Unlocking the Power of Kvants AI Quant Vault: A New Standard in Digital Asset Management

Mar 10 | 5 Mins MIN | Institutional investment

By

Kvants Team

Introduction

As investors and quantitative traders increasingly explore AI-driven strategies, the digital asset market is undergoing a significant transformation. The integration of machine learning into trading models has created unparalleled opportunities for optimizing portfolio performance. Kvant’s AI Quant Vault embodies this evolution by fusing advanced quantitative finance techniques with AI-driven optimizations. This innovation enhances algorithmic trading efficiency, risk management, and liquidity provisioning, setting a new benchmark in decentralized finance (DeFi) trading.

The growing interest in AI-powered trading is not surprising, given the potential of these models to deliver alpha while minimizing downside risk. AI-driven hedge funds are already outperforming traditional asset management strategies by leveraging real-time data, pattern recognition, and high-speed execution. The combination of AI and blockchain technology in DeFi applications provides an additional layer of security, transparency, and efficiency, making solutions like Kvant’s AI Quant Vault highly attractive to institutional investors.

AI-Driven Multi-Strategy Framework

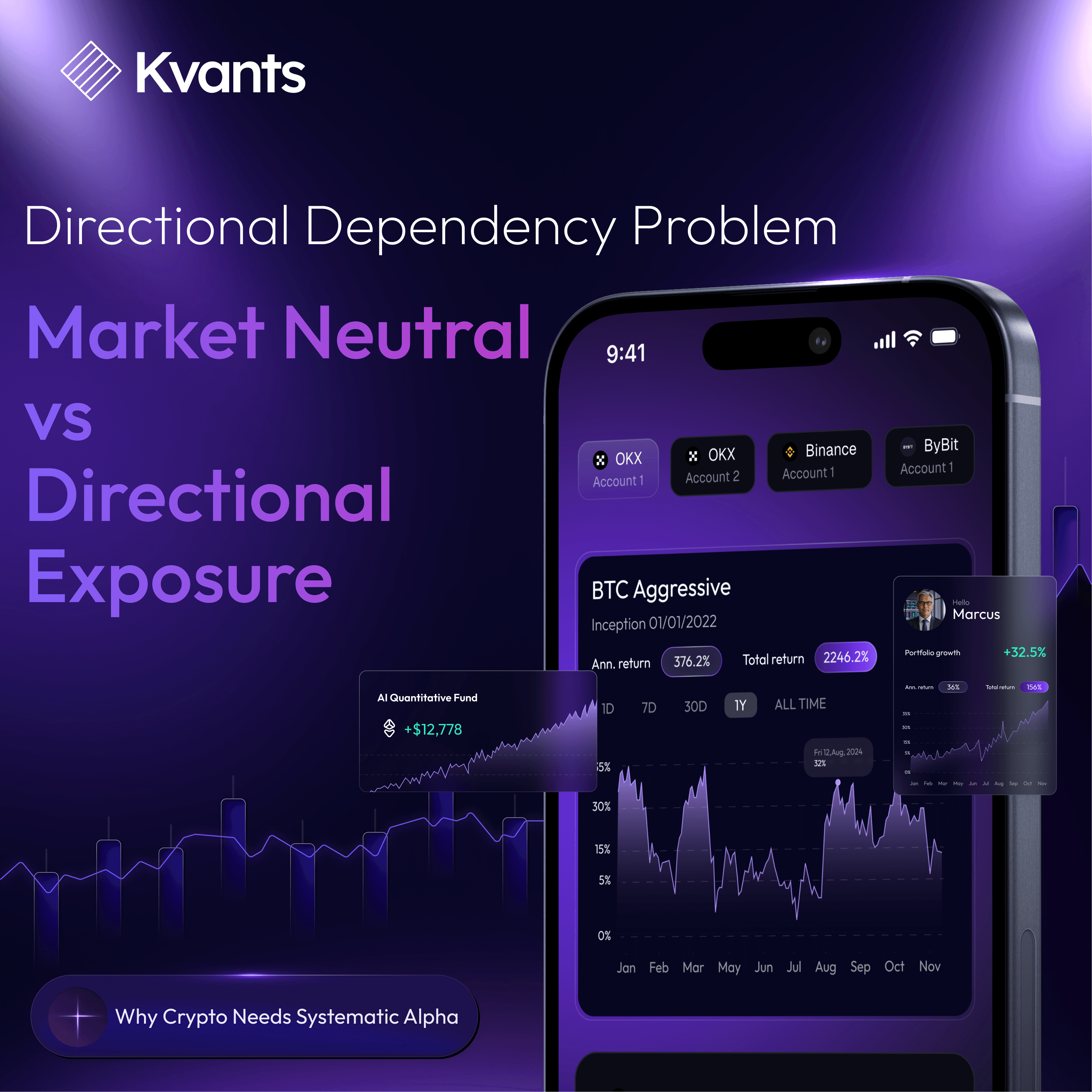

At the core of Kvant’s AI Quant Vault is a sophisticated multi-strategy trading framework that combines traditional quantitative finance methodologies with AI-powered enhancements. One of the key strategies employed is market-neutral statistical arbitrage, which capitalizes on mean-reverting price spreads across correlated assets. This approach ensures minimal exposure to directional market risk, a critical factor for institutions seeking stable returns in volatile markets.

Another integral strategy is momentum and trend-following modeling, which utilizes AI-driven adaptive filters to detect persistent trends and adjust execution strategies accordingly. These models analyze historical price movements and market sentiment to anticipate potential breakouts or reversals, enhancing profitability while mitigating downside risk. Additionally, AI-powered market-making algorithms leverage predictive order book modeling to optimize spreads and inventory management across decentralized exchanges, ensuring robust liquidity provisioning.

Beyond trading strategies, Kvant’s AI Quant Vault strategically allocates capital to DeFi lending protocols, utilizing AI-driven yield curve modeling to maximize efficiency. The vault also implements advanced options trading strategies, using AI-driven volatility forecasting models to execute covered call and protective put strategies. These approaches not only enhance yield but also offer effective risk mitigation tools for investors seeking diversified returns.

High-Frequency Execution with AI Optimization

Kvant’s AI Quant Vault is designed to operate within a high-performance, low-latency execution framework optimized for DeFi markets. Reinforcement learning-based execution engines dynamically adjust trade execution to minimize slippage and reduce front-running risks. By continuously analyzing order flow and liquidity conditions, these engines ensure that trades are executed at the best possible prices.

AI-driven order flow analysis plays a crucial role in predicting market liquidity dynamics. By analyzing on-chain transaction patterns, funding rates, and liquidity pool imbalances, Kvant’s AI models generate actionable insights that improve capital deployment strategies. The vault integrates decentralized data infrastructure, aggregating inputs from multiple on-chain and off-chain oracles to enhance the accuracy of market predictions.

High-frequency trading (HFT) strategies further complement Kvant’s execution model, reducing adverse selection risk while improving capital efficiency. Layer 2 scalability solutions also contribute to lower gas fees, enabling more cost-effective execution of strategies across multiple blockchain networks. The ability to execute trades seamlessly across centralized and decentralized exchanges enhances order execution efficiency, ensuring that the vault remains competitive in fast-moving markets.

Risk Management and Portfolio Optimization

Risk management is a fundamental aspect of Kvant’s AI Quant Vault. The vault employs volatility-adjusted position sizing techniques, using AI-driven models to dynamically adjust leverage based on historical and real-time volatility profiles. This ensures that positions are scaled appropriately to mitigate excessive drawdowns while optimizing returns.

A multi-factor portfolio rebalancing framework systematically allocates capital across different strategies based on real-time risk-adjusted return estimates. This adaptive approach ensures that portfolio composition remains optimized for changing market conditions. AI-powered liquidation prevention models monitor collateralization ratios in real-time, proactively adjusting margin requirements to prevent forced liquidations.

Liquidity fragmentation analysis is another key feature of Kvant’s risk management framework. By assessing liquidity distribution across different DeFi ecosystems, the vault can dynamically shift capital to areas offering the best execution conditions. Counterparty risk evaluation continuously monitors the solvency and smart contract security of DeFi lending and trading protocols, minimizing exposure to systemic risks.

AI-Powered Liquidity Aggregation for DeFi Markets

One of the major challenges in DeFi markets is liquidity fragmentation. Kvant’s AI Quant Vault addresses this issue by leveraging AI-driven liquidity aggregation across multiple protocols and ecosystems. Deep reinforcement learning algorithms anticipate liquidity shifts, allowing the vault to dynamically rebalance positions to optimize capital efficiency.

Real-time data integration from decentralized exchanges, automated market makers (AMMs), and lending protocols enhances market depth provisioning while reducing impermanent loss. Predictive liquidity forecasting allows institutional investors to allocate capital more effectively, mitigating slippage risks and improving trade execution. The integration of automated market-making intelligence further enhances liquidity provisioning, ensuring that the vault remains highly efficient in managing liquidity across fragmented DeFi markets.

Security and Decentralization Considerations

Security and transparency are critical components of Kvant’s AI Quant Vault. The vault employs smart contract-driven execution, ensuring that all trades, collateral management processes, and strategy allocations are managed through auditable and non-custodial mechanisms. Zero-knowledge proof validation further enhances security by verifying trade execution integrity without revealing proprietary strategy details.

To prevent unauthorized access, Kvant has implemented multi-signature governance frameworks that eliminate single points of failure. Institutional investors benefit from on-chain risk monitoring dashboards, which provide real-time insights into portfolio risk exposure. Additionally, AI-powered blockchain security systems continuously monitor transaction flows for anomalies, preventing potential security breaches. Kvant’s security infrastructure aligns with rigorously audited and insured DeFi platforms, further reducing smart contract vulnerabilities.

Performance Benchmarks and Competitive Advantage

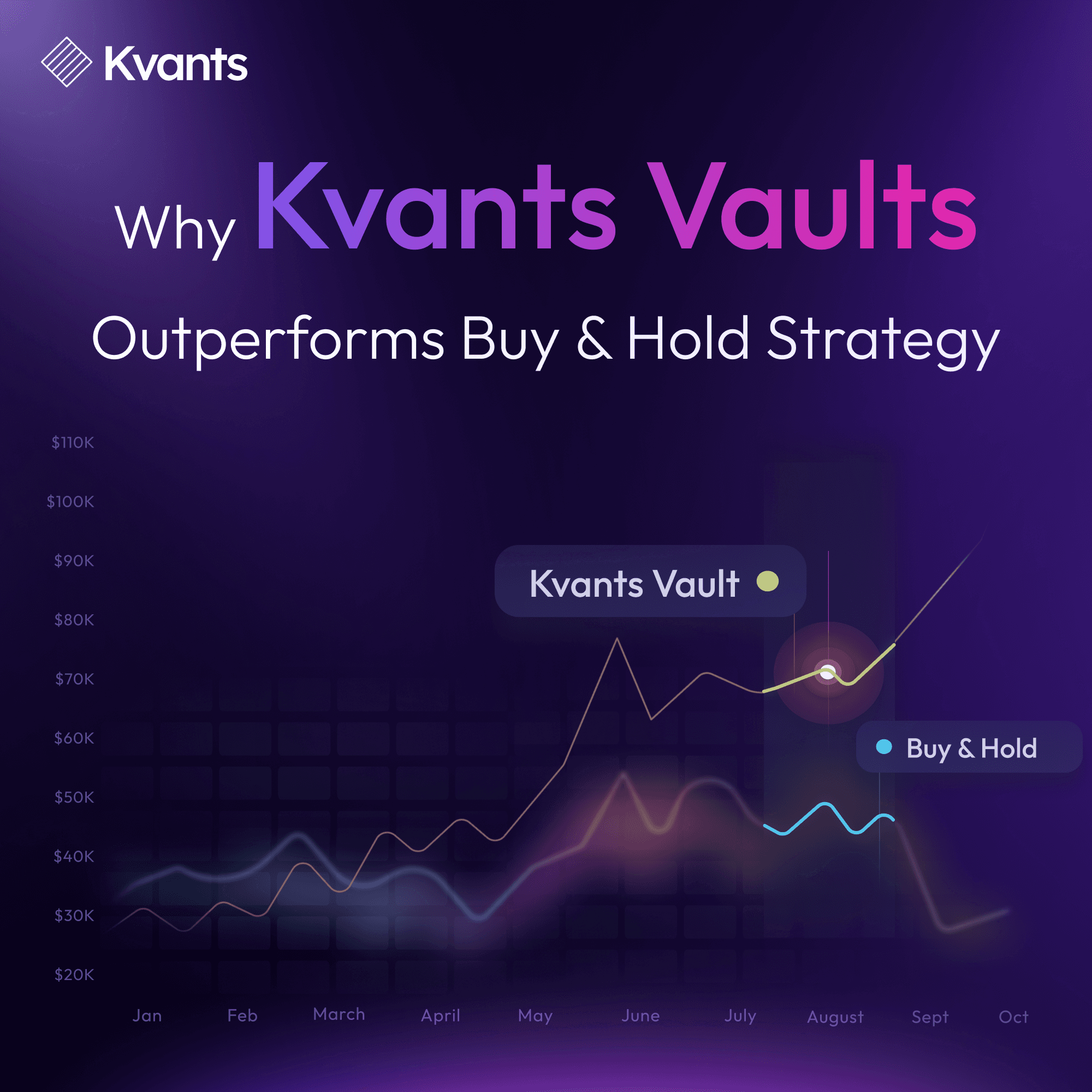

Kvant’s AI Quant Vault consistently outperforms traditional passive staking and spot-holding strategies by delivering superior risk-adjusted returns. AI-driven order execution significantly reduces slippage, Improving execution efficiency by 20-30% compared to conventional market-making approaches. The vault’s ability to dynamically hedge risk ensures resiliency during volatile market conditions, minimizing drawdowns. Optimized capital deployment enhances capital turnover ratios by reducing idle capital exposure. AI-driven PnL attribution analysis provides a detailed breakdown of profit and loss across different trading strategies, improving transparency for institutional investors. Furthermore, Kvant allows investors to customize their risk-return preferences, enabling a tailored investment approach based on individual objectives.

Future Roadmap and Expansion

Kvant’s AI Quant Vault continues to evolve, with several advancements on the horizon. DEX-native AI-powered liquidity provisioning is being developed to improve capital efficiency within automated market makers. Cross-chain strategy execution leveraging blockchain interoperability will allow capital to be dynamically deployed across multiple ecosystems. Institutional-grade compliance tools are also being integrated, offering enhanced risk reporting, auditability, and regulatory compliance solutions tailored for institutional investors. AI-driven credit risk modeling will refine counterparty risk assessment in DeFi lending markets, ensuring more robust due diligence procedures. Automated yield curve arbitrage strategies will enable Kvant to exploit inefficiencies in DeFi interest rate markets, further enhancing alpha generation capabilities.

Conclusion

Kvant’s AI Quant Vault is redefining digital asset management by integrating AI-driven optimizations with institutional-grade risk management. Through its multi-strategy approach, high-frequency execution models, and predictive liquidity aggregation, the vault delivers superior performance, enhanced security, and improved capital efficiency. As DeFi continues to mature, Kvant remains at the forefront of AI-powered financial innovation, ensuring sustainable alpha generation for institutional investors. By continuously refining its AI-driven trading strategies and liquidity management solutions, Kvant’s AI Quant Vault is well-positioned to lead the next evolution of digital asset management.

AI-powered trading is redefining DeFi, and Kvant’s AI Quant Vault is at the forefront of this transformation. By integrating institutional-grade strategies, automated risk management, and high-frequency execution, Kvant’s AI-driven models optimize every trade with precision and efficiency. The platform leverages advanced machine learning to minimize slippage, dynamically rebalance portfolios, and predict market trends in real time, ensuring traders stay ahead in the rapidly evolving digital asset landscape. As DeFi matures, AI-driven execution is becoming a necessity rather than an option.

Kvant’s AI Quant Vault is designed to deliver superior risk-adjusted returns by adapting to market conditions with data-driven intelligence. The combination of algorithmic efficiency and real-time market monitoring creates an ecosystem where investors can execute trades with maximum accuracy while mitigating risk exposure. With seamless integration across decentralized exchanges, liquidity fragmentation is no longer a barrier to effective trading.

The future of quant-driven DeFi trading is here.

Join the whitelist now: https://app.kvants.ai/

Read more