Maximizing Your Crypto Portfolio with Kvants AI Agent’s Automated Quant Trading Strategies

Mar 12 | 5 Mins MIN | Institutional investment

By

Kvants Team

Key Highlights

- AI-driven trading automation: Kvants AI removes human biases and emotions from trading, executing trades with precision and speed using sophisticated machine learning models to maximize efficiency and profitability.

- 24/7 market monitoring: The AI continuously scans and analyzes market data in real time, identifying profitable opportunities and executing trades instantly, ensuring that investors capitalize on market fluctuations without constant manual oversight.

- Advanced risk management: Incorporates automated stop-loss mechanisms, position sizing adjustments, and predictive risk assessments to safeguard investor capital and minimize exposure to sudden market downturns.

- Diversified quantitative strategies: Uses a combination of momentum trading, arbitrage, mean reversion, and market-making strategies to ensure optimized returns under different market conditions and volatility levels.

- DeFi and decentralization integration: Enhances returns through automated staking, liquidity provision, and lending, leveraging smart contract-based execution to minimize counterparty risks and improve transactional efficiency within decentralized finance ecosystems.

Introduction

Navigating the cryptocurrency market requires adaptive strategies due to its rapid fluctuations and inherent volatility. Traditional investment approaches like spot holding and staking often fail to maximize potential gains. To address this, Kvants AI introduces an advanced, AI-driven trading system that integrates quantitative models with automated portfolio management. This innovative platform enhances performance across centralized and decentralized exchanges by utilizing machine learning and real-time data analysis. Whether for passive investors or active traders, Kvants AI delivers a strategic advantage in optimizing returns while managing risks effectively.

Understanding AI Agents

AI agents are intelligent systems designed to analyze environments, process data, and make informed decisions. Unlike conventional automation, these agents continuously learn and evolve, adjusting their actions based on new data. Within financial markets, AI agents process vast amounts of information, detecting trends and executing trades with precision and speed beyond human capability.

AI Agents in Crypto and Blockchain

AI agents are transforming cryptocurrency and blockchain technology by automating trade execution, analyzing market trends, and optimizing decision-making. These systems leverage data from both on-chain and off-chain sources to identify arbitrage opportunities, improve liquidity, and reduce trading risks. By integrating with decentralized finance (DeFi), AI-powered strategies enhance yield farming, staking, and lending automation, making the crypto market more efficient and accessible.

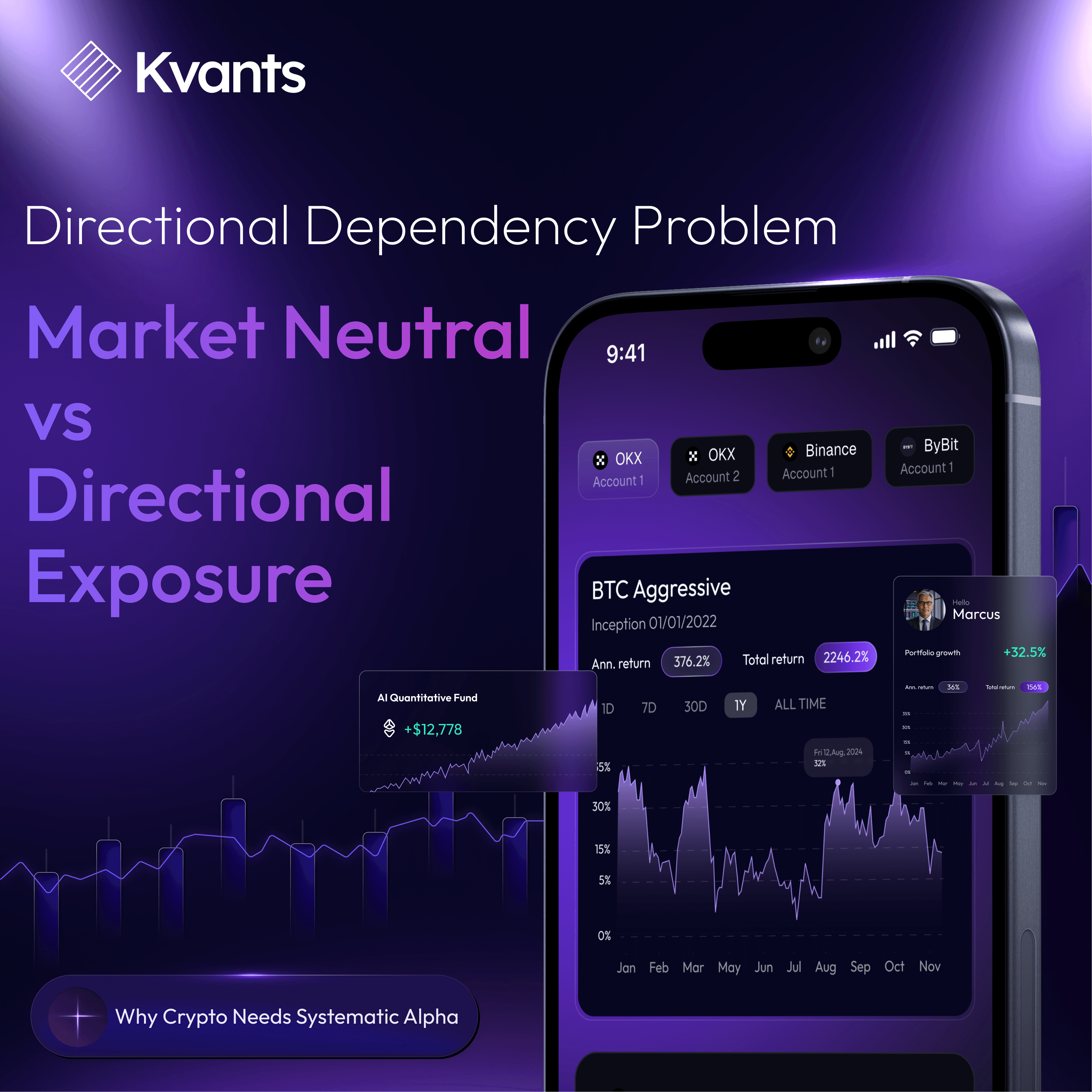

The Shift Towards Automated Trading

Cryptocurrency markets operate non-stop, with unpredictable price swings that create both risks and opportunities. Manual trading is often hindered by emotional biases, delayed reactions, and human limitations. AI-driven automation resolves these challenges by executing trades instantly, analyzing data without bias, and adapting to market conditions in real time. Kvants AI provides a seamless trading experience by eliminating inefficiencies and maximizing profitability.

Key benefits of Kvants AI’s automated trading include data-driven decision-making, 24/7 market monitoring, and instant execution for optimal trade entry and exit points. Advanced risk management protocols, including automated stop-loss orders and dynamic position sizing, further enhance capital protection. By integrating automation, Kvants AI delivers consistent returns while ensuring robust risk controls.

What is Kvants AI Agent

Kvants AI Agent is an advanced AI-powered trading system designed to automate and optimize cryptocurrency investments. It leverages machine learning, quantitative models, and real-time data analysis to execute trades with precision, adapt to market conditions, and manage risk efficiently. Kvants AI Agent eliminates emotional biases, ensuring data-driven decision-making across both centralized and decentralized exchanges. By integrating predictive analytics, automated portfolio rebalancing, and institutional-grade risk controls, Kvants AI Agent provides traders and investors with a seamless and intelligent approach to maximizing returns while minimizing risk.

How Kvants AI Enhances Portfolio Performance

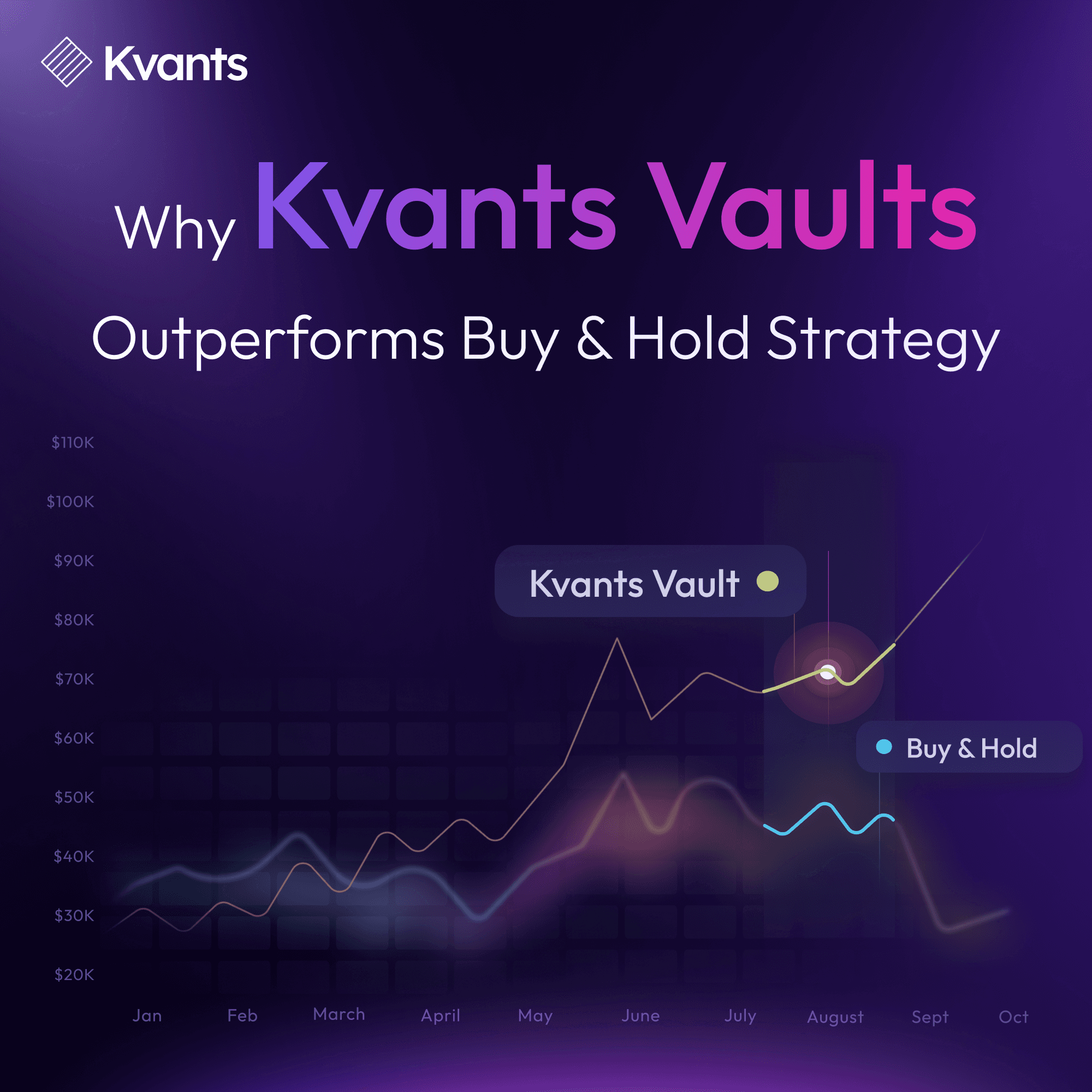

Kvants AI is built on sophisticated quantitative models designed by financial experts and AI specialists. These models analyze market data in real time, adjusting trading strategies dynamically. Key approaches include:

- Momentum Trading: Captures profits from strong price trends.

- Arbitrage: Exploits price differences across exchanges for risk-free gains.

- Mean Reversion: Identifies overbought and oversold assets for reversal opportunities.

- Market-Making: Enhances liquidity and profits from bid-ask spreads.

Beyond individual trades, Kvants AI employs intelligent portfolio rebalancing, ensuring dynamic asset allocation based on market trends and volatility. It diversifies holdings across high-growth sectors such as DeFi, Layer 1 blockchain projects, and AI tokens while maintaining defensive strategies during downturns. Stablecoins are incorporated to hedge against extreme price fluctuations, preserving liquidity and protecting investments.

Another key strength of Kvants AI is its predictive analytics powered by machine learning. Unlike traditional quantitative models, Kvants AI continuously refines its strategies by analyzing real-time market conditions and historical trends. It processes large volumes of data to detect emerging opportunities before they gain mainstream attention. This proactive approach enables Kvants AI to optimize positioning and enhance long-term portfolio growth.

Decentralization and the Future of Trading

While centralized exchanges (CEXs) have long dominated crypto trading, they come with risks such as regulatory uncertainty, security vulnerabilities, and limited transparency. Kvants AI is built for the decentralized finance (DeFi) ecosystem, leveraging smart contracts to execute trades securely without third-party intervention. This ensures transparency, reduces reliance on centralized entities, and minimizes exposure to exchange-related risks.

Kvants AI optimizes liquidity sourcing on decentralized exchanges (DEXs), reducing slippage and improving trade execution efficiency. Additionally, it strategically manages transaction costs by executing trades on blockchain networks with lower gas fees. Beyond trading, Kvants AI enhances DeFi yield generation by automating staking, yield farming, and lending strategies. The AI continuously evaluates the most profitable opportunities, automatically adjusting positions to maximize returns while mitigating risks.

Who Benefits from Kvants AI?

Kvants AI caters to a diverse range of investors:

- Retail Investors: Automates portfolio growth, ensuring data-driven decisions and superior returns without manual intervention.

- Institutional Traders: Provides hedge fund-level AI models, real-time analytics, and scalable automated execution for professional investors.

- DeFi Users: Optimizes staking, liquidity provision, and lending, allowing passive income generation with minimal effort.

Conclusion

The future of crypto trading is defined by automation, AI-powered decision-making, and data-driven strategies. Kvants AI is at the forefront of this evolution, offering cutting-edge technology to optimize trading, enhance yield generation, and implement institutional-grade risk management. Whether you are a retail trader seeking consistent portfolio growth, an institutional investor looking for algorithmic execution, or a DeFi participant maximizing passive income, Kvants AI delivers a tailored solution to elevate your trading experience.

By integrating machine learning, advanced quantitative models, and decentralized trading, Kvants AI ensures that portfolios remain optimized, protected, and positioned for maximum returns. In an industry where market dynamics shift rapidly, automated trading is no longer optional—it is essential for staying ahead. Kvants AI empowers investors with an unparalleled advantage in the evolving crypto landscape.

Kvant’s AI is designed to deliver superior risk-adjusted returns by adapting to market conditions with data-driven intelligence. The combination of algorithmic efficiency and real-time market monitoring creates an ecosystem where investors can execute trades with maximum accuracy while mitigating risk exposure. With seamless integration across decentralized exchanges, liquidity fragmentation is no longer a barrier to effective trading.

The future of quant-driven DeFi trading is here.

Join the whitelist now: https://app.kvants.ai/

Read more