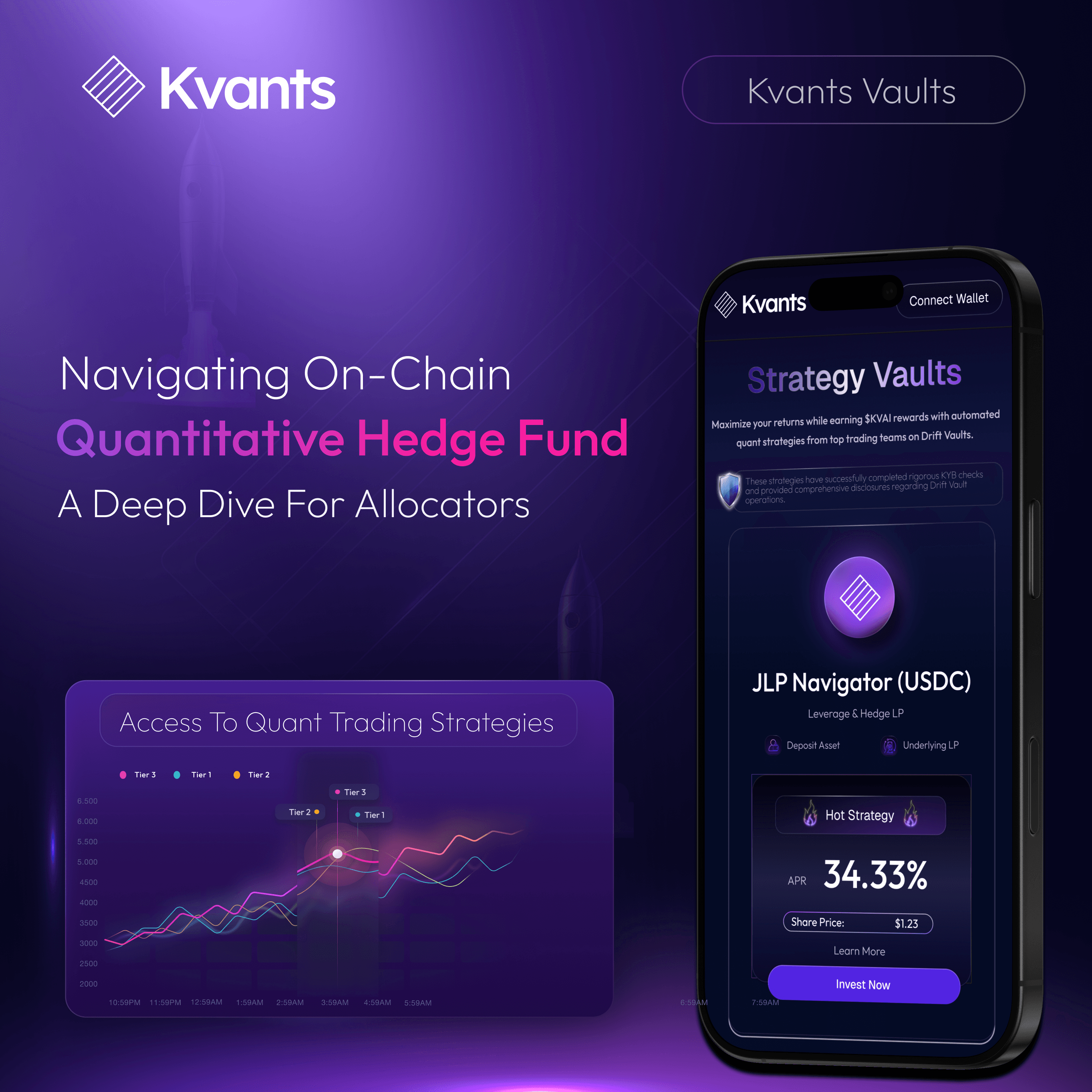

Navigating On-Chain Quantitative Hedge Fund: A Deep Dive for Allocators

Jul 23 | 5 Mins MIN | Product

By

Kvants

Introduction to On-Chain Quantitative Hedge Funds

The emergence of on-chain quantitative hedge funds marks a shift in how institutional strategies are structured, executed, and governed. These funds apply algorithmic models to digital asset markets using blockchain infrastructure as the operational layer. Unlike traditional hedge funds that rely on third-party brokers and custodians, on-chain funds operate through smart contracts, portfolio, market positions, and decentralized liquidity venues. This approach changes how capital is allocated, trades are executed, and investor interests are managed. For allocators, analysts, and fund builders, understanding how on-chain models work is essential to evaluating their viability and limitations.

How Hedge Funds Are Redefining Capital Access Onchain

On-chain infrastructure unlocks new possibilities for how hedge funds raise and manage capital. Tokenizing a hedge fund allows managers to issue digital tokens that represent ownership in a specific strategy. These tokens can be purchased in small denominations, enabling global investors to gain exposure without traditional barriers like large minimums or prime brokerage accounts. Capital can be onboarded around the clock, with smart contracts automating tasks such as fee distribution, investor onboarding, and redemptions. This structure dramatically expands the fund’s potential reach and reduces operational frictions. The token format turns a traditionally exclusive product into a programmable, accessible, and responsive investment vehicle.

Creating a Hedge Fund Index With Strategy Tokens

Onchain funds allow investors to build a personal index of multiple hedge fund strategies directly in their wallet. This eliminates the need for fund-of-funds structures and associated fees. With composable infrastructure, users can dynamically allocate across long-short, delta-neutral, and stat arb strategies with no intermediaries. Strategies become programmable units, enabling diversification and automated rebalancing via smart contracts. It’s hedge fund indexing built for a blockchain-native workflow cost, highly customizable, and transparent by design.

Unlocking Scale and Lowering Fees for On-Chain Funds

The convergence of smart contract automation introduces powerful effects at scale. Smaller investors gain access to sophisticated strategies that were once the domain of institutions. Meanwhile, high-performing managers can attract global capital without expensive fundraising infrastructure. As hedge fund strategies proliferate, fee competition will intensify. The ability to compare, rotate, or reallocate between strategies in real time increases market efficiency. High-fee structures will struggle to remain competitive unless paired with strong, differentiated performance.

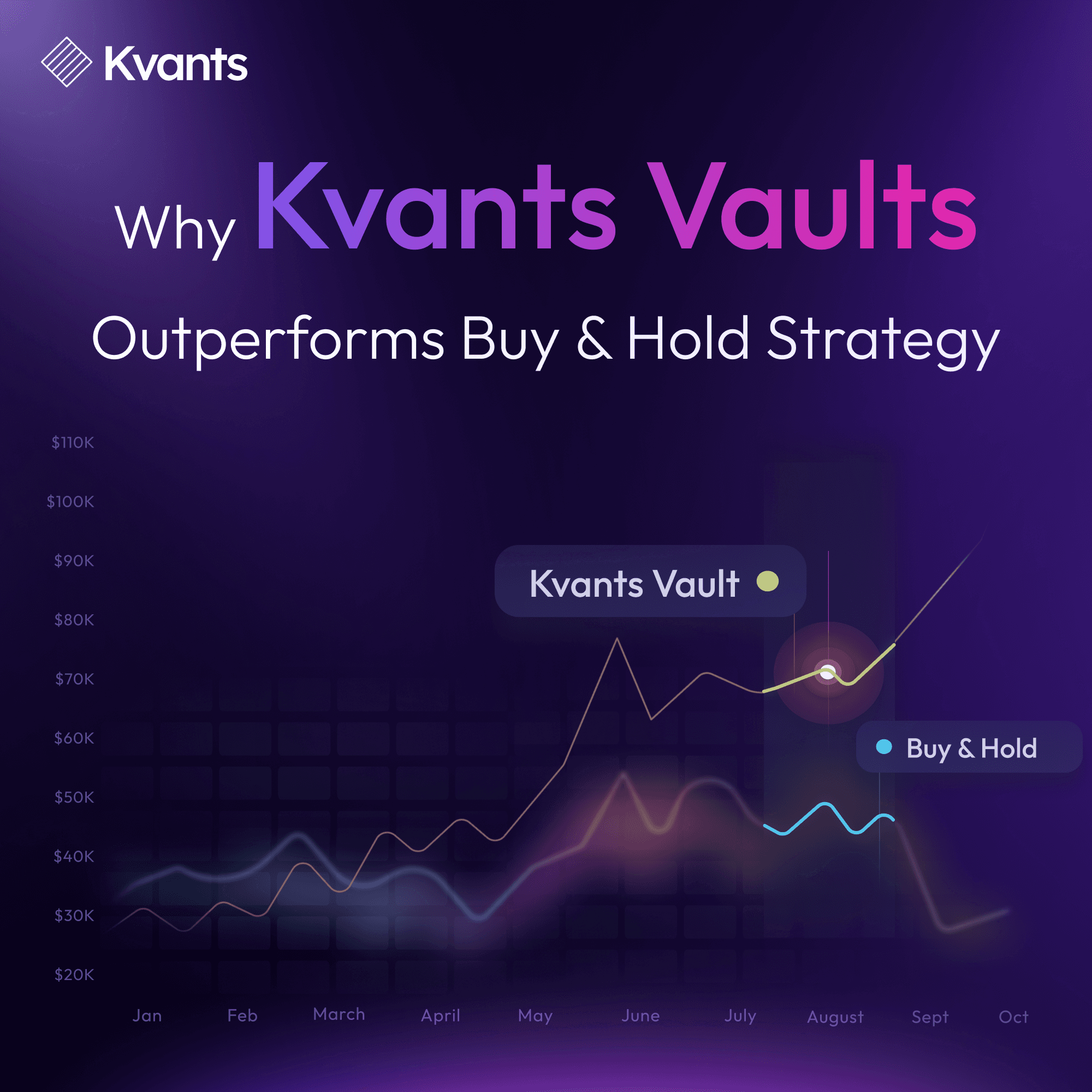

Performance-driven Onchain Quant Funds Investing for Hedge Funds

Over time, this could mirror the fee compression seen in the traditional ETF space. Investors will favor leaner vehicles that provide transparency, simplicity, and measurable performance. Managers who embrace this structure not only expand their reach but also align better with capital allocators demanding lower friction and greater visibility. Ultimately, the shift toward on-chain strategies introduces a more competitive and performance-driven landscape for hedge fund investing.

Blockchain-Based Data Models for Quant Strategy Design

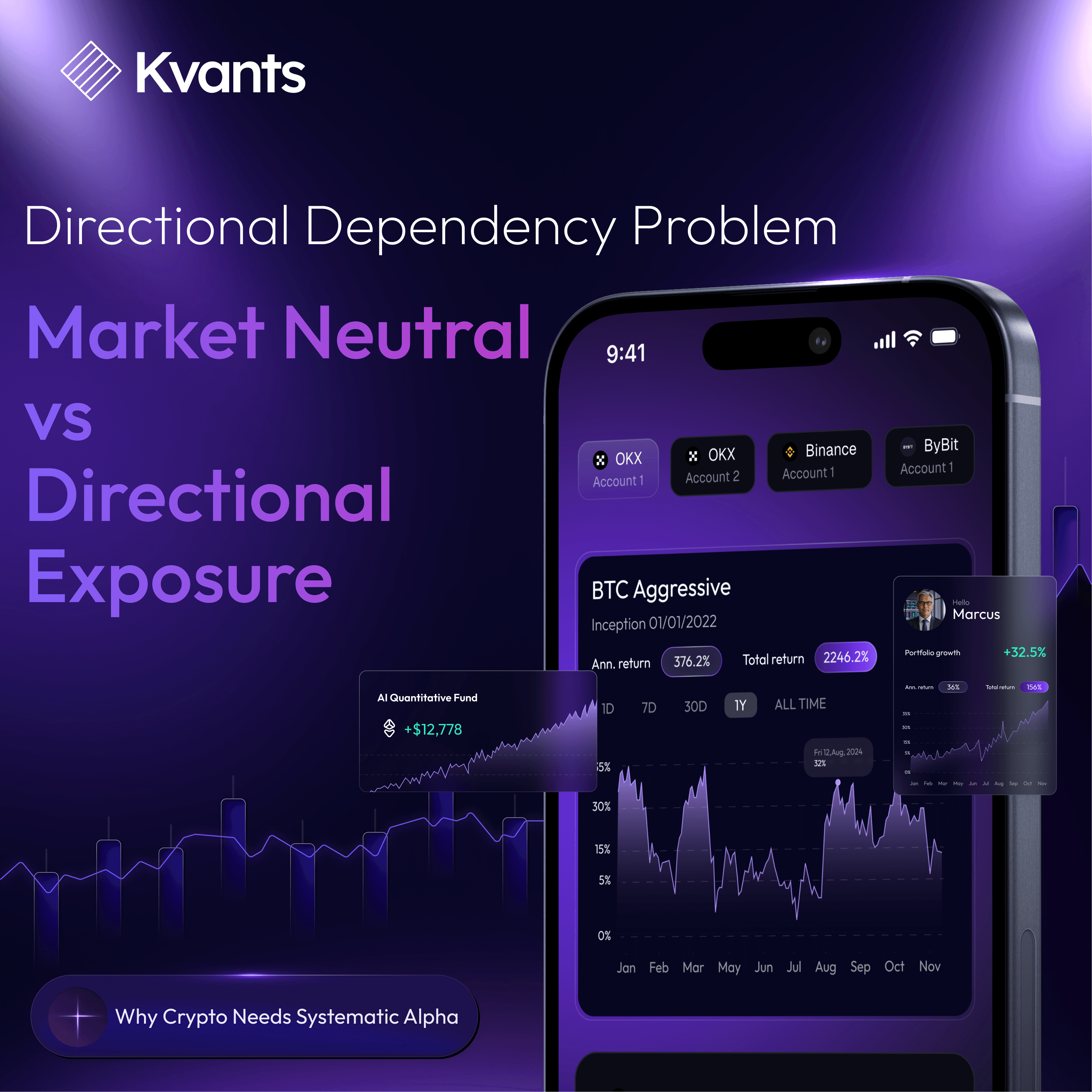

Data Architecture and Model Design Building quantitative strategies for blockchain environments begins with rethinking the data layer. Traditional quant models rely on structured feeds from exchanges and data vendors. In contrast, on-chain systems generate data through public ledgers, transaction histories, and smart contract states. This introduces new sources of insight but also requires specialized tooling to extract, clean, and interpret the data. Indexing protocols serve as foundational infrastructure. Signal generation involves adapting familiar frameworks,momentum, mean reversion, statistical arbitrage, to conditions shaped by automated market makers and gas fee dynamics. Execution constraints, such as slippage and liquidity depth across decentralized venues, become part of model design, not post-trade analysis. In short, strategy construction is inseparable from infrastructure awareness.

Algorithmic Execution Across Decentralized Trading Venues

Execution in on-chain markets bypasses traditional brokers entirely. Signals are generated off-chain and executed via smart contract transactions across decentralized exchanges. Orders must be gas-optimized, properly signed, and timed with precision. Advanced routing logic determines the most efficient venue per trade, accounting for liquidity and volatility. Strategies may also integrate with derivatives platforms like dYdX or Synthetix. While centralized exchanges remain useful for hedging, the core of execution is automated and trust-minimized, built to withstand high volatility with minimal human intervention.

Smart Contract Fund Structures and Institutional Custody

What distinguishes an on-chain hedge fund is not just where it trades, but how it is structured. Tokenization allows fund interests to be issued as programmable digital assets. These tokens represent claims on the fund’s strategy, with logic for subscriptions, redemptions, fees, and governance encoded directly into smart contracts. Custody is managed through institutional wallets with policy control, that capital can be securely held and moved according to predefined rules. For investors, this structure offers direct access to fund performance, simplified onboarding, and in some cases, the ability to trade fund tokens on secondary markets. From a fund manager’s perspective, tokenization streamlines operations, reduces dependency on administrators, and allows for transparent interaction with other on-chain protocols. This structural design brings new capabilities, but also regulatory complexity, especially regarding investor qualification, reporting, and jurisdictional compliance.

Managing Risk in a Composable On-Chain Environment

With smart contracts as the foundation, risk in on-chain hedge funds takes on new dimensions. Smart contract vulnerabilities, oracle manipulation, and governance attacks are part of the landscape. Platforms like Gauntlet and Chaos Labs offer tools for stress testing strategies under DeFi-specific conditions. Regulatory compliance also introduces risk depending on fund structure, tokens may be treated as securities or be subject to AML requirements. Effective risk management requires marrying engineering with operations, ensuring robustness across code, custody, and legal status.

Aligning On-Chain Hedge Funds With Allocator Objectives

For family offices, pensions, and multi-strategy allocators, the appeal of on-chain quant funds lies in their potential to offer verifiable exposure to digital assets without relying on opaque structures. Smart contract–based systems can provide real-time reporting, enforce fee logic without negotiation, and allow allocators to track portfolio composition transparently. The ability to integrate these funds with other on-chain instruments, collateral systems, staking platforms, structured products and flexibility to capital deployment. Tokenization also allows for smaller entry points and more dynamic liquidity management. However, adoption depends on more than technical merit. Funds must be able to demonstrate model robustness, execution discipline, security best practices, and alignment with regulatory frameworks. In that sense, the success of on-chain quant funds will depend not just on innovation, but on the credibility and clarity of the operational choices behind them.

The Future of Quant Investing Is On-Chain

On-chain hedge funds are not just a crypto-native curiosity they are a blueprint for the next generation of asset management. By merging algorithmic strategy with transparent execution and programmable fund structure, they challenge legacy assumptions around trust, custody, and cost. With the right architecture, they become scalable, auditable, and composable vehicles that serve both sophisticated institutions and next-gen allocators. As the ecosystem matures, on-chain vs. off-chain will matter less. What matters most is clarity of execution, alignment with investor priorities, and resilience in unpredictable markets.

Read more