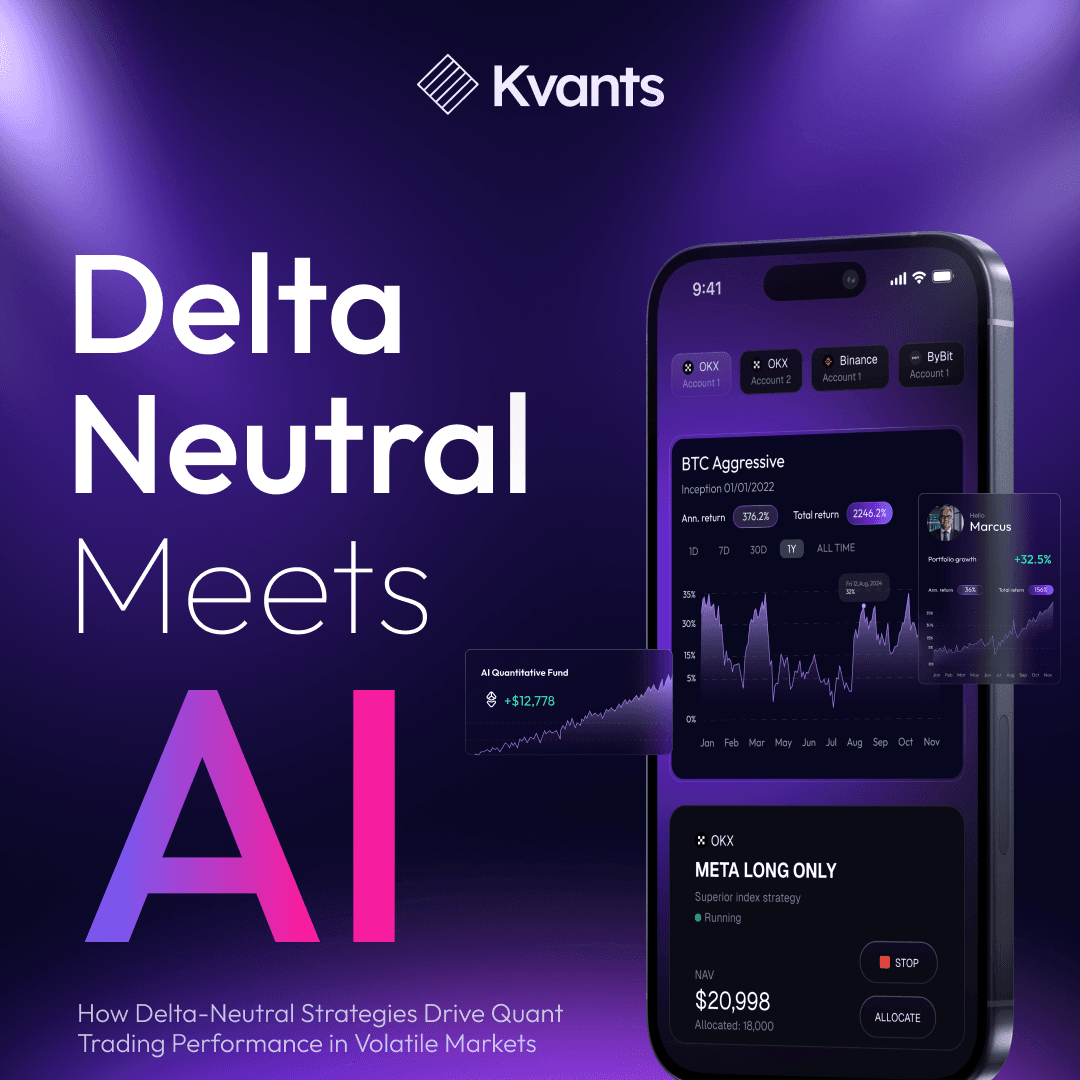

Delta-Neutral Meets AI: How Delta-Neutral Strategies Drive Quant Trading Performance in Volatile Markets

Jun 2 | 5 mins MIN | Product

By

Kvants

Key Takeaways

- AI enhances every layer of quant strategy design—from identifying market regimes to real-time hedge adjustments—making systems more adaptive and resilient.

- Delta-neutral strategies reduce directional market risk by balancing exposures, targeting inefficiencies like funding spreads and volatility instead of price trends.

- Kvants' Quant Vaults use AI models that continuously learn from real-time data, allowing them to respond to sudden shifts in sentiment, liquidity, and volatility.

- Intelligent execution is critical. AI-powered order routing minimizes slippage by selecting optimal venues and splitting orders based on live conditions.

- The combination of delta-neutral frameworks and AI creates scalable, automated strategies that adjust to market noise and maintain performance in dynamic environments.

Navigating Volatility with Intelligence

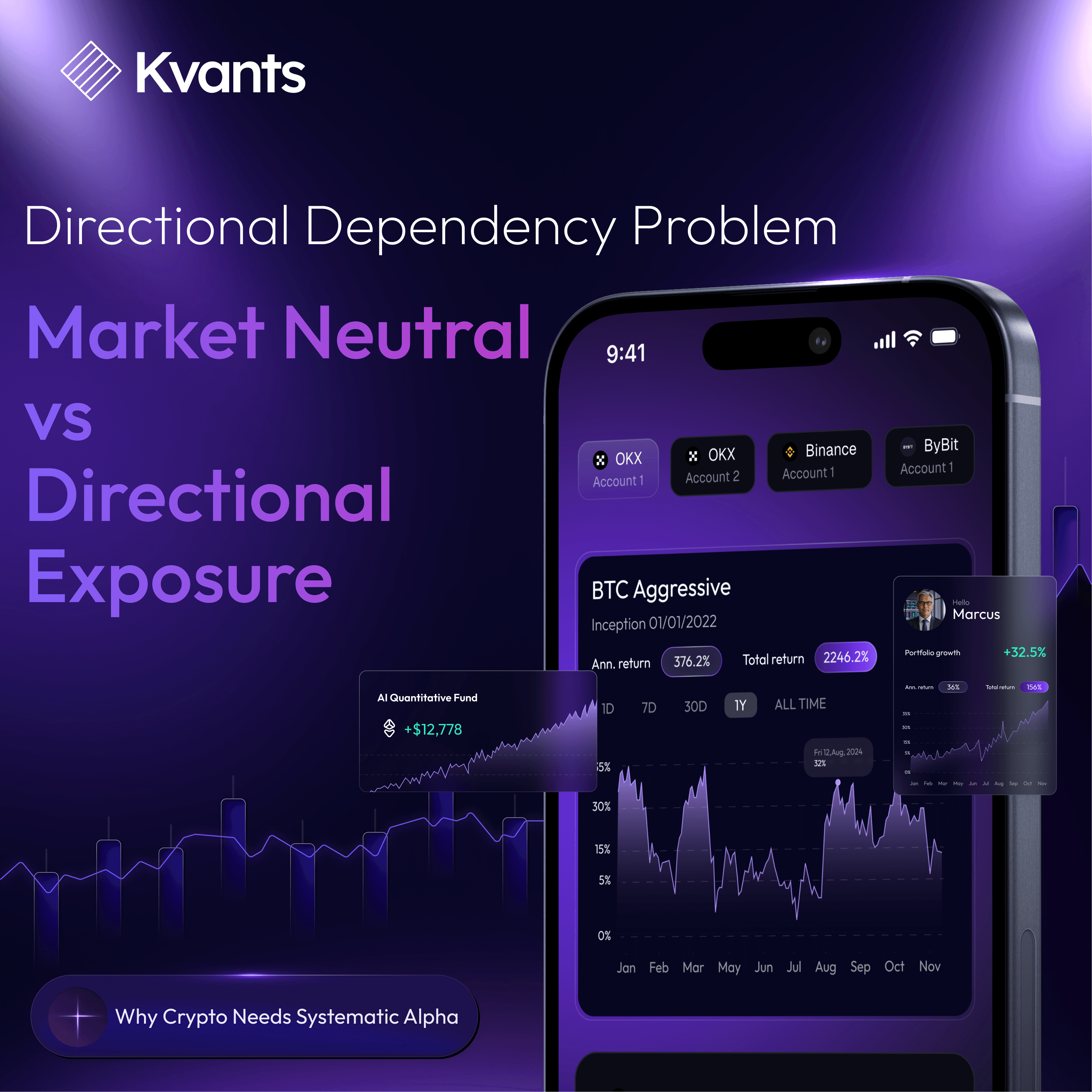

Delta-neutral strategies have become a go-to approach for many quant traders. These strategies don’t bet on the direction of prices; instead, they balance exposure so that gains and losses offset each other. The goal is simple: capture consistent returns by exploiting inefficiencies across correlated assets while minimizing risk.

But there’s a new edge in town artificial intelligence. As traditional quant signals become more crowded and less reliable, AI offers a way to adapt faster, learn from noisy data, and keep strategies competitive. When combined with a delta-neutral foundation, AI enables trading systems that are not only risk-aware but constantly evolving. Kvants' suite of Quant Vaults demonstrates this synergy in action.

What is a delta-neutral quantitative strategy?

A delta-neutral quantitative strategy is a strategy designed to generate profits regardless of the direction in which the market moves. The delta, which represents the sensitivity of the portfolio with respect to changes in the underlying asset’s price, is reduced to zero. By achieving a delta-neutral state, the strategy eliminates the impact of market movements on the overall position, allowing it to generate profits in all market conditions.

A delta-neutral strategy seeks to capitalize on factors other than market direction, such as volatility, time decay, or relative pricing relationships between different financial instruments. The latter will be explored in this article.

A delta-neutral strategy is built so the total exposure to price movement known as “delta”is zero. This can be done by combining assets that move in opposite directions, like holding spot Bitcoin while shorting Bitcoin futures. Instead of riding market trends, the strategy aims to profit from pricing discrepancies, funding rate spreads, or short-term volatility.

In fast-moving crypto markets, this approach helps reduce volatility and smooth out returns. For example, a long/short setup across related tokens can keep overall exposure low while still targeting pricing mismatches. These strategies are ideal for automation and align well with Kvants’ AI-powered quant trading models, which adjust positions based on real-time data.

The AI Advantage: Real-Time Thinking in Complex Environments

AI makes delta-neutral strategies smarter. Instead of using fixed rules or outdated correlations, machine learning models scan massive data sets for patterns whether that’s shifts in sentiment, on-chain flows, or market microstructure.

AI can also adjust hedge ratios on the fly. If the market suddenly enters a high-volatility phase, the system can respond immediately, recalibrating positions to maintain neutrality. At Kvants, AI enhances every stage of the quant process from identifying inefficiencies to managing risk. By letting models learn continuously from new inputs, quant strategies stay relevant longer and react more intelligently to stress events or regime changes.

Signal Generation and Regime Detection: Smarter Entry Points

One of the biggest AI breakthroughs is in recognizing when market conditions change. In traditional setups, this requires human intervention or model retraining. With AI, models can learn to identify different “regimes”for example, when a market shifts from calm to volatile and adapt their trading logic accordingly. This helps improve timing and reduce false signals. Tools like natural language processing (NLP) can also scan Twitter, news headlines, or Discord channels for sentiment changes. Combined with clustering techniques applied to order book data, AI-driven systems can refine how and when they act.

Kvants’ Signal Vaults incorporate these ideas, giving traders access to strategies that respond in real time, not just on backtested logic.

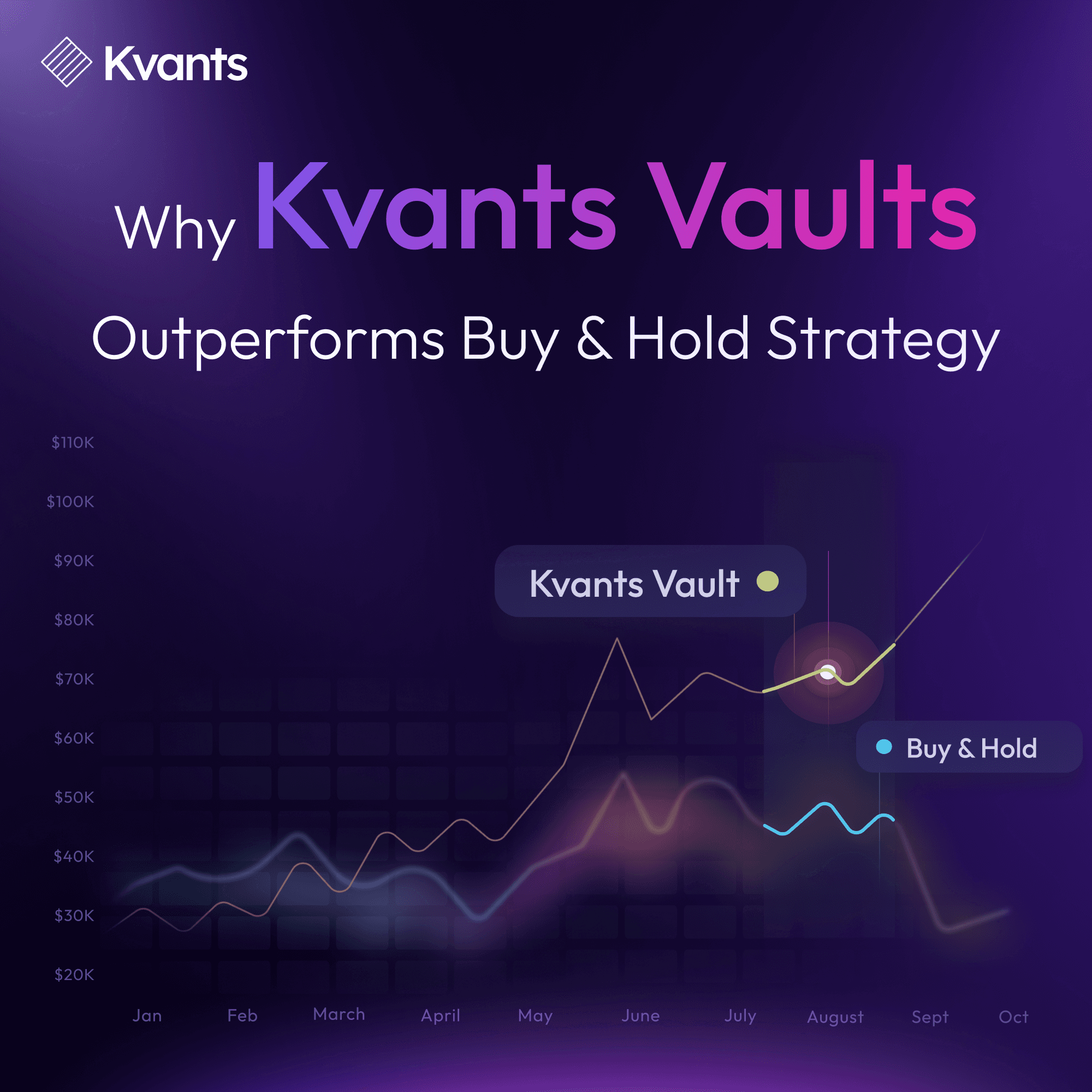

Risk and Capital Allocation: More Than Just Protection

AI isn't only about spotting trades it also helps decide where to place capital. Running multiple delta-neutral strategies means weighing tradeoffs: Which strategy has the best return-to-risk ratio? Which ones are becoming correlated? Which are most resilient in a downturn?

AI can assess these factors constantly and reallocate capital accordingly. Instead of static allocations, the system learns which setups are working and shifts capital toward them while managing drawdowns.

This keeps the portfolio stable and effective, even during rough patches. Kvants shares its approach to dynamic reallocation and downside protection through AI-based risk models that continuously monitor strategy health.

Execution: Where Speed Meets Intelligence

Good trades can still go bad if they’re executed poorly. In tight arbitrage strategies, slippage and fees eat into gains quickly. AI helps here too, powering smart order routing (SOR) tools that scan multiple venues for the best execution path.

These systems can anticipate slippage, split orders, or switch venues if one becomes less reliable. Some even use reinforcement learning to understand how different venues behave under load and adjust accordingly.

At Kvants, execution strategies are built with machine learning at the core, ensuring that the tech powering the strategy also powers how it hits the market.

Automation and Scaling: Taking Strategy to the Next Level

AI lets delta-neutral systems run hands-free and scale globally. As conditions change, strategies adjust automatically, no manual tuning required.

Market Microstructure Awareness: Winning at the Edges

Understanding order flow and liquidity is critical. AI deciphers venue behavior, letting strategies react faster and more efficiently than ever.

Smarter Trading with Kvants Delta Neutral Strategy

Delta-neutral strategies offer a resilient way to engage volatile markets without taking big directional risks. But by layering in AI, they become much more powerful, adapting to change, learning from data, and allocating resources in ways human traders simply can’t. This blend of market neutrality and machine intelligence is reshaping the future of quant trading. With platforms like Kvants leading the way, we’re entering an era where the smartest strategies don’t just protect capital they constantly evolve to find opportunity in the noise.

Read more