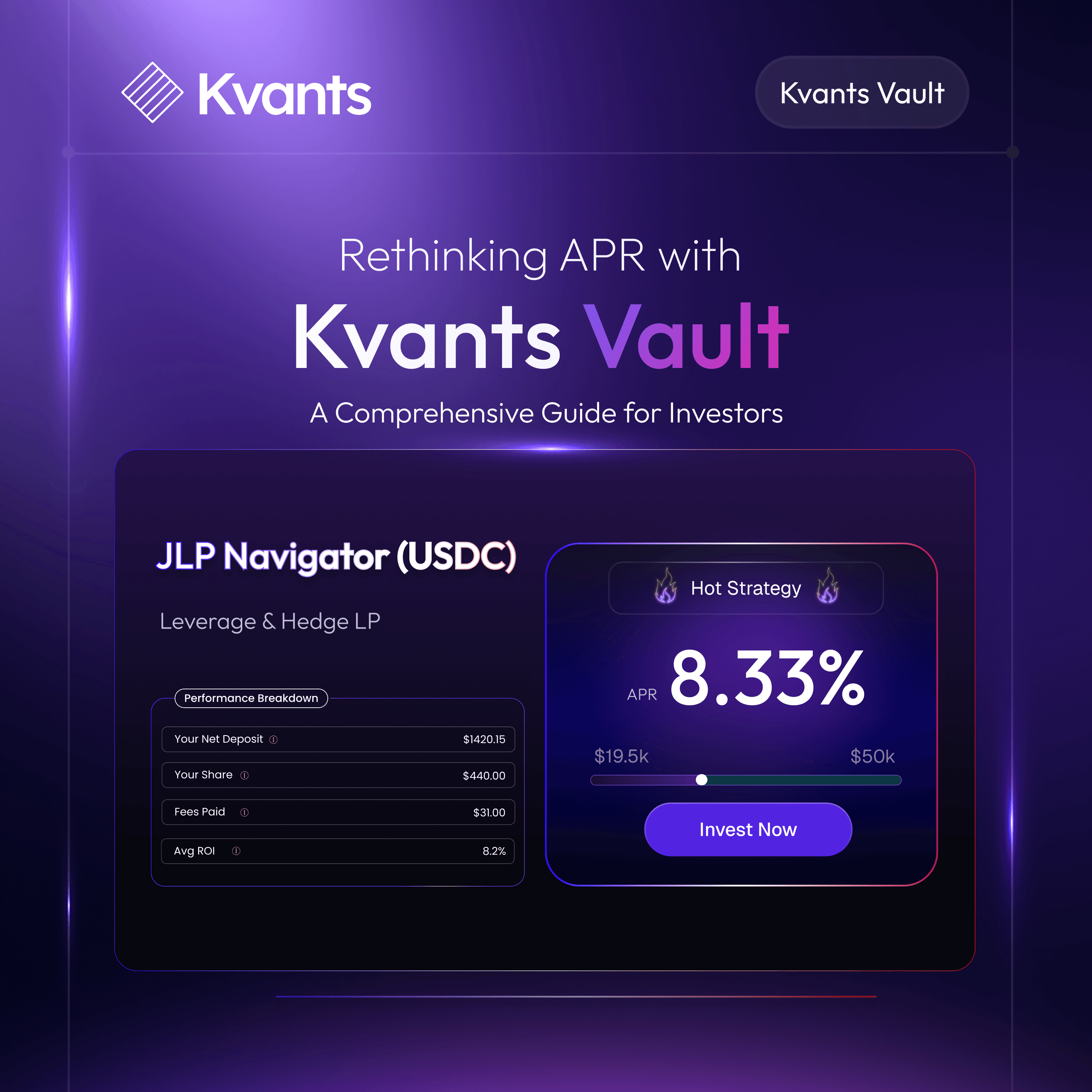

Rethinking APR with Kvants Vaults: A Comprehensive Guide for Investors

Jul 19 | 5 Mins MIN | Product

By

Kvants

Understanding APR vs Real Returns

Annual Percentage Rate (APR) expresses the return on investment over one year as a percentage. However, APR hides two factors: yield stability and compounding frequency. Yield stability tracks how consistent the rate remains, while compounding frequency determines how often earnings are reinvested. These factors shape real returns. Yield stability measures the reliability of reward streams in changing markets. A high APR means little if yields spike and crash unpredictably. By contrast, a stable rate, even slightly lower, can produce more dependable results when averaged over multiple periods.

Compounding frequency defines how often returns are reinvested back into the principal. APR ignores this element, whereas Annual Percentage Yield (APY) reflects it. More frequent compounding, daily versus monthly, can significantly boost effective yields over time.

At Kvants, Vaults are engineered with both firmly in mind. Whether employing funding-rate carry, statistical mean-reversion, momentum strategies, or the neutralized JLP engine, each Vault is designed to capture persistent reward streams, even amid token price volatility.

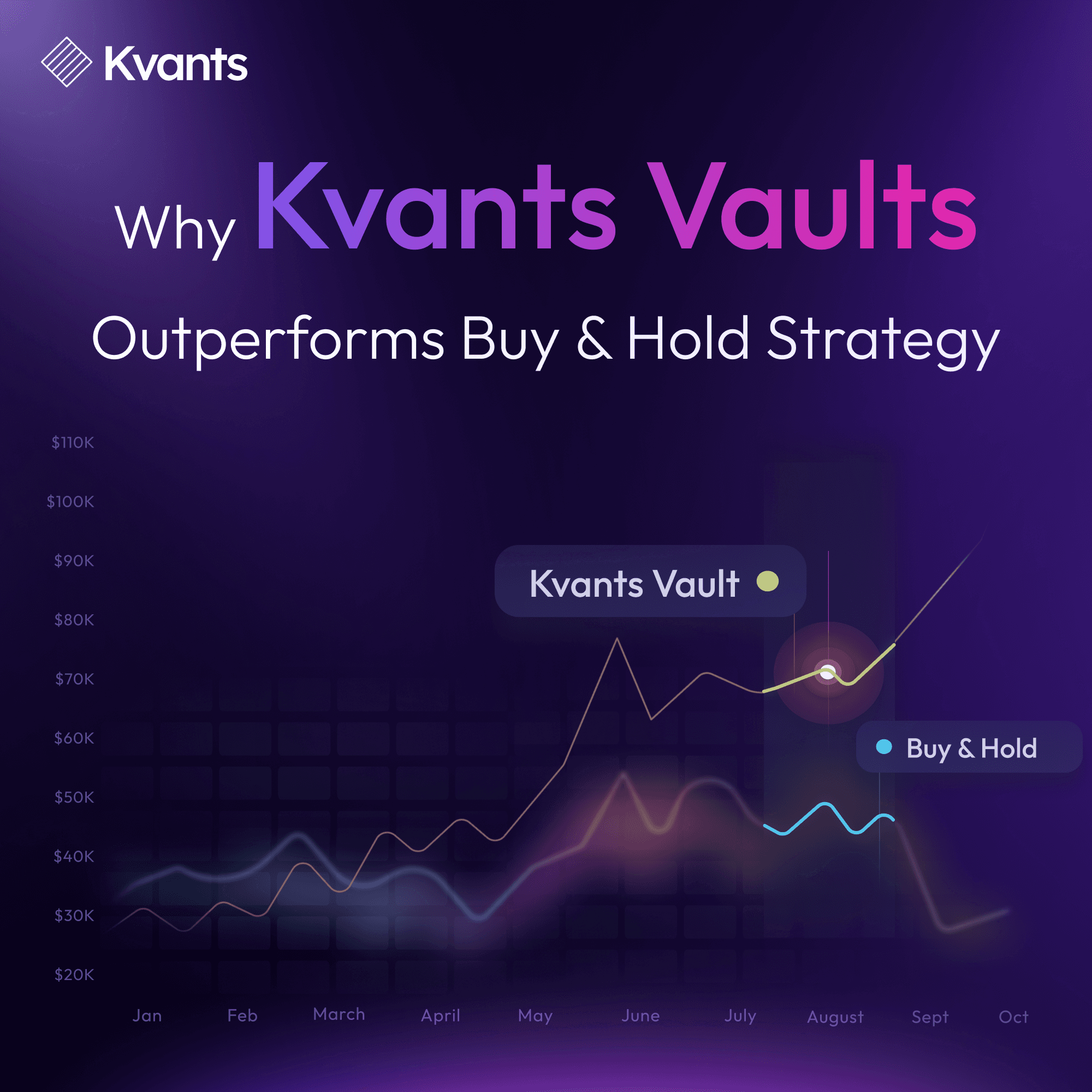

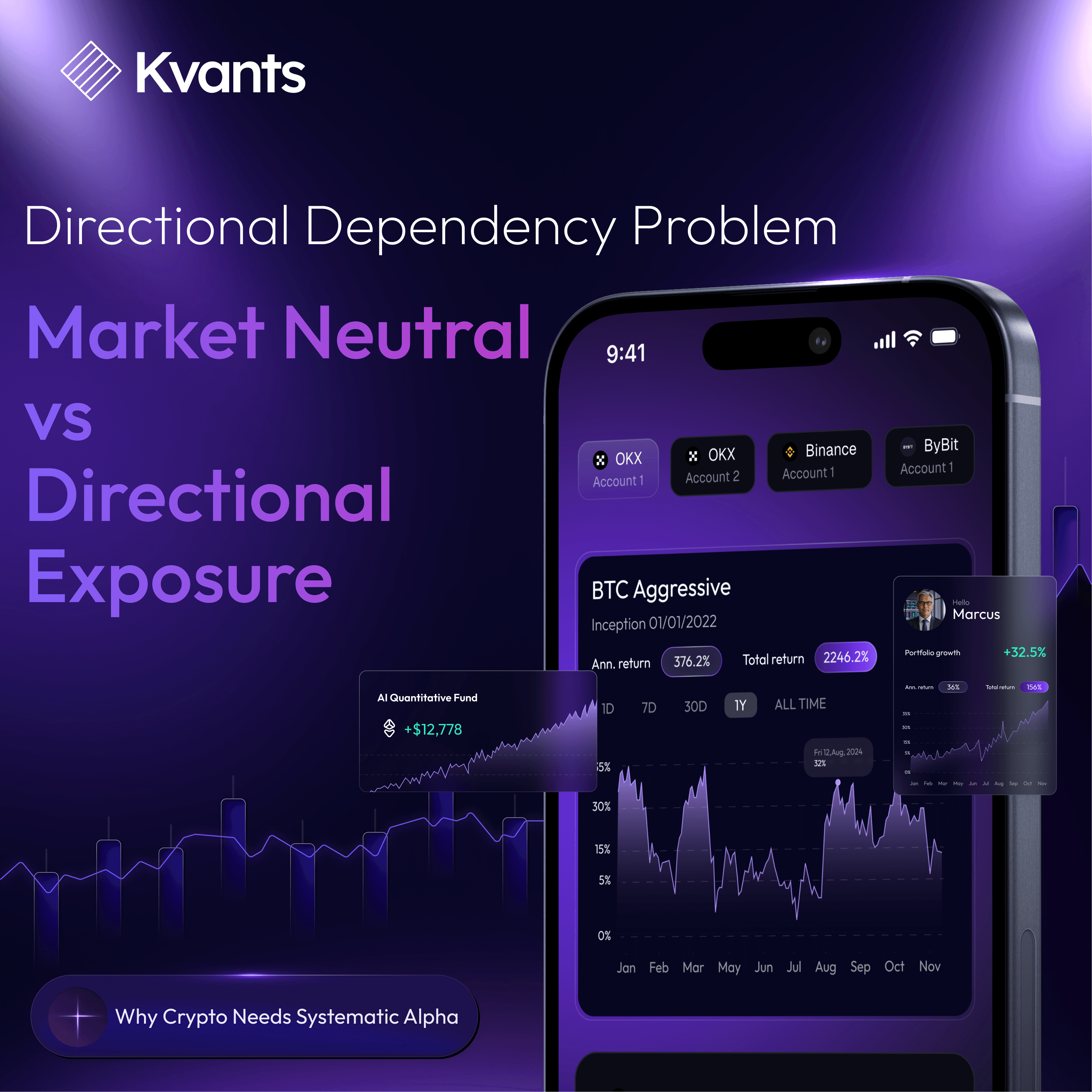

Market-Neutral Yield: Decoupling APR from Token Price Hype

A core differentiator of Kvants APR lies in the delta-neutral approach. Instead of relying on token inflation or speculative token price movements, Kvants Vaults earn through funding fees, liquidity rebates, and spread capture. This means that returns are tied to actual trading activity, not hype cycles. Institutional investors especially benefit from knowing that yield is driven by real market mechanics, not promotional token emissions.

Automatic Compounding: From APR to Real APY

Kvants Vaults are structured to auto-compound all profits block by block. That means an advertised 15% APR becomes a significantly higher effective APY in practice, without any manual intervention. Idle funds are never left on the sidelines. For institutional clients, this translates to enhanced real yield and streamlined treasury operations.

Risk Transparency: Sharpe, Drawdown, VaR

Yield is only valuable when viewed in risk-adjusted terms. That is why each Kvants Vault makes its Sharpe ratio, maximum drawdown, and daily Value at Risk (VaR) publicly available on our dashboard. You can see exactly how much volatility accompanies your expected yield. This is crucial for sizing allocations within multi-asset portfolios. Transparency is fundamental at Kvants. Every metric is on-chain verifiable and designed for institutional compliance.

Fee Integrity: On-Chain, Performance-Only

Fee structures can be murky unless smart contracts enforce them directly. Kvants Vaults charge performance fees only on positive PnL, automatically deducted by the contract itself. There are no hidden emissions, management slices, or pre-funded allocations. Your Vault share price always reflects net, realized return in real time. Institutions can confidently audit and verify all fee events via blockchain explorers..

Portfolio Synergy: Adding Alpha, Reducing Volatility

One of Kvants’ most powerful value propositions is portfolio diversification. Market-neutral returns can complement both spot holdings and staking. Even a modest allocation to Kvants Vaults can flatten equity curve volatility and improve overall portfolio performance. Institutional allocators utilizing multi-strategy portfolios, especially those combining DeFi, digital assets, and traditional exposures, have reported smoother drawdown cycles and enhanced Sharpe. Related insights can be found in financial diversification strategies.

Deep Dive: How Each Strategy Enhances Yield Robustness

Funding-Rate Carry Vault

This Vault captures the spread between long and short funding rates across derivatives exchanges. Returns accumulate persistently even when underlying tokens whipsaw because funding mechanisms operate irrespective of price direction.

Statistical Mean-Reversion Vault

Leveraging on-chain and off-chain data signals, this Vault takes advantage of predictable reversion patterns, whether in AMM pools or cross-exchange price divergence. Designed to profit when prices return to equilibrium, it provides stable, low-volatility income.

Momentum Vault

Capturing durable trends with adaptive filters, our momentum engine harvests sustained directional moves. Sessions include rigorous risk controls like dynamic trailing stops and scaled exposure management.

Neutralised JLP Engine

This proprietary Joint-Liquidity-Pool engine is fully hedged to eliminate directional token risk while capturing bid-ask spread and protocol incentives on DEX pools. By neutralizing delta exposure, it extracts pure reward from liquidity provisioning mechanics, freeing yield from directional bias.

Optimization: How Kvants Maximizes Net Yield

Ultra-Fast Compounding Blocks

Every Vault reinvests earnings in every Ethereum block, not daily or weekly. This micro-compounding effect, when executed consistently, yields significant advantages. Institutional investors appreciate how even 1% APR, compounded about 6500 times annually, can scale.

Gas Optimization and Smart Execution

Kvants Vaults are designed with gas efficiency as a core principle to preserve and enhance net yield. By leveraging batched transactions, the system groups multiple operations into a single execution cycle, significantly reducing overhead. Sub-gas estimation techniques ensure that transactions are executed only when the gas cost-to-yield ratio is favorable, avoiding unnecessary spending. This is especially valuable during periods of high network congestion, where gas prices can erode returns.

Smart Rebalancing

Kvants employs predictive rebalancing, forecasting funding rate and price shifts to adjust exposures proactively. Institutions benefit from seeing automated adjustments with on-chain proofs. This anticipatory approach reduces lag in volatile markets, enhancing capital efficiency and stabilizing returns across strategy cycles.

Institutional-Grade Integration and Infrastructure

Kvants vaults are built with the same latency‑sensitive architecture institutional desks demand. Execution legs run on Drift’s cross‑margin accounts and Hyperliquid’s native vault module, both tuned for sub‑second finality. Orders are relayed through co‑located keeper nodes that maintain automatic fail‑over across three geographic regions. Position sizing, VaR computation, and leverage throttles are calculated off‑chain in a Rust risk engine that writes signed instructions on‑chain every block. The codebase follows SOLID engineering practice, uses exhaustive unit tests, and passes monthly chaos drills. Kubernetes deployment pipelines push deterministic binaries, enabling rollbacks within five minutes if a regression is observed in production.

On‑Chain Auditability

Every Kvants transaction emits an event that can be queried by any Solana or Hyperliquid explorer, giving allocators a permanent, tamper‑proof audit trail. The vault program stores position deltas, collateral balances, accrued funding, fee take, and performance‑fee deductions in publicly readable state variables. A companion TypeScript SDK surfaces these metrics through a GraphQL endpoint so portfolio managers can plug live data into internal dashboards without writing blockchain code. Weekly Merkle proofs of share supply are posted to IPFS and signed by two independent auditors, OtterSec and CertiK, ensuring that vault NAV calculations match on‑chain reality down to the last satoshi.

Custodial and Permissioned Access

Kvants is non‑custodial by default, yet larger allocators often require permissioned controls. For these clients the platform supports delegate wallets with granular signing rights. Funds can whitelist cold‑storage addresses that approve deposits while restricting withdrawals to multi‑sig committees. API‑only trade keys mean Kvants never gains transfer authority over centralized exchange balances; the service pushes signed orders, but withdrawal permissions stay disabled. Compliance modules can flag deposits exceeding preset thresholds, pause execution, and await manual approval. All permission rules are stored in immutable config accounts, visible on chain, so external auditors and LPs can verify that operational segregation policies are enforced.

Data Feeds and Compliance Reporting

Kvants consumes low‑latency price feeds from Pyth and Switchboard, supplemented by Hyperliquid’s internal oracle, then cross‑checks every update against a five‑minute rolling median to prevent manipulation. Trade, funding, and NAV snapshots are pushed to an on‑chain time‑series storage contract every block, making historical analysis easy for regulators and due‑diligence teams. A SOC‑2 aligned reporting engine exports daily CSVs containing wallet addresses, transaction hashes, and calculated yield, which can be ingested directly into standard fund accounting software. For MiCA and VASP jurisdictions, the engine can auto-generate capital gains and suspicious‑activity flags, ensuring institutional clients meet audit and compliance obligations without tooling.

Final Takeaway

Headline APR is a teaser. It is the tip of the yield iceberg. Kvants Vaults deliver real, risk-adjusted returns. Vault strategies operate market-neutrally, auto-compound every block, show complete risk transparency, and enforce fees based solely on performance. With robust institutional infrastructure, on-chain auditability, and streamlined integrations, they offer a compelling solution to elevate modern portfolio management in digital assets. Kvants is more than a yield provider. It is a partner in architecting compounded, transparent, institutional-grade DeFi yield.

Read more