Market Recovery & Volatility: Why Bitcoin’s Swings Demand a Smarter Investment Approach

May 14 | 5 mins MIN | Product

By

Kvants

On May 12, Bitcoin broke past the $105,700 mark for the first time in over four months, responding strongly to a major development in macroeconomic policy: the United States and China announced an unexpected agreement to slash mutual trade tariffs. The U.S. will lower its tariffs on Chinese goods from 145% to 30%, while China will reduce its duties on U.S. imports from 125% to just 10%. This geopolitical thaw has fueled optimism across financial markets, and Bitcoin, ever sensitive to macro sentiment and liquidity shifts, is now firmly on track toward a $150,000 target.

For crypto bulls, this was a moment of validation. For traders caught on the wrong side of the recent drawdown, it was a moment of whiplash. Just one month earlier, Bitcoin had plummeted to $74,000 in a sharp correction that liquidated billions in open interest and temporarily shook investor confidence. In classic crypto fashion, the rebound was as swift as the collapse, leaving many retail participants sidelined or emotionally drained.

This isn’t a one-off. Crypto is a volatile, reflexive, and sentiment-driven market where price can turn violently within hours. And while these moves create opportunity, they also expose the limitations of human emotion, unstructured decision-making, and passive investment strategies. The question isn’t whether crypto is here to stay,the question is how to navigate its chaos effectively.

Why Retail Investors Keep Missing the Mark

The volatility of Bitcoin and other digital assets has created immense wealth over the last decade,but also immense loss. For every investor who held on through the storms and came out ahead, there are many who bought the top, sold the bottom, and watched from the sidelines as the market turned again. There’s a pattern here. Retail investors consistently struggle to time market cycles, and the reasons are deeply psychological.

Fear and greed dominate retail behavior. When prices are rising, fear of missing out kicks in. When they fall, panic takes over. Without a structured approach to decision-making, most investors operate on emotion rather than data. They enter trades late, exit prematurely, and often lack conviction when it matters most. Then there’s the issue of information. Institutions operate with access to high-frequency data, advanced execution tools, and deep market intelligence. Retail investors are often left reacting to news that’s already priced in, relying on influencers, forums, or surface-level technical analysis.

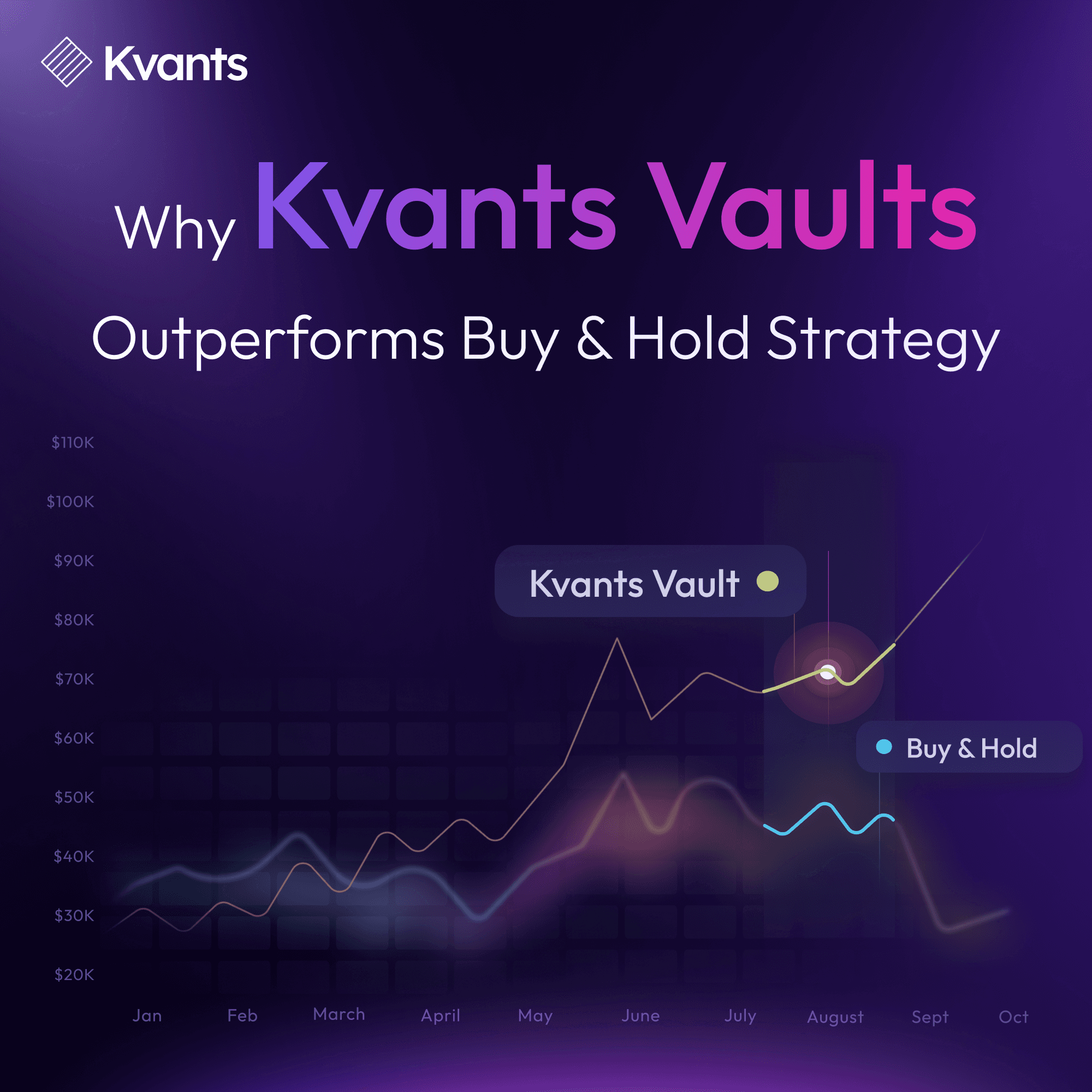

Finally, most retail strategies lack adaptability. What works in a trending bull market rarely survives a sideways chop or high-volatility drawdown. The inability to shift strategy based on market regime often leads to compounding losses or missed opportunities.

The end result? A fragmented, emotional experience that underperforms not only the market but also the investor’s own expectations.

The Case for Quantitative Systems

This is where quant strategies offer a radically different approach. Unlike discretionary trading, quantitative systems are built on rule-based models, algorithms, and historical data. They don’t rely on gut feeling or emotional reactions, they operate with discipline, backtested logic, and statistical edge.

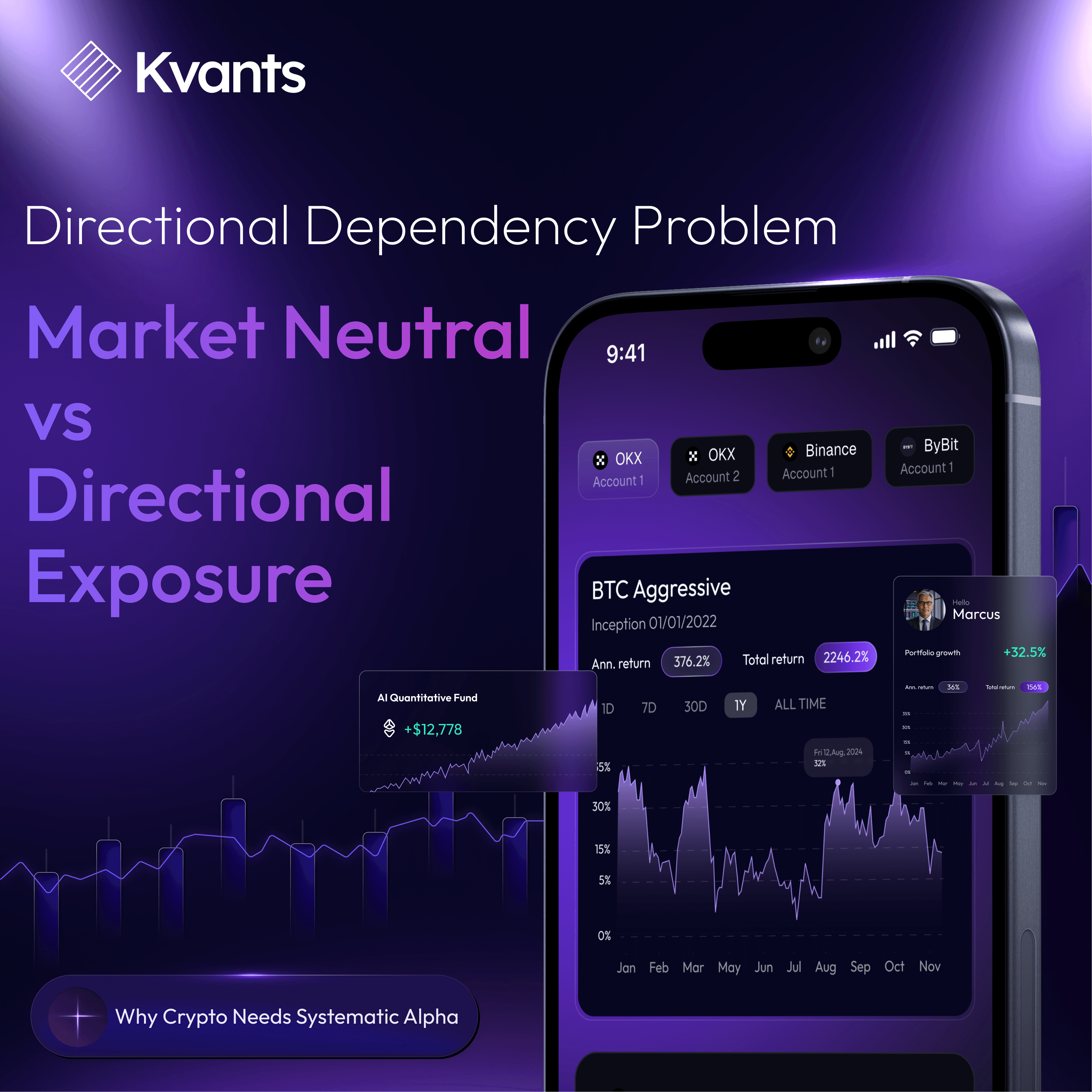

Quant strategies can take many forms. Momentum models capture directional trends. Mean-reversion strategies exploit overextended price action. Market-neutral systems profit from spreads, inefficiencies, or arbitrage opportunities. Volatility-based strategies adjust exposure dynamically based on risk conditions. What unites all of them is the pursuit of consistency. Rather than chasing outsized gains in bull runs and suffering drawdowns in bear markets, quant systems aim to produce repeatable results across market cycles.

They’re structured, monitored, and continuously refined to account for shifting volatility, correlation breakdowns, and new liquidity patterns. But even quant strategies have limitations. No single model works forever. Market conditions change, volatility regimes shift, and strategies that were profitable last month can lose edge today. That’s why diversification,not just across assets, but across strategy types,is key. Which brings us to the next evolution in crypto fund design.

The Rise of Multi-Quant Strategy Funds

In traditional finance, the multi-manager, multi-strategy hedge fund model has long been the gold standard. Firms like Millennium, Citadel, and Point72 allocate capital across dozens of uncorrelated strategies, each run independently, with a centralized risk overlay. This structure reduces idiosyncratic risk, enhances adaptability, and enables alpha generation regardless of market direction.

Crypto is now heading down the same path.As digital asset markets mature, we’re seeing the emergence of sophisticated multi-strategy frameworks designed to capture alpha across fragmented, 24/7 trading environments.

These funds blend directional trend-following models with arbitrage, relative value, and volatility targeting, all within a dynamic capital allocation engine that adapts in real-time. This isn’t just about chasing returns, it’s about protecting capital, controlling risk, and staying in the game when others are forced out.

Introducing Kvants: A Multi-Quant Fund Built for Crypto Chaos

At Kvants, we’ve been building exactly this.

Launching in two weeks, the Kvants Multi-Quant Strategy Fund represents a new class of crypto-native investment vehicle,one designed specifically for the volatility, fragmentation, and opportunity of this market. The fund allocates capital across over 15 proprietary quant strategies developed in-house and in collaboration with experienced hedge fund managers. These include:

Short-term momentum strategies for breakout detection and continuation patterns

Statistical arbitrage models identifying mean-reversion pairs across CEX and DEX liquidity

Market-neutral funding rate arbitrage that monetizes perpetuals premium vs spot

Volatility harvesting strategies calibrated to crypto’s unique implied/realized vol structures

Sentiment-integrated systems using on-chain activity and social signal overlays

What Sets Kvants Apart

What sets Kvants apart is not just the diversity of strategies, but how they’re managed. Our adaptive capital allocation layer monitors dozens of real-time indicators: volatility spikes, liquidity fragmentation, asset correlations, funding rates, macro triggers, and sentiment dislocations. Based on this data, the system dynamically reallocates capital toward the most suitable strategies for the current regime. When markets trend, we lean into directional models. When chop or drawdowns emerge, capital rotates toward neutral, delta-hedged, or arbitrage frameworks. This ability to pivot quickly is what allows Kvants to navigate crashes like $74K BTC, while staying positioned to ride rallies like the surge to $105K.

Our investment team brings a mix of Wall Street pedigree and crypto-native experience. From JP Morgan and Citigroup to top-tier hedge funds and algorithmic research firms, our team has designed and deployed systems that have weathered both TradFi meltdowns and DeFi boom-bust cycles. Risk management is baked into every layer. Every strategy operates with strict drawdown limits. Portfolio-level exposure is constrained through volatility targeting. Positions are automatically reduced or closed if statistical assumptions break or macro shocks occur.

Why Now?

Timing is everything. The crypto market is entering a new cycle,one defined by institutional adoption, macro sensitivity, and an explosion of on-chain activity. Capital is flowing back into the space, but it’s more selective, risk-aware, and performance-driven than ever.

The traditional playbook of buy-and-hold no longer guarantees results. Passive exposure is being replaced by active strategy allocation. This is the moment when funds with real infrastructure, research, and execution capabilities will stand out. Kvants is launching now because the market is demanding better risk-adjusted returns,and the infrastructure finally exists to deliver them. We’ve onboarded a growing community of users through our platform, and built API integrations with leading partners across ecosystems. This isn’t a prototype. It’s a live, tested, and scaling investment engine.

The Road Ahead

Bitcoin may well reach $150,000 in the coming months. But it won’t be a straight line. Geopolitical shocks, regulatory headlines, liquidation cascades,these events will continue to whipsaw markets. The edge will belong to those who can adapt in real-time, manage risk professionally, and exploit inefficiencies at speed. Kvants is built for that environment.

Ready to start earning?

Join the whitelist now: https://app.kvants.ai/

Read more