tested the vaults with real users and real capital, not simulations.

July till December, the vaults have performed at a 52% annualized APY.

In July right after the launch, while Bitcoin was up 8.3%, our Alpha Aggressive vault has delivered 22%+ net returns over the same period. Due to our fundamentally strong momentum overlay.

You can access the detailed performance report here. LINK

2) Strategic Product Integrations:

Our integrations with KuCoin and Gate.io Web3 Wallets marked a significant inflection point in Q4, exposing Kvants to 66 million potential users. Results were immediate: DeFi AUM increased 5x from $100K to $500K within 15 days, while registered users grew 22% from 2,300 to 2,800. These partnerships validated our embedded distribution strategy and established a scalable growth channel for 2025.

3) Development of the Kvants Yield embed for exchanges and investment apps.

Behind the scenes, we also build Kvants Embed, a white label SDK that lets other platforms integrate our strategies without rebuilding them from the ground up.

Incentivize existing communities to expand their product, offering with the added feature of increasing the communities revenue from split in trading performance fees. Working on a revenue split for our vaults this is already accelerating our CeFi and DeFi retail app push.

With major partnerships for our strategies integration already in late stages of integration with KuCoin, a strategic partner of Kvants who will bring visibility to our core product from there global 41m users.

4) Institutional Fund Performance & Strategic Leadership Evolution

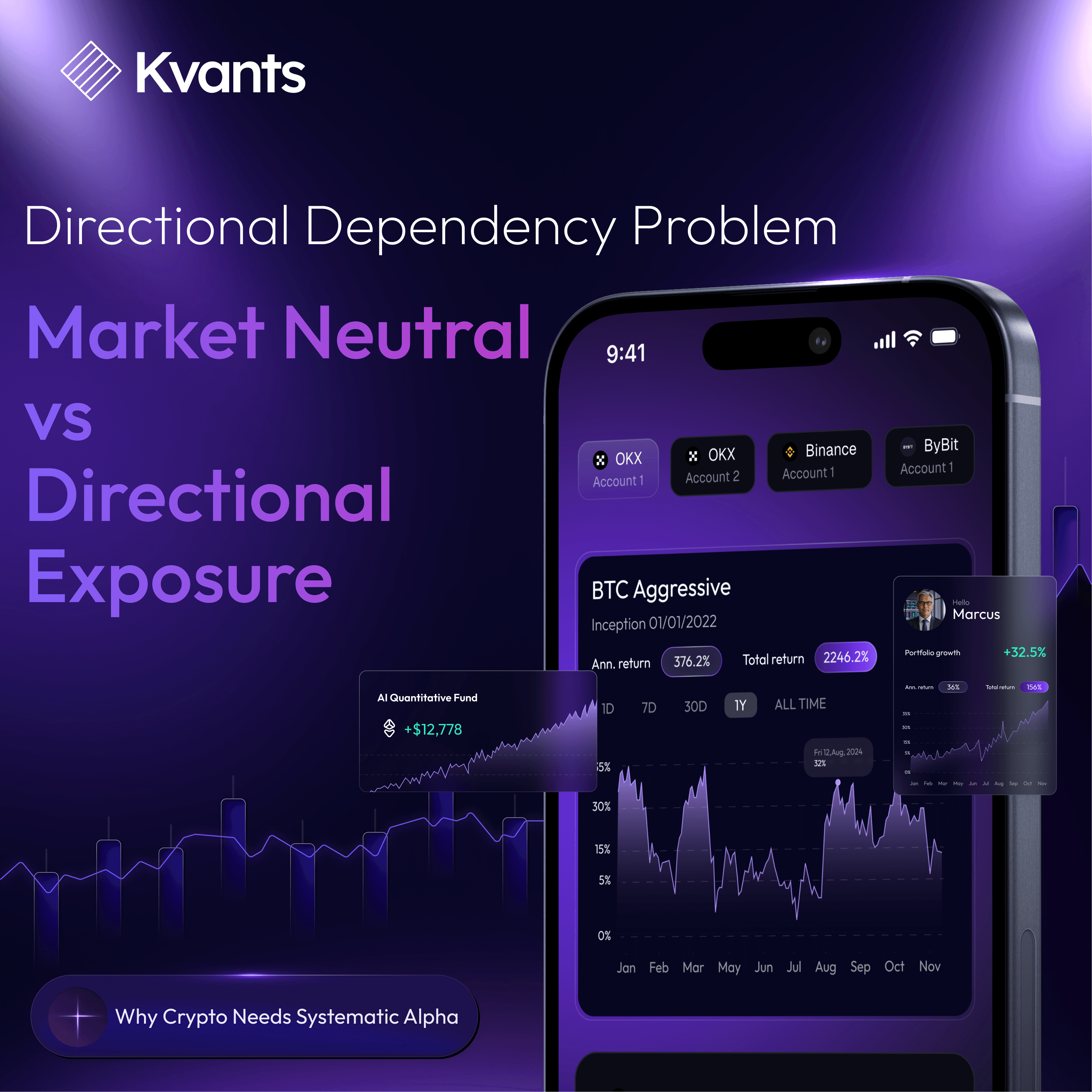

Our institutional fund delivered strong risk-adjusted returns throughout 2025, maintaining disciplined capital allocation and prudent risk management.

The fund’s performance validated our quantitative approach and reinforced investor confidence in our systematic strategies.

On the CeFi side, growth has been substantial, driven primarily by institutions that prefer custody on major exchanges via SMAs (Separately Managed Accounts). This reflects increasing institutional appetite for systematic crypto strategies with institutional-grade risk management.

5) Leadership Structure to Accelerate Dual-Vertical Expansion

As Kvants continues to scale both retail-focused vaults and institutional fund management, we are implementing a strategic leadership transition to maximize execution across both verticals.

Dev has been instrumental to the success and distribution of Kvants vaults in 2025, driving key partnerships and user growth. Following this exceptional performance, Dev will officially take the role of CEO of Kvants App, bringing his proven growth acumen and expansion strategies from his previous roles at OKX and Gate.io to lead Kvant's consumer business vertical.

The Kvants app will primarily focus on the expansion of our vaults across multiple chains and partnerships. Dev's immediate priority is leading the $KVAI token launch in the first weeks of 2026, ensuring successful execution and strong market positioning. Following the TGE, his focus will shift to scaling vault adoption and deepening distribution channels all with the central focal point being utility token adoption and demand generation via platforms utility.

Michal’s core responsibility until now has been building the full product ( strategy and front end) and performing substantial product management across our internal quant team, internal development team, and external development teams. With the product infrastructure now established and operational, Michal will transition to focus entirely on expanding the institutional side of the business, leading institutional liquid fund capital raising efforts, LP relationships, and institutional product development to significantly grow Kvant's institutional AUM.

This structural change allows both leaders to operate with singular focus: Dev on the token launch and retail vault expansion, Michal on institutional liquid capital scaling.

2026 will focus on these expansion points and strategic priorities:

Absolute priority = $KVAI Launch

1. BTC Alpha Vault Launch – A BTC denominated multi strategy vault backed by dollar-neutral quantitative strategies, offering institutional-grade stability with yield all denominated in BTC for yield accrual on top of BTC.

2. Strategy offering & Partner Expansion – Deploying new strategy vaults across and expanding wallet and strategic integrator partnerships.

3. Institutional Fund Scaling – Rolling out new institutional-grade quant funds with expanded strategy offerings

4. Kvants Systematic Alpha Embed – Will focus on B2B product vertical; where we scale aum via custom white labeled product embed features to enable protocols, wallets, and other pertners to integrate Kvants Systematic Alpha products natively into their platforms.

Looking Ahead, we thank you for being part of the Kvants ecosystem. We will be sharing more detailed roadmap and exciting developments over the coming weeks as we execute the TGE and accelerate our 2026 growth plan.

The foundation is built. Now we scale.

Read more