Why Smart Traders Are Ditching Buy-and-Hold for $KVAI-Powered Risk-Adjusted Strategies

Jan 25 | 5 Minutes MIN | AI, DeFi

By

Kvants Team

Let's be honest: buy-and-hold in crypto is essentially a prayer disguised as a strategy.

You buy Bitcoin or your favorite altcoin, stare at charts, and hope the market gods reward your patience. Sometimes they do. But when they don't? You're watching your portfolio crater 70%, 80%, even 90%—and there's nothing you can do except cope and wait for the next cycle.

This isn't a bug in the system. It's the system. Crypto markets don't behave like equities. There are no dividends, no earnings reports to justify valuations, no floor under prices except collective belief. In this environment, passive holding isn't investing—it's gambling with extra steps.

Kvants was built for traders who want off that rollercoaster.

The Problem With Being Long-Only in a Volatile Market

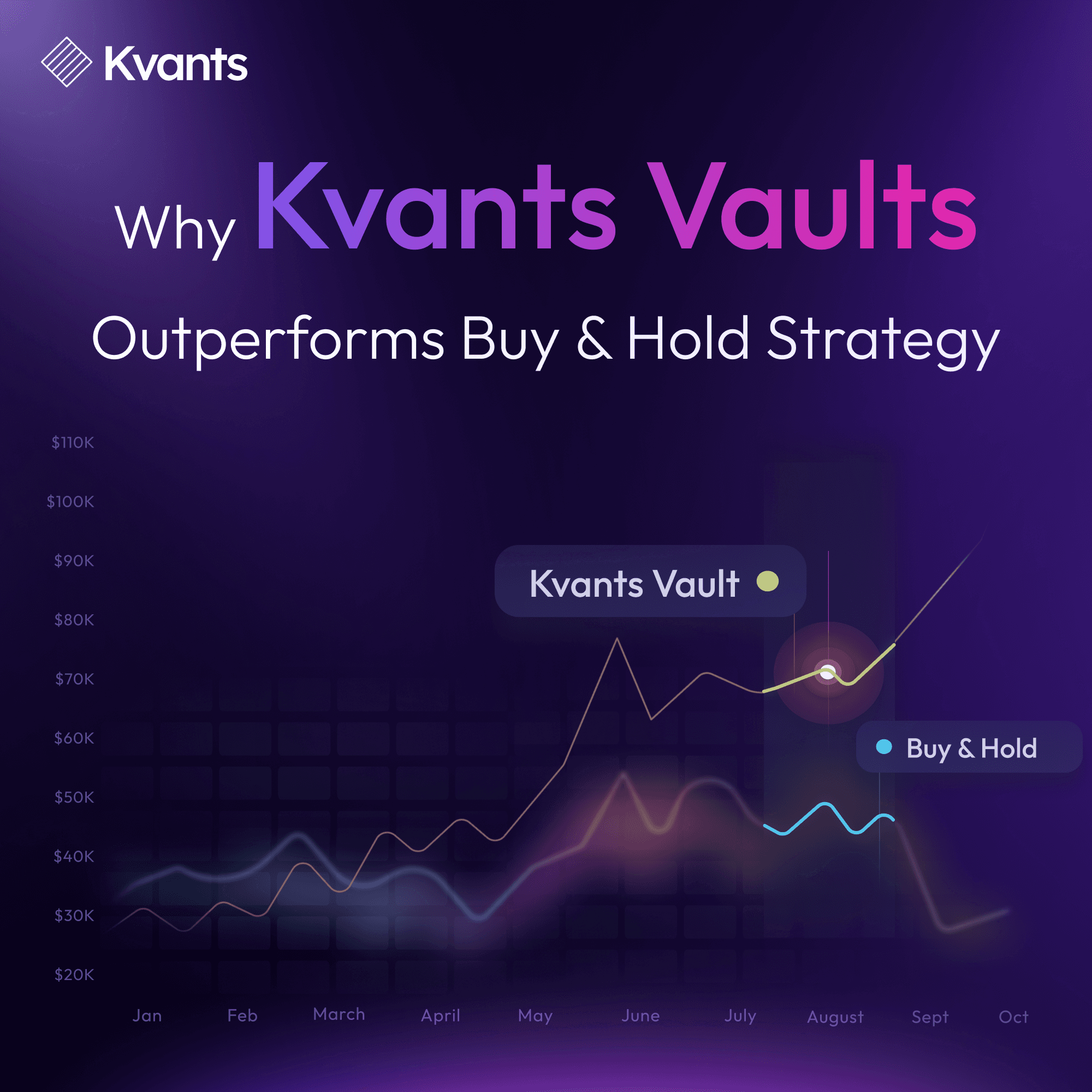

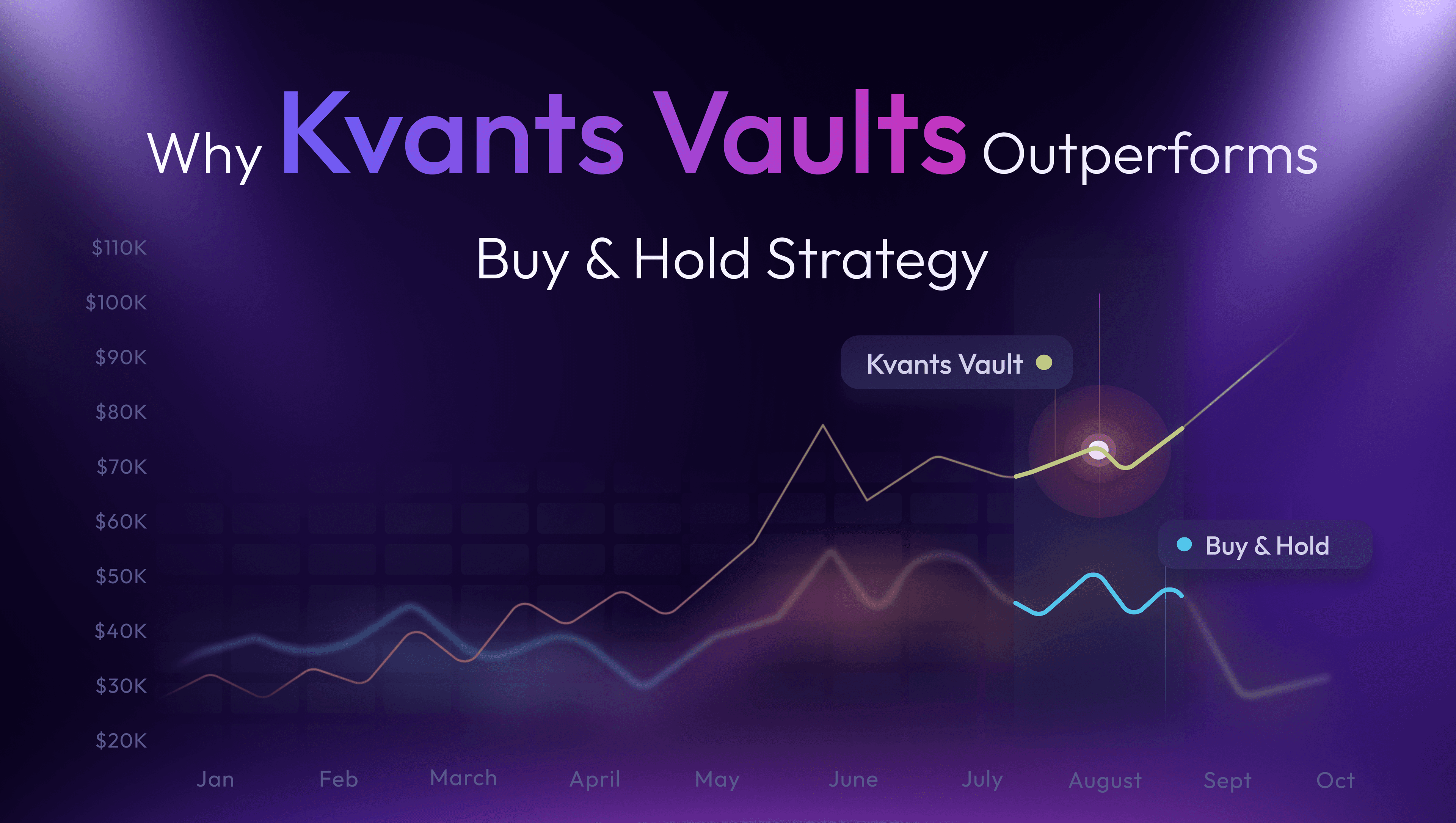

When you buy and hold, you're making one bet: that prices go up. That's it. You have zero mechanism to manage volatility, zero downside protection, and zero way to profit when markets turn south.

Most of the time, your capital is either underwater or sitting through uncompensated volatility—big swings that don't actually reward you for the risk you're taking. The Sharpe ratio of a typical buy-and-hold crypto portfolio looks decent only because of a handful of explosive rallies. The rest of the time? You're just along for the ride, hoping you don't get shaken out.

Kvants flips this dynamic entirely. Instead of betting on direction, Kvants strategies are designed to profit from market mechanics—funding rate imbalances, basis spreads, volatility patterns, and statistical inefficiencies that exist regardless of whether Bitcoin is pumping or dumping.

How Kvants Generates Returns in Bear Markets

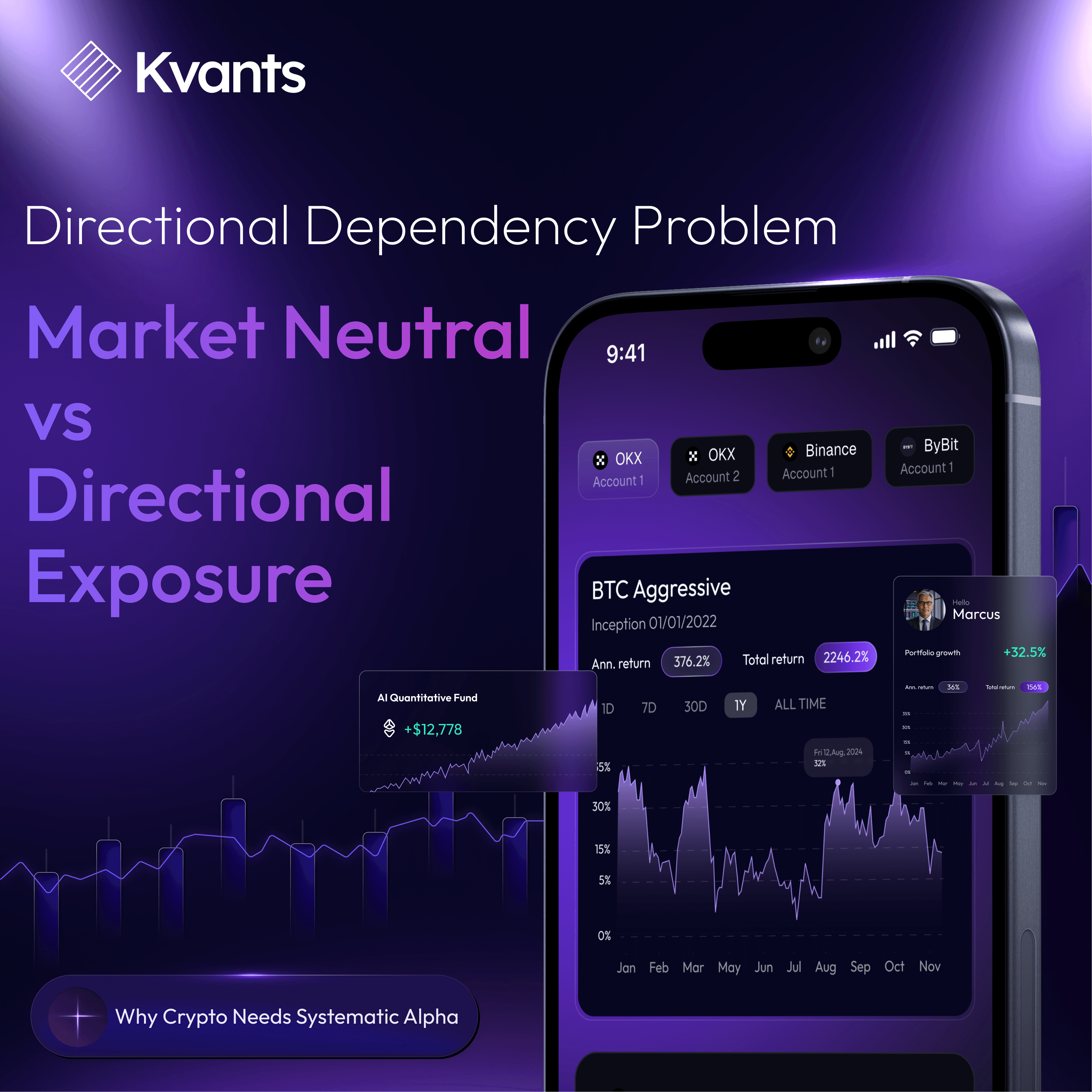

Here's what makes Kvants different: market neutrality isn't an afterthought—it's the foundation.

Kvants strategies are built to minimize net market exposure while extracting returns from structural inefficiencies. Think funding rate arbitrage, statistical arbitrage, and basis trading—strategies that hedge funds have used for decades, now deployed on-chain through DeFi vaults and CeFi signal services.

The result? During stress periods when Bitcoin is getting crushed, Kvants vaults have historically limited losses to around 1% while the broader market dropped 10% or more. In July 2025, while most traders were licking their wounds, the flagship vault delivered a 22% net return.

That's not luck. That's systematic risk management—volatility-aware position sizing, drawdown thresholds, and regime filters that automatically de-risk when conditions deteriorate. No discretionary panic selling. No emotional decisions. Just rules-based execution designed to protect and grow capital across market cycles.

The Kvants App: Institutional-Grade Strategies for Everyone

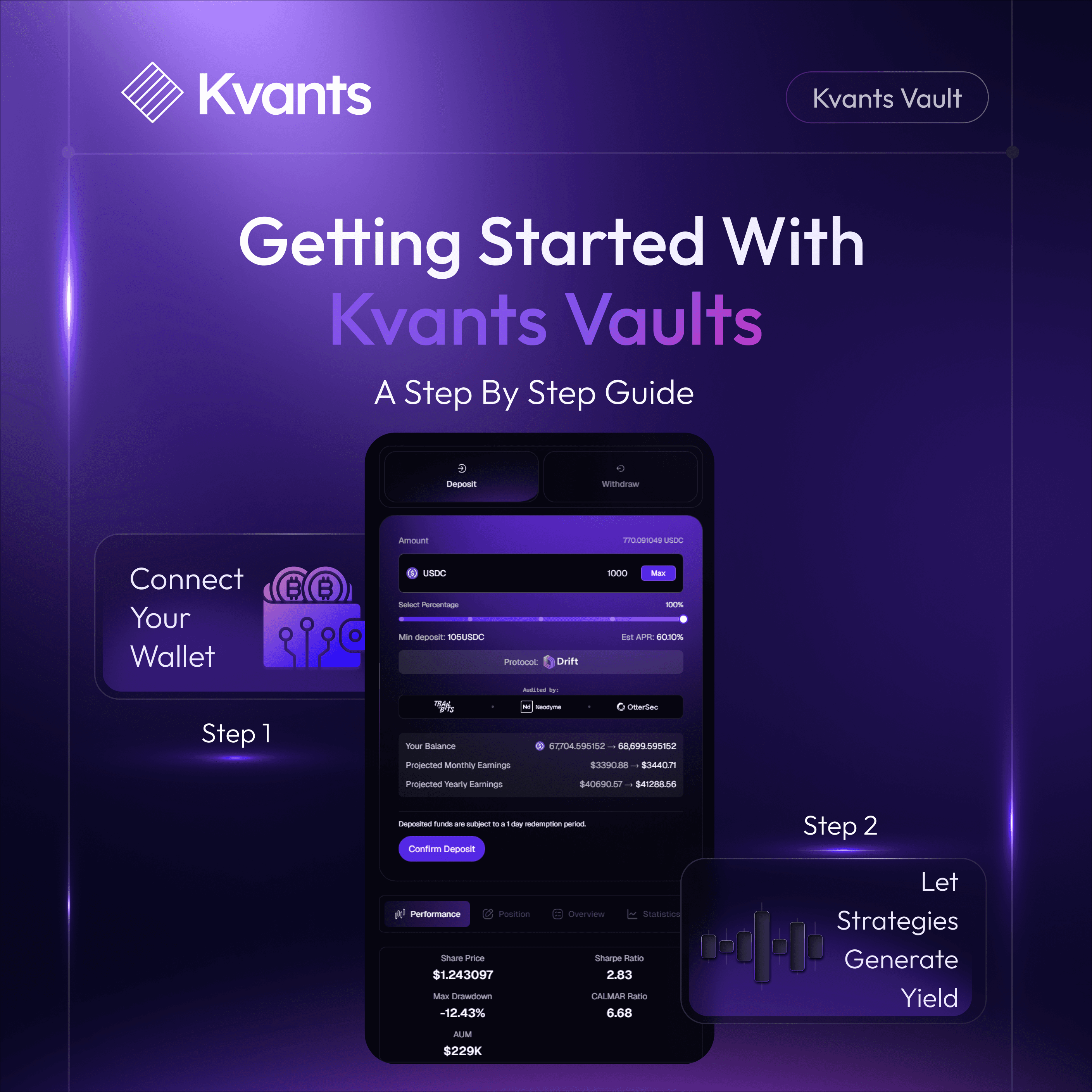

Kvants operates as an AI-powered quantitative asset management platform that bridges CeFi and DeFi. You can access strategies through permissionless on-chain vaults on Drift Protocol and Hyperliquid, or through the CeFi signal service that connects to your exchange account via API—all non-custodial, meaning Kvants never touches your funds.

The numbers tell the story: an average APY around 35%, Sharpe ratios targeting above 3, and volatility kept sub-12% on hedged strategies. Over 2,300 users are already deploying capital, with institutional CeFi AUM exceeding $42 million. And the minimum investment? Around $500—making institutional-caliber trading accessible to retail.

$KVAI: Your Gateway to the Kvants Ecosystem

This is where $KVAI enters the picture.

$KVAI is the ecosystem utility token that powers access, participation, and incentives across the entire Kvants infrastructure. It's not just a token—it's the key that unlocks the full platform experience.

With $KVAI, you can unlock premium product tiers, including advanced strategy access, higher allocation limits, and exclusive modules. It enables enhanced participation mechanics across vault systems, aligning committed users with the platform's long-term growth. And as Kvants expands its integrations with wallets, DeFi apps, and distribution partners, $KVAI becomes the common utility rail for onboarding flows, partner campaigns, and ecosystem incentives.

Think of it this way: users come to Kvants for the strategies and vault performance. $KVAI is what connects you to the best of what the platform offers—and rewards you for being part of the ecosystem through referrals, strategy adoption incentives, and community growth loops.

As more traders recognize that risk-adjusted returns beat buy-and-hope strategies, and as Kvants scales its distribution partnerships, demand for $KVAI is positioned to surge. When access to alpha becomes token-gated, the token becomes essential infrastructure—not speculation.

The Bottom Line

Buy-and-hold is a bet. Kvants is a system.

One hopes the market cooperates. The other is designed to profit regardless of direction—extracting returns from the structural mechanics of crypto markets while managing risk systematically.

If you're tired of watching your portfolio swing wildly with every market mood shift, it might be time to rethink your approach. Kvants gives you the tools. $KVAI gives you access to the best of them.

The smart money isn't just holding anymore. It's trading smarter.

Disclaimer: Past performance is not indicative of future results. Cryptocurrency investments carry significant risk including potential loss of principal. This material is for informational purposes only and does not constitute investment advice.

Read more