Kvants Vault Trading Strategies: A Deep Dive for Allocators

Jul 4 | 5 Mins MIN | Product

By

Kvants

Introduction to Systematic On-Chain Yield Strategies

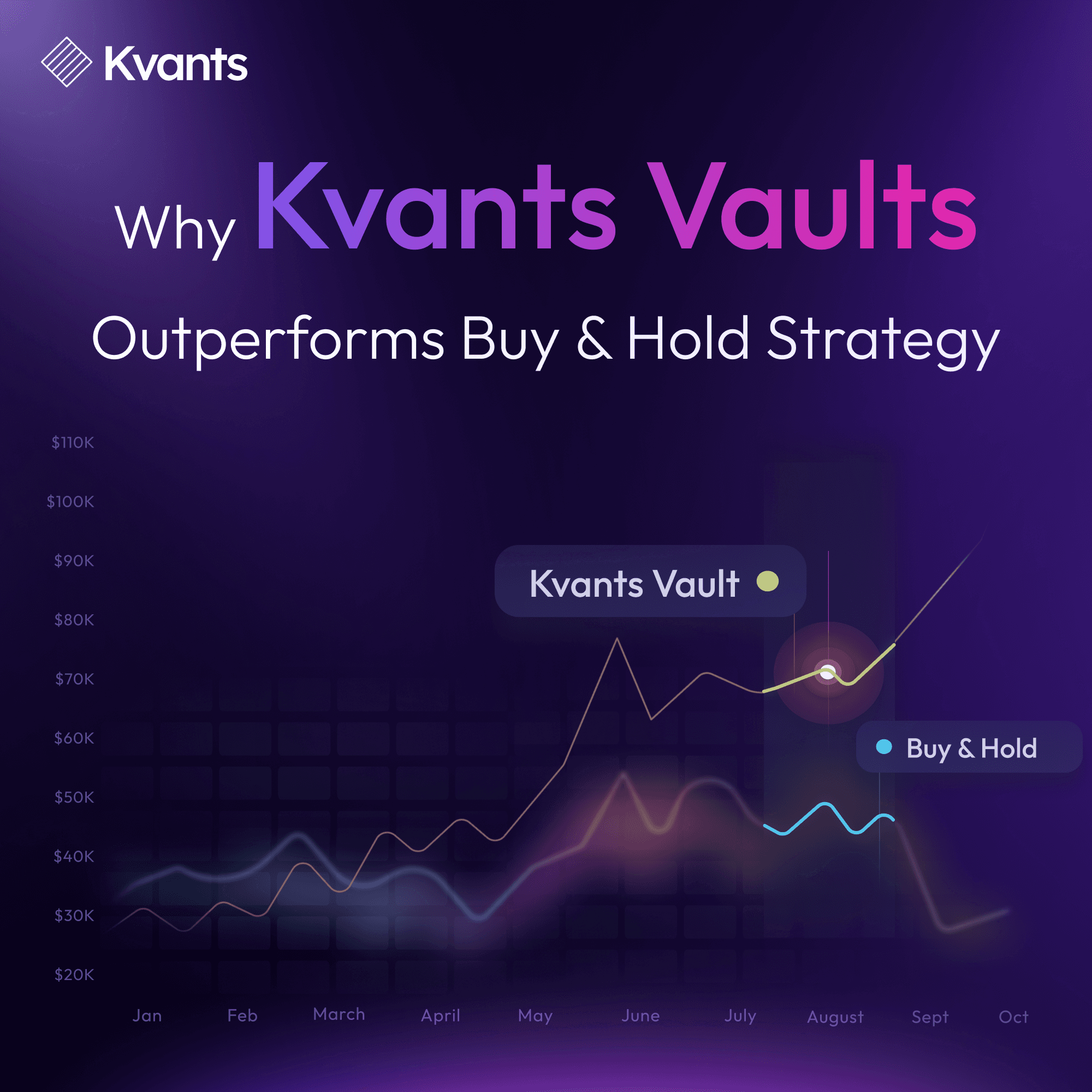

As capital increasingly explores structured products in decentralized finance, the emergence of on-chain quantitative trading strategies represents a critical evolution in how performance is sourced and risk is managed. Kvants Vaults are smart contract-based vehicles designed to execute algorithmic strategies across derivative platforms like Drift protocol on Solana. These Solana vaults operate with fully automated, non-custodial architecture that integrates strategy logic, risk parameters, execution, and monitoring, without requiring user intervention. Unlike passive yield farming or simple staking tools, Kvants vaults are engineered to extract alpha from crypto markets through real-time quant trading models. Allocators can leverage these vaults to construct portfolios with delta-neutral strategies, directional overlays, and uncorrelated yield drivers. What follows is a breakdown of five core vault strategies, each representing a distinct design in the emerging world of smart contract automation and DeFi-native asset management.

Funding-Rate Carry: Market-Neutral Yield from Perpetual Skews

The Funding-Rate Carry strategy captures yield opportunities from dislocated funding rates across perpetual futures markets. By taking a long position in spot markets and shorting perpetual contracts when the funding rate is positive, the vault earns payments from over-leveraged traders, while maintaining a delta-neutral exposure. The logic is familiar to hedge funds but is now deployed via smart contracts on Drift protocol. In addition to funding income, the vault captures maker rebates and trading incentives, optimizing capital efficiency while minimizing directional exposure. This strategy has historically delivered low variance returns in the low-teens APY range, positioning it as a strong crypto market-neutral strategy. Yield-seeking allocators benefit from its real-time funding data integration and stablecoin-denominated income. Transparent on-chain accounting and automated VaR controls ensure the vault operates with institutional-grade discipline.

Statistical Arbitrage: Co-Integrated Pair Trading at Protocol Speed

Statistical arbitrage remains one of the most proven quant trading strategies in legacy finance and has found new life in decentralized markets. The Kvants stat arb vault continuously scans for co-integrated pairs using price histories from Drift protocol’s perpetual contracts. When asset pairs such as BTC/ETH or SOL/ETH diverge beyond their statistical mean, the vault executes a mean-reversion trade, long the undervalued asset and short the overvalued one. This approach is entirely beta-neutral and highly suitable for volatile, range-bound environments. Kvants’ smart contract automation ensures that pair updates, trade entries, and rebalancing are conducted every hour with no manual intervention. Typical returns fall in the low- to mid-teens APY, with minimal correlation to broader market cycles. For funds seeking exposure to crypto alpha without taking on outright token risk, this model delivers programmable, data-driven convergence exposure.

Short-Term Momentum: Event-Driven Trading with Delta Hedging

Short-Term Momentum vaults use event-driven models to detect emerging breakout behavior across large-cap crypto assets. The system parses order flow imbalance, liquidity shifts, and volatility patterns to generate directional signals. Trades are taken long or short and delta-hedged immediately through offsetting perps. This reduces portfolio volatility while retaining exposure to short-lived price trends. Kvants incorporates smart stop-loss mechanisms and grid-based exposure limits, allowing the vault to navigate trend reversals with limited downside. Yields generally reach high teens or low 20s in volatile markets, making it ideal for active DeFi hedge fund strategies. This vault serves as a complementary overlay for allocators looking to capture short-term dislocations using automated, real-time execution infrastructure built entirely on-chain.

Neutralised JLP Yield: Dual Stream Income with Hedged Exposure

The Neutralised JLP Yield strategy combines liquidity provision with systematic hedging. By holding Drift’s JLP token and simultaneously shorting the perp equivalents of the token’s asset weights, the vault isolates JLP fee income while neutralizing market exposure. As JLP basket allocations evolve, Kvants’ smart contracts dynamically adjust hedge weights in real time. This enables stable dual-stream income generation, trading fees and lending yield without price risk. On-chain yield generated through this model has reached 30% APR in optimal conditions. With capital-efficient design and real-time NAV tracking, the JLP vault offers a compelling alternative to fixed income in crypto-native portfolios. Its smart contract automation ensures all hedge ratios, fee streams, and exposure metrics are fully auditable at the block level.

Directional Sentiment Index Vault (In Testing)

This vault is a sentiment-driven long-only strategy optimized for high-beta digital assets. It aggregates on-chain behavioral data (DEX flows, whale activity) and off-chain sentiment signals (social velocity, keyword polarity) to build a composite score that governs allocations. When sentiment scores are high, the vault rotates into a curated list of high-correlation altcoins; when sentiment deteriorates, it reallocates capital to stablecoins. This dynamic rotation avoids prolonged drawdowns while remaining exposed during risk-on conditions. The vault is still in testing but early data suggests that when deployed in parallel with delta-neutral strategies, it adds convex upside to multi-strategy DeFi hedge fund portfolios. While not yet available to the public, it reflects Kvants’ broader effort to integrate macro-aware signal processing into on-chain yield products.

Composable Alpha with Transparent Execution

Kvants vaults present a modular framework for extracting on-chain yield through quant trading strategies. Unlike most DeFi vaults which rely on emissions or liquidity mining, Kvants vaults are performance-based systems built with measurable drawdown limits, composable execution logic, and automated exposure management. By offering real-time access to yield-generating strategies across momentum, stat arb, funding-rate carry, and liquidity hedging, Kvants aligns risk, performance, and custody in a single on-chain architecture. As the broader landscape shifts toward programmatic asset management and verifiable execution, Kvants vaults provide allocators with a set of tools that can be integrated into structured crypto portfolios or used as standalone return engines. This evolution marks a transition from discretionary trading to deterministic, smart contract-governed capital deployment in digital assets. Whether deploying capital in delta-neutral strategies or testing directional overlays informed by real sentiment, Kvants represents the future of programmable crypto alpha.

Broader Industry Outlook: From Passive Yield to Programmatic Alpha

The broader decentralized finance ecosystem is undergoing a structural shift from high-emission farming models to capital-efficient, programmable alpha generation. As composability and infrastructure maturity improve across blockchains like Solana and Ethereum, DeFi hedge funds and smart contract asset managers are increasingly integrating quant trading methodologies once exclusive to traditional finance. Market-neutral strategies, statistical arbitrage, and dynamic rebalancing are now accessible to any on-chain capital allocator with clear audit trails, real-time analytics, and permissionless access. This democratization of structured yield paves the way for more risk-aware capital deployment and deeper liquidity fragmentation across multiple protocol layers. As execution quality, latency minimization, and on-chain governance continue to advance, the competitive advantage will shift toward players that combine real-time decision logic with smart contract automation and differentiated data pipelines. The next frontier of crypto asset management will belong to systems that can price, allocate, and protect capital autonomously, governed by code but informed by market logic.

Read more