Why Kvants Vault Is the Need of the Moment

May 26 | 5 mins MIN | Product

By

Kvants

Making Hedge-Fund-Grade Quant Strategies Accessible to All

As the crypto market evolves, so too does investor behavior. The days of chasing viral meme coins or relying on Twitter influencers for trading tips are giving way to a more informed, data-driven approach. Retail investors are seeking better tools, smarter strategies, and risk-managed opportunities that go beyond speculation. This shift has created an urgent demand for accessible, institutional-grade investment solutions. Kvants Vault rises to meet this moment by enabling everyday investors to participate in professional quantitative trading strategies through a simple, transparent, and non-custodial platform.

A Fragmented Landscape for Retail Investors

Retail participants today face a challenging environment. Liquidity is fragmented across thousands of tokens, many of which fail to reclaim their previous cycle highs. Projects dilute value through aggressive token emissions, while narratives change faster than market sentiment can adjust. For the average investor, distinguishing signal from noise is increasingly difficult. Despite the promise of decentralization and financial inclusion, most retail portfolios are subject to volatile swings, poor risk management, and emotional decision-making.

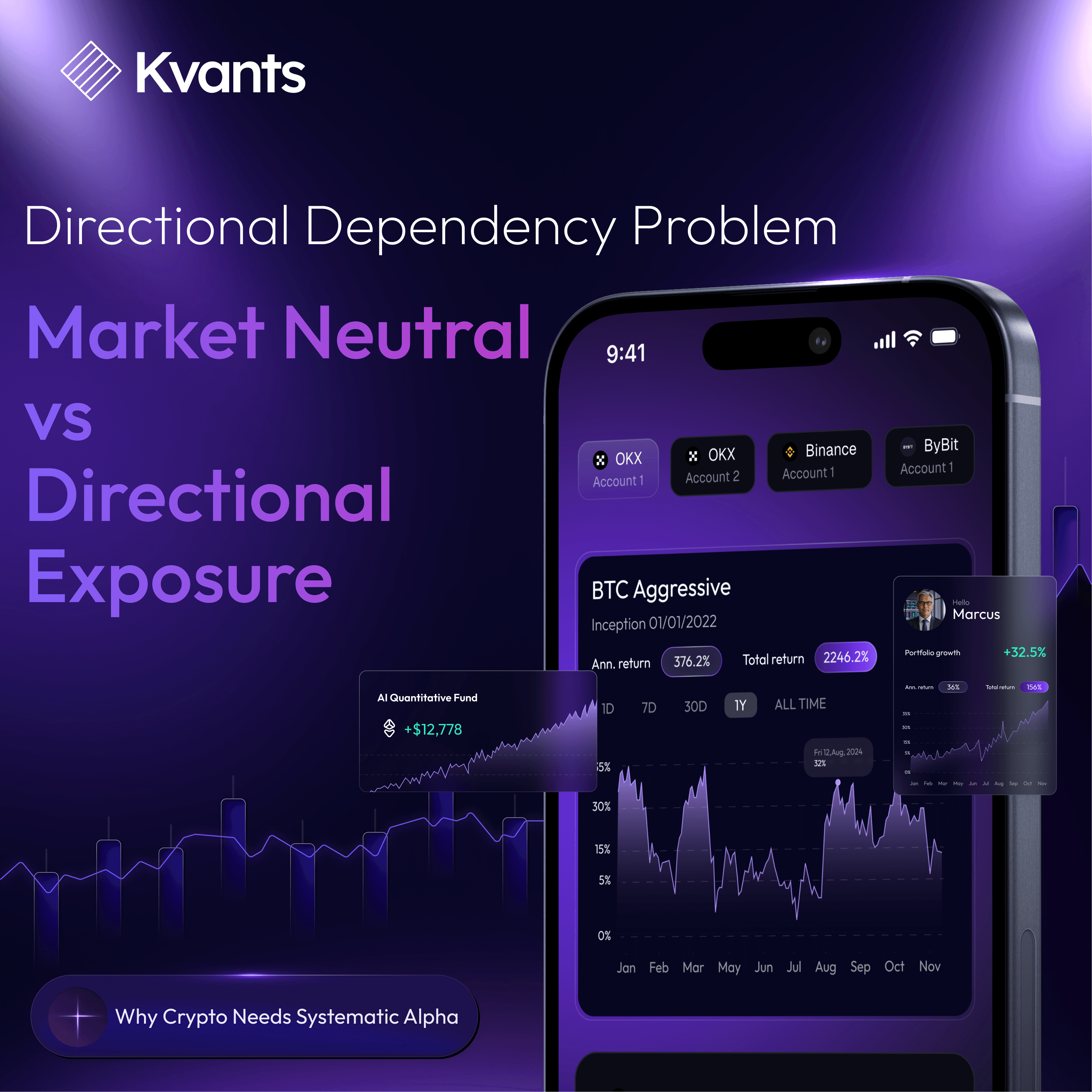

In contrast, institutional players rely on structured quantitative models, backed by extensive data, risk controls, and algorithmic precision. This creates a gap not just in performance, but in the entire investment experience.

The Rise of Quantitative Trading in Crypto

Quantitative trading has quietly become one of the most effective strategies in digital assets. By using statistical models, backtested strategies, and programmatic execution, quant funds are able to generate consistent alpha across both trending and sideways markets. These strategies are not built around hype. They focus on measurable inefficiencies such as funding rate imbalances, volatility mean reversion, trend breakouts, and order book signals. They adapt in real time, respond to new data, and remove human emotion from the equation. Until recently, these tools were only available to hedge funds and proprietary trading firms. Kvants Vault is set to change that.

What Makes Kvants Vault Different?

Kvants Vault is more than a passive yield product or copy-trading bot. It is a vault-based access layer that gives investors the opportunity to allocate into structured, AI-enhanced quantitative strategies. These vaults are built with capital efficiency, performance transparency, and investor protection in mind.

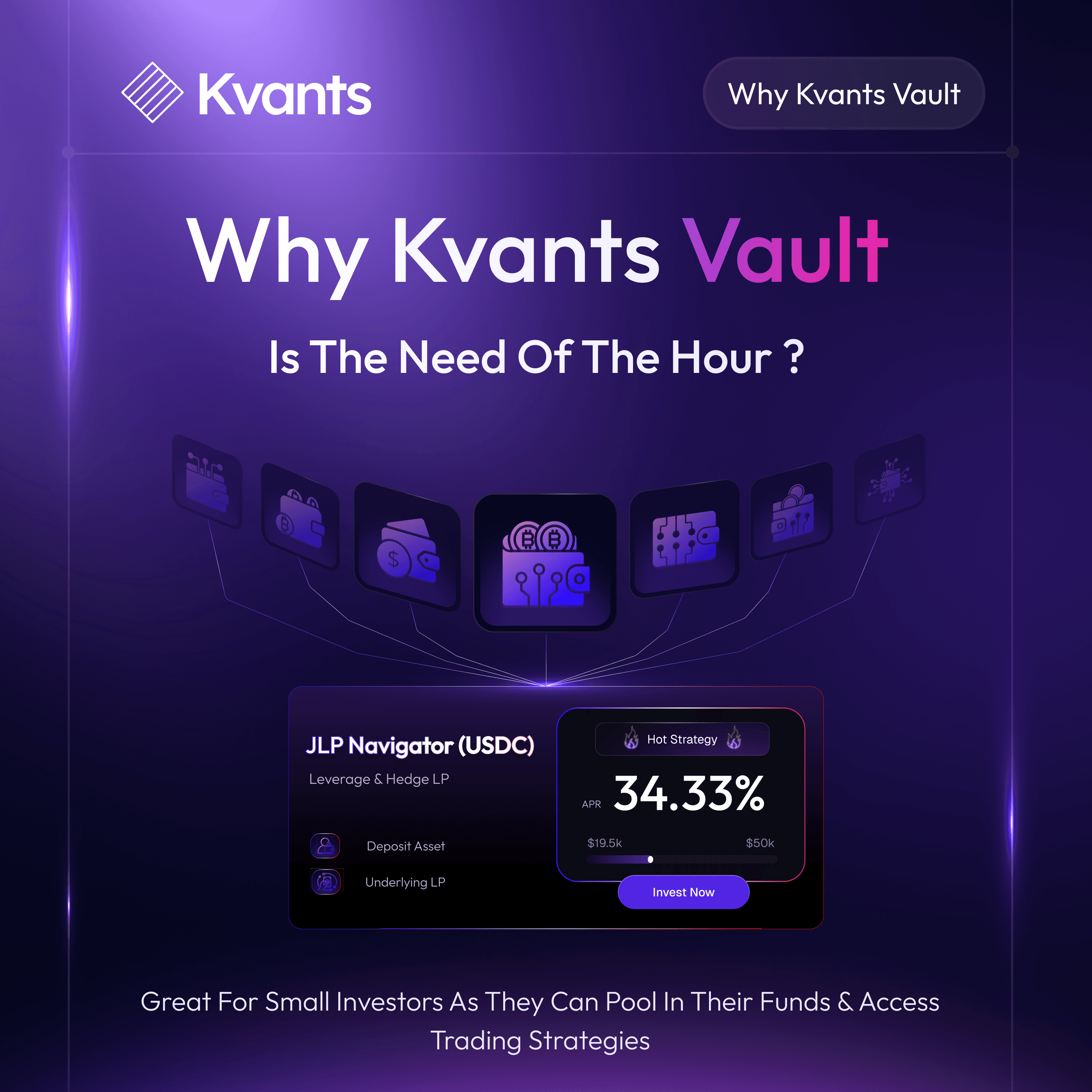

A standout example is the JLP Navigator Vault, which has been delivering an impressive 34.33 percent APR. Strategies like this are typically only accessible through private hedge funds or managed accounts, often with multi-million dollar minimums. Kvants breaks that barrier.

Key Features of Kvants Vault

Institutional-grade quant strategies

Each vault is powered by strategies that have been designed and optimized by experienced quant researchers and fund managers. These strategies span a range of risk profiles and market conditions.

AI-powered strategy rotation

Rather than sticking to static logic, Kvants uses machine learning agents to adaptively switch strategies or rebalance positions based on changing market conditions.

Non-custodial and transparent

The capital is never held by Kvants. All vaults are smart-contract based, providing full on-chain transparency and allowing users to monitor performance, risk exposure, and fund flows in real time.

Lower barriers to entry

Unlike hedge funds that require significant capital commitments and long lock-ups, Kvants Vault is built to be accessible. It opens the door for retail users, smaller institutions, and emerging allocators to participate with minimal friction.

Why Now?

The launch of Kvants Vault aligns perfectly with current market dynamics. Several factors highlight why this solution is not just timely, but necessary.

The infrastructure is ready

DeFi has matured to the point where complex, automated strategies can be executed on-chain with precision. Perpetual DEXs, lending protocols, and liquidity networks now support the kind of architecture needed to run quant strategies at scale.

Investors want more than hype

The retail market is showing clear signs of fatigue with speculative trading. There is a growing appetite for tools that focus on performance consistency, risk-adjusted returns, and smarter capital allocation. Kvants meets this demand with a platform that is both easy to use and institutionally robust.

Smart Money Coming In

Institutional hedge funds are now entering crypto with serious capital and advanced quantitative strategies. These firms use automation, data, and risk models to consistently outperform, leaving retail investors trailing behind. Many retail traders end up chasing trends, driven by FOMO and online noise, while institutions quietly rotate capital with precision. In this new landscape, relying on emotion or intuition simply doesn’t work. The gap between professional and retail investors is widening. Mere access to markets is no longer enough—edge comes from having the right strategy. Without the tools to compete, retail investors risk being systematically outplayed. Competing requires access to the same tools the pros use. Kvants Vault makes that possible—offering retail investors AI-powered quant strategies like JLP Navigator, which currently delivers 34.33% APR.

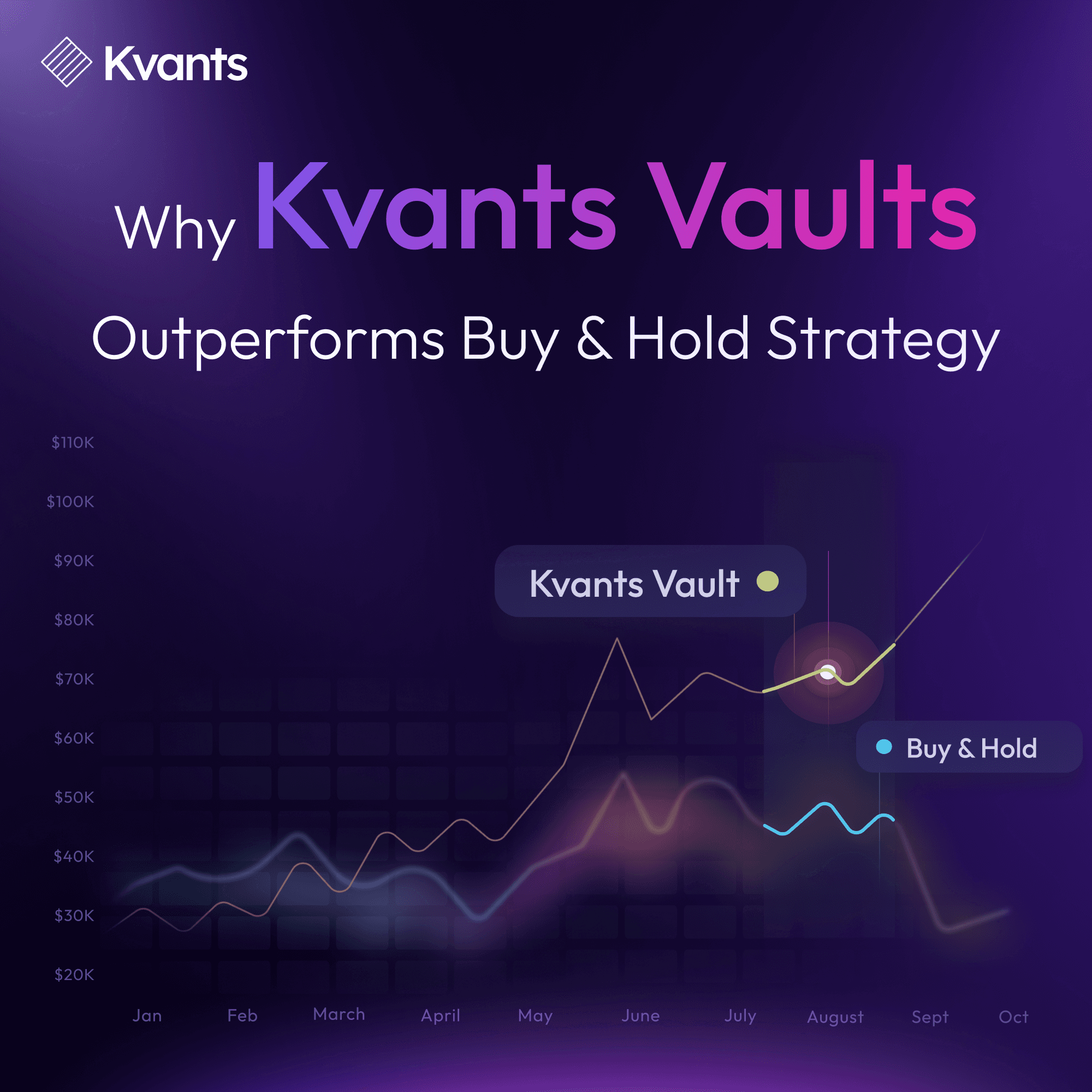

Quant strategies are outperforming

Over the past two years, quantitative strategies have proven their resilience. While discretionary portfolios have suffered from unpredictable volatility, quant strategies have continued to deliver stable performance by dynamically adapting to market regimes.

Kvants brings this capability to a broader audience, empowering investors who previously lacked the infrastructure, data, or experience to implement such models on their own.

Democratizing Access to Quantitative Alpha

Kvants Vault is not just about yield, it is about unlocking access. For too long, the best-performing strategies in crypto have been confined to those with insider access, proprietary tools, and deep pockets. With Kvants, the playing field begins to level. Investors from around the world can allocate into rigorously designed vaults, managed through transparent smart contracts, and powered by the same models that institutional traders use to generate alpha. By democratizing access to these strategies, Kvants contributes to a more mature and equitable crypto ecosystem, one where performance is earned through research, not hype.

What Lies Ahead

Kvants Vault is launching soon, and it arrives at a moment when crypto markets are actively searching for credibility and professionalism. As new capital prepares to enter the space, platforms that offer clarity, transparency, and proven performance will stand out. Kvants is positioning itself to become the institutional gateway for the next generation of investors, those who seek more than just volatility, and who understand the power of compounding returns over time.

Kvants Vault represents a major step forward in how investors access and benefit from the world of quantitative trading. By removing the barriers of capital, infrastructure, and complexity, Kvants enables a broader audience to participate in sophisticated strategies that were once the domain of hedge funds. Kvants offers a quieter but far more compelling storyline long-term value creation.

Kvants Vault is launching soon.

Read more